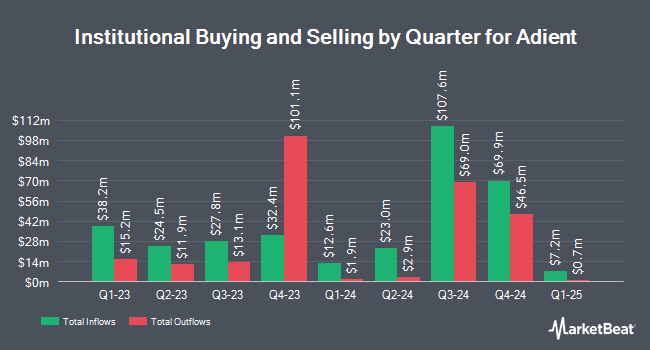

Charles Schwab Investment Management Inc. lifted its stake in Adient plc (NYSE:ADNT - Free Report) by 6.1% in the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 963,446 shares of the company's stock after purchasing an additional 55,387 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.10% of Adient worth $21,745,000 at the end of the most recent reporting period.

A number of other hedge funds have also bought and sold shares of the company. CWM LLC boosted its position in Adient by 44.5% during the second quarter. CWM LLC now owns 1,439 shares of the company's stock valued at $36,000 after purchasing an additional 443 shares in the last quarter. US Bancorp DE lifted its holdings in shares of Adient by 583.8% during the third quarter. US Bancorp DE now owns 1,860 shares of the company's stock worth $42,000 after purchasing an additional 1,588 shares during the period. Signaturefd LLC boosted its holdings in shares of Adient by 493.8% in the 3rd quarter. Signaturefd LLC now owns 2,191 shares of the company's stock valued at $49,000 after acquiring an additional 1,822 shares during the last quarter. KBC Group NV grew its position in Adient by 51.8% during the 3rd quarter. KBC Group NV now owns 3,328 shares of the company's stock worth $75,000 after purchasing an additional 1,136 shares during the period. Finally, Covestor Ltd raised its position in Adient by 23.2% during the third quarter. Covestor Ltd now owns 5,482 shares of the company's stock valued at $124,000 after acquiring an additional 1,032 shares in the last quarter. Institutional investors own 92.44% of the company's stock.

Adient Stock Performance

NYSE ADNT traded down $0.21 during trading on Friday, reaching $19.28. The company's stock had a trading volume of 1,169,953 shares, compared to its average volume of 1,231,657. The business's fifty day moving average price is $20.76 and its 200-day moving average price is $22.95. Adient plc has a twelve month low of $18.53 and a twelve month high of $37.19. The company has a debt-to-equity ratio of 0.98, a quick ratio of 0.90 and a current ratio of 1.11. The firm has a market cap of $1.64 billion, a price-to-earnings ratio of 84.74, a P/E/G ratio of 0.33 and a beta of 2.15.

Adient (NYSE:ADNT - Get Free Report) last issued its quarterly earnings results on Friday, November 8th. The company reported $0.68 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.56 by $0.12. Adient had a return on equity of 6.86% and a net margin of 0.12%. The firm had revenue of $3.56 billion for the quarter, compared to analysts' expectations of $3.47 billion. During the same quarter in the previous year, the firm posted $0.51 EPS. The firm's revenue for the quarter was down 3.7% on a year-over-year basis. As a group, analysts anticipate that Adient plc will post 2.04 EPS for the current fiscal year.

Insider Buying and Selling

In other Adient news, EVP James Conklin sold 11,500 shares of Adient stock in a transaction that occurred on Wednesday, December 4th. The stock was sold at an average price of $20.25, for a total value of $232,875.00. Following the sale, the executive vice president now owns 51,829 shares of the company's stock, valued at approximately $1,049,537.25. The trade was a 18.16 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 1.30% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently issued reports on ADNT shares. StockNews.com raised shares of Adient from a "hold" rating to a "buy" rating in a research note on Monday, November 11th. Barclays cut their price objective on shares of Adient from $29.00 to $24.00 and set an "equal weight" rating for the company in a research report on Thursday, August 8th. Wells Fargo & Company lowered their price target on Adient from $29.00 to $27.00 and set an "overweight" rating for the company in a report on Friday, September 20th. Bank of America cut Adient from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $30.00 to $24.00 in a research note on Thursday, November 21st. Finally, JPMorgan Chase & Co. dropped their price objective on shares of Adient from $31.00 to $27.00 and set a "neutral" rating for the company in a report on Thursday, August 8th. One analyst has rated the stock with a sell rating, seven have assigned a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat, Adient presently has a consensus rating of "Hold" and a consensus target price of $24.38.

Get Our Latest Stock Report on Adient

About Adient

(

Free Report)

Adient plc engages in the design, development, manufacture, and market of seating systems and components for passenger cars, commercial vehicles, and light trucks. The company's automotive seating solutions include complete seating systems, frames, mechanisms, foams, head restraints, armrests, and trim covers.

Read More

Before you consider Adient, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adient wasn't on the list.

While Adient currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.