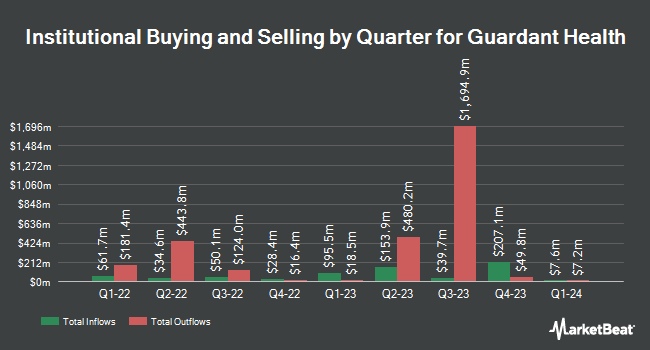

Charles Schwab Investment Management Inc. trimmed its holdings in shares of Guardant Health, Inc. (NASDAQ:GH - Free Report) by 23.4% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,003,138 shares of the company's stock after selling 306,293 shares during the period. Charles Schwab Investment Management Inc. owned about 0.81% of Guardant Health worth $23,012,000 at the end of the most recent reporting period.

Other large investors have also modified their holdings of the company. Canton Hathaway LLC purchased a new position in Guardant Health in the second quarter valued at about $59,000. Byrne Asset Management LLC acquired a new position in shares of Guardant Health in the second quarter worth $77,000. Fullcircle Wealth LLC acquired a new position in shares of Guardant Health during the 2nd quarter valued at about $211,000. Bank of New York Mellon Corp lifted its holdings in shares of Guardant Health by 31.8% during the 2nd quarter. Bank of New York Mellon Corp now owns 1,280,221 shares of the company's stock worth $36,973,000 after acquiring an additional 309,157 shares during the period. Finally, Railway Pension Investments Ltd boosted its holdings in shares of Guardant Health by 63.8% in the 2nd quarter. Railway Pension Investments Ltd now owns 620,878 shares of the company's stock valued at $17,931,000 after purchasing an additional 241,800 shares during the last quarter. 92.60% of the stock is owned by hedge funds and other institutional investors.

Guardant Health Stock Performance

Shares of NASDAQ:GH traded down $0.24 on Friday, hitting $36.87. The company's stock had a trading volume of 1,512,538 shares, compared to its average volume of 2,053,644. The company has a market capitalization of $4.56 billion, a price-to-earnings ratio of -8.75 and a beta of 1.26. The company has a debt-to-equity ratio of 16.70, a quick ratio of 5.85 and a current ratio of 6.22. Guardant Health, Inc. has a 12 month low of $15.81 and a 12 month high of $38.53. The stock's 50-day moving average is $26.32 and its two-hundred day moving average is $27.64.

Guardant Health (NASDAQ:GH - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The company reported ($0.88) EPS for the quarter, missing the consensus estimate of ($0.55) by ($0.33). The business had revenue of $191.48 million during the quarter, compared to the consensus estimate of $170.49 million. Guardant Health had a negative return on equity of 1,200.44% and a negative net margin of 74.02%. Guardant Health's revenue was up 33.9% compared to the same quarter last year. During the same quarter last year, the firm posted ($0.73) earnings per share. On average, equities research analysts forecast that Guardant Health, Inc. will post -3.38 EPS for the current year.

Insiders Place Their Bets

In other Guardant Health news, Director Meghan V. Joyce sold 2,896 shares of the company's stock in a transaction that occurred on Wednesday, November 13th. The shares were sold at an average price of $29.90, for a total value of $86,590.40. Following the transaction, the director now owns 7,648 shares in the company, valued at approximately $228,675.20. This represents a 27.47 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Corporate insiders own 5.50% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts have issued reports on GH shares. Leerink Partners lowered their price target on Guardant Health from $60.00 to $50.00 and set an "outperform" rating for the company in a research report on Thursday, October 17th. Citigroup lifted their price objective on shares of Guardant Health from $40.00 to $45.00 and gave the company a "buy" rating in a research note on Thursday, August 8th. Piper Sandler upped their target price on shares of Guardant Health from $30.00 to $34.00 and gave the company an "overweight" rating in a research note on Tuesday, August 13th. UBS Group lifted their price target on Guardant Health from $32.00 to $40.00 and gave the stock a "buy" rating in a research note on Wednesday, August 21st. Finally, Craig Hallum upped their price objective on Guardant Health from $28.00 to $37.00 and gave the company a "buy" rating in a research note on Thursday, August 8th. One research analyst has rated the stock with a hold rating and fifteen have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $40.60.

Get Our Latest Report on GH

About Guardant Health

(

Free Report)

Guardant Health, Inc, a precision oncology company, provides blood and tissue tests, data sets, and analytics in the United States and internationally. The company provides Guardant360; Guardant360 LDT; Guardant360 CDx Test; Guardant360 Response Test; Guardant360 TissueNext Test; GuardantINFINITY Test; GuardantConnect, an integrated software-based solution designed for clinical and biopharmaceutical customers to connect patients tested with assays with actionable alterations with potentially relevant clinical studies; GuardantOMNI Test for advanced stage cancer; and GuardantINFORM, an in-silico research platform for tumor evolution and treatment resistance across various biomarker-driven cancers.

Featured Stories

Before you consider Guardant Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Guardant Health wasn't on the list.

While Guardant Health currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.