Charles Schwab Investment Management Inc. cut its position in shares of Pan American Silver Corp. (NYSE:PAAS - Free Report) TSE: PAAS by 4.7% during the 3rd quarter, according to the company in its most recent filing with the SEC. The firm owned 905,474 shares of the basic materials company's stock after selling 44,575 shares during the quarter. Charles Schwab Investment Management Inc. owned 0.25% of Pan American Silver worth $18,927,000 as of its most recent filing with the SEC.

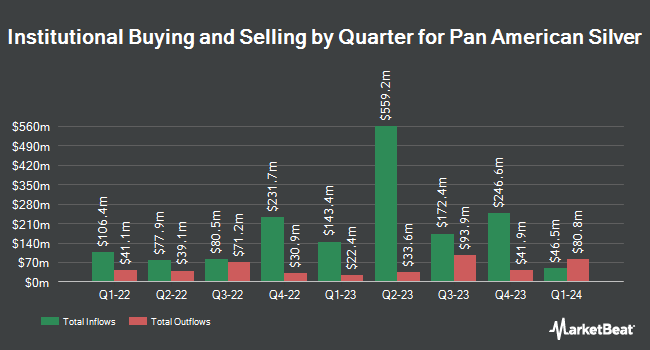

Other hedge funds and other institutional investors also recently modified their holdings of the company. Van ECK Associates Corp raised its position in shares of Pan American Silver by 6.3% during the third quarter. Van ECK Associates Corp now owns 39,512,808 shares of the basic materials company's stock worth $824,632,000 after purchasing an additional 2,328,306 shares during the period. Mackenzie Financial Corp raised its holdings in Pan American Silver by 51.1% during the 2nd quarter. Mackenzie Financial Corp now owns 3,124,517 shares of the basic materials company's stock worth $62,107,000 after buying an additional 1,056,981 shares during the period. TD Asset Management Inc boosted its holdings in shares of Pan American Silver by 22.1% in the second quarter. TD Asset Management Inc now owns 2,186,157 shares of the basic materials company's stock worth $43,440,000 after buying an additional 395,589 shares during the period. Driehaus Capital Management LLC purchased a new position in shares of Pan American Silver in the second quarter worth approximately $38,116,000. Finally, The Manufacturers Life Insurance Company raised its holdings in shares of Pan American Silver by 1.5% during the second quarter. The Manufacturers Life Insurance Company now owns 1,829,052 shares of the basic materials company's stock valued at $36,300,000 after acquiring an additional 27,372 shares during the period. Institutional investors own 55.43% of the company's stock.

Analyst Upgrades and Downgrades

PAAS has been the topic of several research analyst reports. Royal Bank of Canada lifted their price objective on shares of Pan American Silver from $25.00 to $27.00 and gave the stock an "outperform" rating in a research report on Tuesday, September 10th. Jefferies Financial Group lifted their price target on Pan American Silver from $21.00 to $23.00 and gave the company a "hold" rating in a report on Friday, October 4th. Finally, StockNews.com downgraded Pan American Silver from a "buy" rating to a "hold" rating in a research note on Sunday, December 1st. Two investment analysts have rated the stock with a hold rating and four have given a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $25.42.

Read Our Latest Stock Report on Pan American Silver

Pan American Silver Stock Down 2.6 %

PAAS traded down $0.59 during trading on Friday, reaching $22.17. 2,658,899 shares of the stock traded hands, compared to its average volume of 3,578,666. The company has a debt-to-equity ratio of 0.16, a current ratio of 2.06 and a quick ratio of 0.96. Pan American Silver Corp. has a fifty-two week low of $12.16 and a fifty-two week high of $26.05. The stock's 50-day simple moving average is $22.60 and its two-hundred day simple moving average is $21.52. The stock has a market cap of $8.05 billion, a price-to-earnings ratio of -130.40 and a beta of 1.28.

Pan American Silver Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, November 29th. Shareholders of record on Monday, November 18th were given a dividend of $0.10 per share. The ex-dividend date of this dividend was Monday, November 18th. This represents a $0.40 dividend on an annualized basis and a yield of 1.80%. Pan American Silver's payout ratio is currently -235.28%.

Pan American Silver Company Profile

(

Free Report)

Pan American Silver Corp. engages in the exploration, mine development, extraction, processing, refining, and reclamation of silver, gold, zinc, lead, and copper mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. The company was formerly known as Pan American Minerals Corp. and changed its name to Pan American Silver Corp.

Featured Stories

Before you consider Pan American Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pan American Silver wasn't on the list.

While Pan American Silver currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.