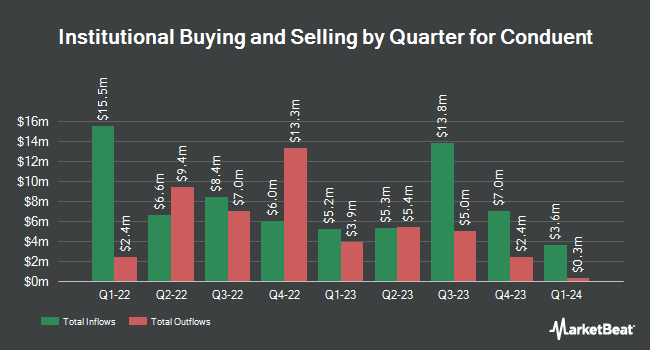

Charles Schwab Investment Management Inc. decreased its position in shares of Conduent Incorporated (NASDAQ:CNDT - Free Report) by 29.3% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,964,357 shares of the company's stock after selling 815,809 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.23% of Conduent worth $7,936,000 as of its most recent filing with the Securities & Exchange Commission.

Other institutional investors also recently modified their holdings of the company. Intech Investment Management LLC bought a new stake in Conduent during the 3rd quarter valued at $146,000. BNP Paribas Financial Markets grew its holdings in shares of Conduent by 68.3% during the third quarter. BNP Paribas Financial Markets now owns 179,330 shares of the company's stock valued at $723,000 after buying an additional 72,783 shares during the last quarter. BBR Partners LLC bought a new stake in shares of Conduent during the third quarter worth about $121,000. Paloma Partners Management Co acquired a new stake in shares of Conduent in the 3rd quarter worth about $100,000. Finally, Jacobs Levy Equity Management Inc. lifted its position in Conduent by 163.2% in the 3rd quarter. Jacobs Levy Equity Management Inc. now owns 1,519,839 shares of the company's stock valued at $6,125,000 after acquiring an additional 942,459 shares in the last quarter. 77.28% of the stock is owned by institutional investors and hedge funds.

Conduent Stock Down 0.7 %

CNDT stock traded down $0.02 during mid-day trading on Thursday, reaching $2.88. 848,675 shares of the company traded hands, compared to its average volume of 1,066,078. The stock has a market cap of $466.07 million, a price-to-earnings ratio of 1.33 and a beta of 1.36. Conduent Incorporated has a fifty-two week low of $2.85 and a fifty-two week high of $4.90. The firm's 50 day moving average price is $3.67 and its 200 day moving average price is $3.85. The company has a quick ratio of 1.75, a current ratio of 1.68 and a debt-to-equity ratio of 0.73.

Conduent (NASDAQ:CNDT - Get Free Report) last announced its quarterly earnings results on Wednesday, February 12th. The company reported ($0.15) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.11) by ($0.04). Conduent had a negative return on equity of 11.39% and a net margin of 12.69%. As a group, equities research analysts predict that Conduent Incorporated will post -0.34 EPS for the current fiscal year.

Conduent Profile

(

Free Report)

Conduent Incorporated provides digital business solutions and services for the commercial, government, and transportation spectrum in the United States, Europe, and internationally. It operates through three segments: Commercial, Government Services, and Transportation. The Commercial segment offers business process services and customized solutions to clients in various industries; and customer experience management, business operations, healthcare claims and administration, and human capital solutions.

Recommended Stories

Before you consider Conduent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Conduent wasn't on the list.

While Conduent currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.