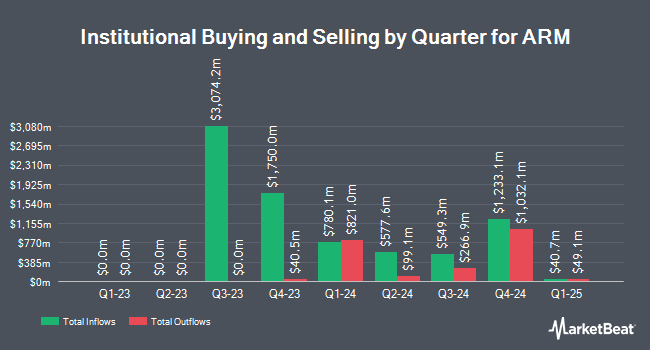

Charles Schwab Investment Management Inc. boosted its position in Arm Holdings plc (NASDAQ:ARM - Free Report) by 89.3% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 18,457 shares of the company's stock after purchasing an additional 8,707 shares during the period. Charles Schwab Investment Management Inc.'s holdings in ARM were worth $2,640,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other large investors have also modified their holdings of ARM. International Assets Investment Management LLC increased its stake in ARM by 14,351.1% in the 3rd quarter. International Assets Investment Management LLC now owns 812,297 shares of the company's stock worth $1,161,670,000 after buying an additional 806,676 shares during the period. Sei Investments Co. grew its stake in ARM by 551.6% in the 2nd quarter. Sei Investments Co. now owns 579,330 shares of the company's stock worth $94,790,000 after acquiring an additional 490,415 shares in the last quarter. Mirae Asset Global Investments Co. Ltd. increased its position in shares of ARM by 186.8% during the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 359,105 shares of the company's stock worth $52,279,000 after acquiring an additional 233,909 shares during the period. Marsico Capital Management LLC bought a new stake in shares of ARM during the second quarter valued at approximately $33,207,000. Finally, ProShare Advisors LLC purchased a new stake in shares of ARM in the second quarter valued at approximately $16,611,000. Hedge funds and other institutional investors own 7.53% of the company's stock.

ARM Stock Performance

ARM stock traded down $6.91 during trading on Monday, reaching $145.00. The company had a trading volume of 6,420,092 shares, compared to its average volume of 10,281,936. Arm Holdings plc has a twelve month low of $65.11 and a twelve month high of $188.75. The company has a market cap of $151.94 billion, a price-to-earnings ratio of 253.18, a price-to-earnings-growth ratio of 7.15 and a beta of 4.67. The firm has a 50-day simple moving average of $142.98 and a 200-day simple moving average of $143.61.

ARM (NASDAQ:ARM - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The company reported $0.30 earnings per share for the quarter, beating analysts' consensus estimates of $0.26 by $0.04. ARM had a net margin of 18.13% and a return on equity of 13.69%. The firm had revenue of $844.00 million for the quarter, compared to analyst estimates of $810.03 million. During the same period in the previous year, the company earned $0.36 earnings per share. The business's quarterly revenue was up 4.7% compared to the same quarter last year. Sell-side analysts expect that Arm Holdings plc will post 0.79 earnings per share for the current year.

Analysts Set New Price Targets

A number of equities research analysts have weighed in on ARM shares. Susquehanna lifted their target price on ARM from $115.00 to $118.00 and gave the company a "neutral" rating in a research report on Thursday, November 7th. UBS Group began coverage on ARM in a report on Monday, November 25th. They issued a "buy" rating and a $160.00 price objective for the company. JPMorgan Chase & Co. increased their target price on shares of ARM from $140.00 to $160.00 and gave the stock an "overweight" rating in a report on Thursday, November 7th. TD Cowen raised their target price on shares of ARM from $150.00 to $165.00 and gave the company a "buy" rating in a research report on Thursday, November 7th. Finally, Barclays upped their price target on shares of ARM from $125.00 to $145.00 and gave the stock an "overweight" rating in a research report on Thursday, November 7th. Two equities research analysts have rated the stock with a sell rating, six have given a hold rating, eighteen have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $150.32.

Read Our Latest Stock Report on ARM

About ARM

(

Free Report)

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers rely on to develop products. It offers microprocessors, systems intellectual property (IPs), graphics processing units, physical IP and associated systems IPs, software, tools, and other related services.

See Also

Before you consider ARM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ARM wasn't on the list.

While ARM currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.