Charles Schwab Investment Management Inc. raised its position in shares of Owens & Minor, Inc. (NYSE:OMI - Free Report) by 10.2% during the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 2,028,236 shares of the company's stock after purchasing an additional 187,079 shares during the quarter. Charles Schwab Investment Management Inc. owned 2.63% of Owens & Minor worth $31,823,000 at the end of the most recent reporting period.

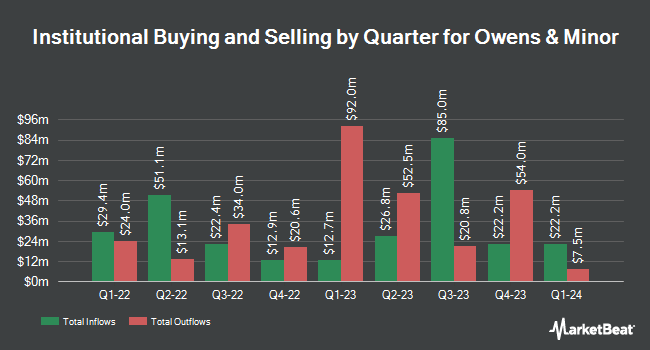

Other hedge funds have also recently modified their holdings of the company. DekaBank Deutsche Girozentrale raised its holdings in shares of Owens & Minor by 76.6% during the second quarter. DekaBank Deutsche Girozentrale now owns 3,126 shares of the company's stock valued at $43,000 after acquiring an additional 1,356 shares during the last quarter. Arizona State Retirement System raised its holdings in shares of Owens & Minor by 7.7% during the second quarter. Arizona State Retirement System now owns 20,371 shares of the company's stock valued at $275,000 after acquiring an additional 1,449 shares during the last quarter. Quarry LP raised its holdings in shares of Owens & Minor by 290.1% during the second quarter. Quarry LP now owns 2,099 shares of the company's stock valued at $28,000 after acquiring an additional 1,561 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank raised its holdings in shares of Owens & Minor by 11.9% during the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 15,364 shares of the company's stock valued at $207,000 after acquiring an additional 1,630 shares during the last quarter. Finally, The Manufacturers Life Insurance Company raised its holdings in shares of Owens & Minor by 4.9% during the second quarter. The Manufacturers Life Insurance Company now owns 36,366 shares of the company's stock valued at $491,000 after acquiring an additional 1,709 shares during the last quarter. Hedge funds and other institutional investors own 98.04% of the company's stock.

Insider Buying and Selling

In other news, CFO Jonathan A. Leon sold 5,282 shares of Owens & Minor stock in a transaction that occurred on Thursday, November 21st. The shares were sold at an average price of $11.82, for a total transaction of $62,433.24. Following the completion of the sale, the chief financial officer now directly owns 130,822 shares in the company, valued at approximately $1,546,316.04. This trade represents a 3.88 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Corporate insiders own 2.62% of the company's stock.

Owens & Minor Stock Up 2.7 %

Owens & Minor stock traded up $0.39 during midday trading on Wednesday, reaching $14.73. The company's stock had a trading volume of 646,376 shares, compared to its average volume of 816,996. The business has a 50-day simple moving average of $13.48 and a 200-day simple moving average of $14.90. The company has a quick ratio of 0.45, a current ratio of 1.09 and a debt-to-equity ratio of 2.11. Owens & Minor, Inc. has a fifty-two week low of $11.42 and a fifty-two week high of $28.35. The company has a market cap of $1.14 billion, a P/E ratio of -22.06, a P/E/G ratio of 0.49 and a beta of 0.42.

Owens & Minor (NYSE:OMI - Get Free Report) last posted its earnings results on Monday, November 4th. The company reported $0.42 EPS for the quarter, topping analysts' consensus estimates of $0.41 by $0.01. Owens & Minor had a positive return on equity of 14.60% and a negative net margin of 0.46%. The business had revenue of $2.72 billion for the quarter, compared to analysts' expectations of $2.68 billion. During the same quarter in the previous year, the firm earned $0.44 earnings per share. The business's revenue was up 5.0% compared to the same quarter last year. On average, research analysts expect that Owens & Minor, Inc. will post 1.49 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of research firms have recently issued reports on OMI. JPMorgan Chase & Co. dropped their price target on Owens & Minor from $22.00 to $18.00 and set an "underweight" rating for the company in a research report on Wednesday, August 21st. Citigroup lowered their price objective on Owens & Minor from $21.00 to $18.50 and set a "buy" rating for the company in a research report on Tuesday, November 5th. Robert W. Baird lowered their price objective on Owens & Minor from $19.00 to $14.00 and set a "neutral" rating for the company in a research report on Tuesday, November 5th. Barclays lowered their price target on Owens & Minor from $18.00 to $14.00 and set an "equal weight" rating for the company in a research report on Tuesday, November 5th. Finally, StockNews.com lowered Owens & Minor from a "buy" rating to a "hold" rating in a research report on Monday, August 26th. Two investment analysts have rated the stock with a sell rating, five have issued a hold rating and two have given a buy rating to the stock. According to MarketBeat, the stock has an average rating of "Hold" and an average price target of $18.50.

Read Our Latest Research Report on Owens & Minor

About Owens & Minor

(

Free Report)

Owens & Minor, Inc, together with its subsidiaries, operates as a healthcare solutions company worldwide. It operates through Products & Healthcare Services and Patient Direct segments. The Products & Healthcare Services segment offers a portfolio of products and services to healthcare providers and manufacturers.

See Also

Before you consider Owens & Minor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Owens & Minor wasn't on the list.

While Owens & Minor currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.