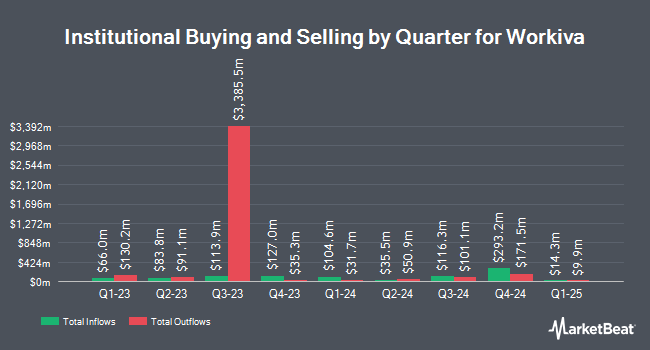

Charles Schwab Investment Management Inc. grew its position in Workiva Inc. (NYSE:WK - Free Report) by 1.5% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 423,782 shares of the software maker's stock after buying an additional 6,422 shares during the quarter. Charles Schwab Investment Management Inc. owned 0.77% of Workiva worth $33,530,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors also recently made changes to their positions in WK. Conestoga Capital Advisors LLC grew its holdings in shares of Workiva by 2.8% during the 2nd quarter. Conestoga Capital Advisors LLC now owns 1,188,445 shares of the software maker's stock valued at $86,745,000 after purchasing an additional 32,230 shares during the last quarter. TimesSquare Capital Management LLC grew its holdings in shares of Workiva by 4.3% during the 3rd quarter. TimesSquare Capital Management LLC now owns 467,769 shares of the software maker's stock valued at $37,010,000 after purchasing an additional 19,095 shares during the last quarter. Bank of New York Mellon Corp grew its holdings in shares of Workiva by 14.3% during the 2nd quarter. Bank of New York Mellon Corp now owns 392,951 shares of the software maker's stock valued at $28,682,000 after purchasing an additional 49,222 shares during the last quarter. William Blair Investment Management LLC grew its holdings in shares of Workiva by 8.3% during the 2nd quarter. William Blair Investment Management LLC now owns 377,832 shares of the software maker's stock valued at $27,578,000 after purchasing an additional 29,005 shares during the last quarter. Finally, Impax Asset Management Group plc grew its holdings in Workiva by 16.5% during the 3rd quarter. Impax Asset Management Group plc now owns 158,586 shares of the software maker's stock worth $12,547,000 after acquiring an additional 22,500 shares during the last quarter. 92.21% of the stock is currently owned by institutional investors and hedge funds.

Workiva Price Performance

Shares of Workiva stock traded up $3.22 during trading on Wednesday, reaching $101.43. 357,737 shares of the company traded hands, compared to its average volume of 376,648. Workiva Inc. has a 1-year low of $65.47 and a 1-year high of $105.00. The company has a 50 day moving average price of $85.38 and a 200-day moving average price of $78.76. The firm has a market capitalization of $5.62 billion, a PE ratio of -106.76 and a beta of 1.09.

Insider Activity at Workiva

In other Workiva news, EVP Michael D. Hawkins sold 2,761 shares of the company's stock in a transaction on Friday, September 13th. The shares were sold at an average price of $74.60, for a total transaction of $205,970.60. Following the transaction, the executive vice president now owns 49,887 shares in the company, valued at approximately $3,721,570.20. This represents a 5.24 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. 3.86% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

WK has been the topic of a number of analyst reports. Robert W. Baird upped their price objective on shares of Workiva from $94.00 to $110.00 and gave the company an "outperform" rating in a research note on Thursday, November 7th. Stifel Nicolaus upped their price objective on shares of Workiva from $85.00 to $102.00 and gave the company a "hold" rating in a research note on Thursday, November 7th. Finally, BMO Capital Markets upped their price objective on shares of Workiva from $96.00 to $104.00 and gave the company an "outperform" rating in a research note on Thursday, November 7th. Two analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. Based on data from MarketBeat, Workiva has a consensus rating of "Moderate Buy" and a consensus target price of $103.20.

Get Our Latest Stock Report on WK

About Workiva

(

Free Report)

Workiva Inc, together with its subsidiaries, provides cloud-based reporting solutions in the United States and internationally. The company offers Workiva platform, a multi-tenant cloud software that provides data linking capabilities; audit trail services; administrators access management; and allows customers to connect data from multiple enterprise resource planning, human capital management, and customer relationship management systems, as well as other third-party cloud and on-premise applications.

See Also

Before you consider Workiva, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workiva wasn't on the list.

While Workiva currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.