Charles Schwab Investment Management Inc. grew its position in Haleon plc (NYSE:HLN - Free Report) by 41.5% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 203,583 shares of the company's stock after acquiring an additional 59,719 shares during the quarter. Charles Schwab Investment Management Inc.'s holdings in Haleon were worth $2,154,000 as of its most recent SEC filing.

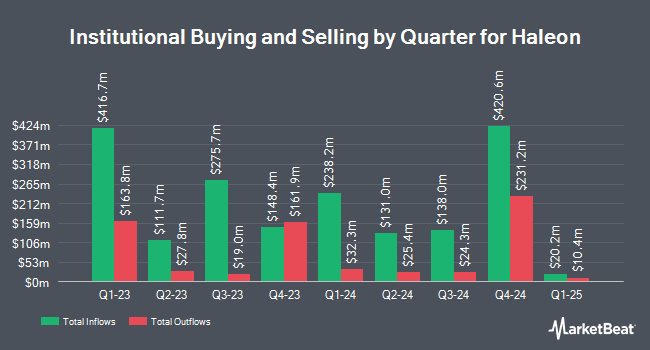

A number of other hedge funds also recently modified their holdings of HLN. Fortitude Family Office LLC acquired a new position in Haleon in the third quarter valued at about $28,000. Cultivar Capital Inc. acquired a new position in shares of Haleon in the 2nd quarter worth approximately $40,000. Prospera Private Wealth LLC acquired a new position in shares of Haleon in the 3rd quarter worth approximately $57,000. BOKF NA grew its position in Haleon by 68.8% during the 2nd quarter. BOKF NA now owns 6,972 shares of the company's stock worth $58,000 after acquiring an additional 2,842 shares during the last quarter. Finally, Rothschild Investment LLC acquired a new stake in Haleon during the 2nd quarter valued at $60,000. Institutional investors own 6.67% of the company's stock.

Analyst Upgrades and Downgrades

HLN has been the subject of a number of research reports. UBS Group upgraded Haleon to a "strong-buy" rating in a research note on Tuesday, October 1st. Morgan Stanley raised their price objective on shares of Haleon from $9.90 to $10.95 and gave the company an "overweight" rating in a research report on Friday, September 20th. One investment analyst has rated the stock with a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Buy" and a consensus price target of $10.95.

Get Our Latest Stock Report on Haleon

Haleon Trading Down 0.4 %

NYSE HLN traded down $0.04 during trading on Monday, reaching $9.72. 7,912,621 shares of the stock traded hands, compared to its average volume of 5,416,784. Haleon plc has a fifty-two week low of $7.89 and a fifty-two week high of $10.80. The company has a quick ratio of 0.58, a current ratio of 0.84 and a debt-to-equity ratio of 0.44. The firm has a market cap of $44.00 billion, a price-to-earnings ratio of 28.71, a price-to-earnings-growth ratio of 2.95 and a beta of 0.28. The stock's 50-day moving average price is $9.75 and its 200 day moving average price is $9.53.

About Haleon

(

Free Report)

Haleon plc, together with its subsidiaries, engages in the research, development, manufacture, and sale of various consumer healthcare products in North America, Europe, the Middle East, Africa, Latin America, and the Asia Pacific. The company provides oral health products, such as toothpastes, mouth washes, and denture care products under the Sensodyne, Polident, Parodontax, Biotene brands; and vitamins, minerals, and supplements under Centrum, Emergen-C, Caltrate brands.

See Also

Before you consider Haleon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Haleon wasn't on the list.

While Haleon currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.