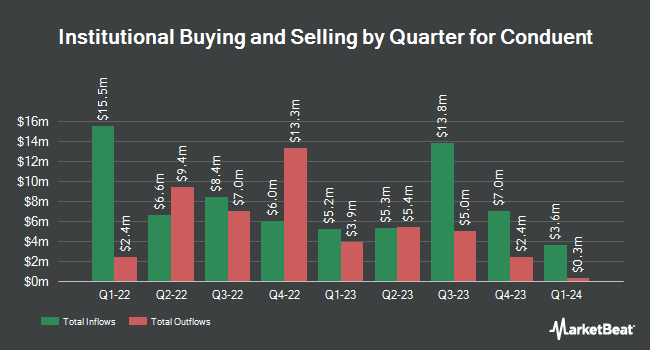

Charles Schwab Investment Management Inc. decreased its holdings in shares of Conduent Incorporated (NASDAQ:CNDT - Free Report) by 19.1% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 2,780,166 shares of the company's stock after selling 656,035 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.74% of Conduent worth $11,204,000 as of its most recent SEC filing.

Other large investors have also modified their holdings of the company. HTG Investment Advisors Inc. purchased a new stake in shares of Conduent during the second quarter worth $37,000. Algert Global LLC purchased a new stake in shares of Conduent in the second quarter valued at about $52,000. Oppenheimer Asset Management Inc. purchased a new stake in shares of Conduent in the second quarter valued at about $80,000. Point72 DIFC Ltd grew its holdings in shares of Conduent by 127.9% in the second quarter. Point72 DIFC Ltd now owns 27,185 shares of the company's stock valued at $89,000 after purchasing an additional 15,254 shares during the period. Finally, US Bancorp DE grew its holdings in shares of Conduent by 1,484.1% in the third quarter. US Bancorp DE now owns 30,352 shares of the company's stock valued at $122,000 after purchasing an additional 28,436 shares during the period. Hedge funds and other institutional investors own 77.28% of the company's stock.

Conduent Trading Up 3.1 %

Shares of CNDT traded up $0.13 during mid-day trading on Tuesday, reaching $4.39. The stock had a trading volume of 1,380,750 shares, compared to its average volume of 1,104,228. The company has a debt-to-equity ratio of 0.81, a current ratio of 1.75 and a quick ratio of 1.75. Conduent Incorporated has a 52-week low of $2.96 and a 52-week high of $4.44. The business's fifty day moving average is $3.89 and its 200 day moving average is $3.69. The firm has a market cap of $701.92 million, a price-to-earnings ratio of 1.88 and a beta of 1.46.

Conduent (NASDAQ:CNDT - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The company reported ($0.14) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.15) by $0.01. Conduent had a net margin of 12.65% and a negative return on equity of 7.94%. The firm had revenue of $807.00 million during the quarter, compared to analyst estimates of $817.33 million. During the same quarter in the prior year, the firm posted ($0.09) earnings per share. Conduent's quarterly revenue was down 13.4% on a year-over-year basis. On average, sell-side analysts predict that Conduent Incorporated will post -0.45 EPS for the current fiscal year.

Conduent Company Profile

(

Free Report)

Conduent Incorporated provides digital business solutions and services for the commercial, government, and transportation spectrum in the United States, Europe, and internationally. It operates through three segments: Commercial, Government Services, and Transportation. The Commercial segment offers business process services and customized solutions to clients in various industries; and customer experience management, business operations, healthcare claims and administration, and human capital solutions.

Read More

Before you consider Conduent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Conduent wasn't on the list.

While Conduent currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.