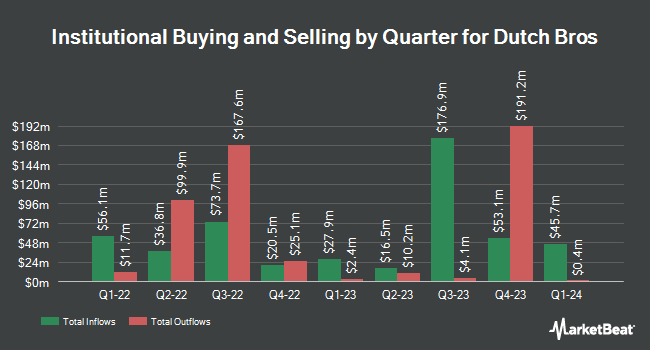

Charles Schwab Investment Management Inc. raised its stake in shares of Dutch Bros Inc. (NYSE:BROS - Free Report) by 0.8% in the 4th quarter, according to its most recent Form 13F filing with the SEC. The fund owned 692,956 shares of the company's stock after purchasing an additional 5,429 shares during the period. Charles Schwab Investment Management Inc. owned 0.45% of Dutch Bros worth $36,297,000 at the end of the most recent reporting period.

Other large investors also recently bought and sold shares of the company. R Squared Ltd purchased a new stake in shares of Dutch Bros during the 4th quarter worth about $25,000. Fortitude Family Office LLC purchased a new stake in Dutch Bros during the fourth quarter worth approximately $41,000. SBI Securities Co. Ltd. acquired a new stake in shares of Dutch Bros in the fourth quarter worth $53,000. Point72 Hong Kong Ltd purchased a new position in shares of Dutch Bros in the 3rd quarter valued at $36,000. Finally, Arcadia Investment Management Corp MI acquired a new position in shares of Dutch Bros during the 4th quarter valued at $60,000. Hedge funds and other institutional investors own 85.54% of the company's stock.

Dutch Bros Price Performance

NYSE BROS traded up $3.47 on Wednesday, reaching $66.48. The company's stock had a trading volume of 4,110,312 shares, compared to its average volume of 2,973,741. The company has a debt-to-equity ratio of 0.77, a quick ratio of 1.58 and a current ratio of 1.76. The firm's 50 day moving average is $66.49 and its two-hundred day moving average is $50.91. Dutch Bros Inc. has a twelve month low of $26.85 and a twelve month high of $86.88. The stock has a market cap of $10.25 billion, a PE ratio of 194.96, a PEG ratio of 4.23 and a beta of 2.65.

Insiders Place Their Bets

In other news, major shareholder Dm Individual Aggregator, Llc sold 291,707 shares of the firm's stock in a transaction on Friday, February 21st. The stock was sold at an average price of $77.73, for a total value of $22,674,385.11. Following the completion of the sale, the insider now owns 2,903,316 shares of the company's stock, valued at $225,674,752.68. This trade represents a 9.13 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. Also, Chairman Travis Boersma sold 471,718 shares of the company's stock in a transaction on Wednesday, February 26th. The shares were sold at an average price of $75.91, for a total value of $35,808,113.38. Following the transaction, the chairman now directly owns 2,310,834 shares in the company, valued at $175,415,408.94. The trade was a 16.95 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 2,643,632 shares of company stock worth $201,509,627. 46.50% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

Several research analysts have commented on BROS shares. UBS Group raised their price objective on Dutch Bros from $67.00 to $90.00 and gave the company a "buy" rating in a research report on Thursday, February 13th. Jefferies Financial Group increased their price objective on shares of Dutch Bros from $60.00 to $69.00 and gave the company a "buy" rating in a research note on Wednesday, January 15th. Robert W. Baird raised their price objective on Dutch Bros from $70.00 to $95.00 and gave the stock an "outperform" rating in a research note on Thursday, February 13th. TD Securities increased their price objective on shares of Dutch Bros from $65.00 to $89.00 and gave the stock a "buy" rating in a research note on Thursday, February 13th. Finally, Bank of America raised their target price on Dutch Bros from $61.00 to $72.00 and gave the company a "buy" rating in a research note on Monday, January 27th. One analyst has rated the stock with a hold rating, twelve have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, Dutch Bros presently has a consensus rating of "Buy" and a consensus target price of $75.75.

View Our Latest Report on Dutch Bros

Dutch Bros Company Profile

(

Free Report)

Dutch Bros Inc, together with its subsidiaries, operates and franchises drive-thru shops in the United States. The company operates through Company-Operated Shops and Franchising and Other segments. It serves through company-operated shops and online channels under Dutch Bros; Dutch Bros Coffee; Dutch Bros Rebel; Dutch Bros; and Blue Rebel brands.

Read More

Before you consider Dutch Bros, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dutch Bros wasn't on the list.

While Dutch Bros currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.