Charles Schwab Investment Management Inc. reduced its stake in Bloom Energy Co. (NYSE:BE - Free Report) by 2.5% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 1,643,822 shares of the company's stock after selling 42,002 shares during the period. Charles Schwab Investment Management Inc. owned 0.72% of Bloom Energy worth $17,359,000 at the end of the most recent quarter.

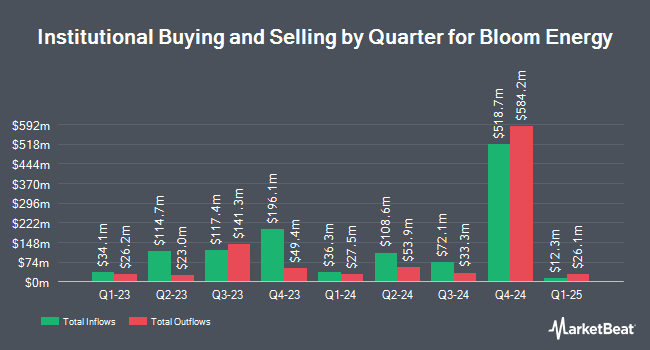

A number of other institutional investors have also made changes to their positions in the stock. Electron Capital Partners LLC boosted its position in shares of Bloom Energy by 131.5% during the second quarter. Electron Capital Partners LLC now owns 3,152,944 shares of the company's stock worth $38,592,000 after purchasing an additional 1,790,733 shares in the last quarter. DigitalBridge Group Inc. grew its stake in Bloom Energy by 66.3% in the second quarter. DigitalBridge Group Inc. now owns 1,160,389 shares of the company's stock valued at $14,203,000 after acquiring an additional 462,581 shares during the period. Pinnacle Associates Ltd. increased its holdings in shares of Bloom Energy by 48.6% in the second quarter. Pinnacle Associates Ltd. now owns 869,586 shares of the company's stock worth $10,644,000 after acquiring an additional 284,298 shares in the last quarter. DekaBank Deutsche Girozentrale raised its position in shares of Bloom Energy by 64.6% during the second quarter. DekaBank Deutsche Girozentrale now owns 830,405 shares of the company's stock worth $11,017,000 after purchasing an additional 325,814 shares during the period. Finally, Bank of New York Mellon Corp lifted its holdings in shares of Bloom Energy by 15.1% during the 2nd quarter. Bank of New York Mellon Corp now owns 773,658 shares of the company's stock valued at $9,470,000 after purchasing an additional 101,519 shares in the last quarter. 77.04% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts recently commented on BE shares. Susquehanna boosted their price objective on shares of Bloom Energy from $20.00 to $33.00 and gave the company a "positive" rating in a research report on Friday. Hsbc Global Res upgraded Bloom Energy to a "hold" rating in a research note on Wednesday, November 20th. Jefferies Financial Group raised their price target on shares of Bloom Energy from $12.00 to $22.00 and gave the stock a "hold" rating in a research note on Friday, November 22nd. BMO Capital Markets boosted their price objective on shares of Bloom Energy from $12.00 to $19.50 and gave the stock a "market perform" rating in a research report on Friday, November 15th. Finally, Royal Bank of Canada raised their price objective on Bloom Energy from $15.00 to $28.00 and gave the company an "outperform" rating in a report on Monday, November 18th. One investment analyst has rated the stock with a sell rating, ten have issued a hold rating, nine have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $20.08.

Check Out Our Latest Research Report on BE

Bloom Energy Price Performance

Shares of NYSE:BE traded up $1.12 during midday trading on Friday, hitting $27.08. The stock had a trading volume of 6,876,995 shares, compared to its average volume of 13,492,131. The company's 50-day moving average price is $15.47 and its 200-day moving average price is $13.68. Bloom Energy Co. has a fifty-two week low of $8.41 and a fifty-two week high of $28.70. The company has a quick ratio of 2.33, a current ratio of 3.36 and a debt-to-equity ratio of 3.09. The company has a market capitalization of $6.19 billion, a P/E ratio of -48.36 and a beta of 3.04.

Insider Buying and Selling

In other Bloom Energy news, insider Shawn Marie Soderberg sold 1,289 shares of the firm's stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $24.56, for a total value of $31,657.84. Following the sale, the insider now owns 168,561 shares in the company, valued at $4,139,858.16. This trade represents a 0.76 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. Also, CEO Kr Sridhar sold 46,697 shares of the stock in a transaction on Friday, November 22nd. The shares were sold at an average price of $25.00, for a total value of $1,167,425.00. Following the completion of the transaction, the chief executive officer now owns 1,822,496 shares of the company's stock, valued at $45,562,400. The trade was a 2.50 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 122,975 shares of company stock worth $3,045,019 in the last ninety days. 8.81% of the stock is owned by insiders.

Bloom Energy Profile

(

Free Report)

Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally. The company offers Bloom Energy Server, a solid oxide technology that converts fuel, such as natural gas, biogas, hydrogen, or a blend of these fuels into electricity through an electrochemical process without combustion.

See Also

Before you consider Bloom Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloom Energy wasn't on the list.

While Bloom Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.