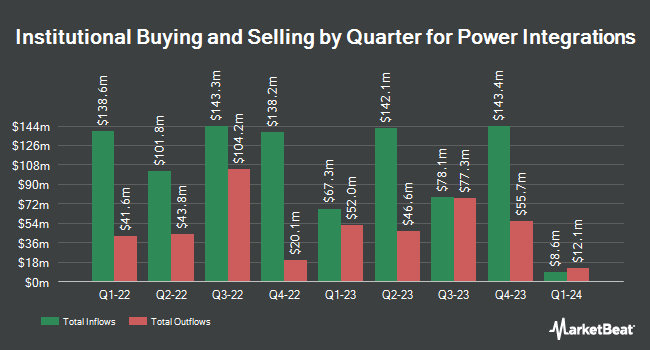

Charles Schwab Investment Management Inc. reduced its holdings in shares of Power Integrations, Inc. (NASDAQ:POWI - Free Report) by 18.9% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 621,232 shares of the semiconductor company's stock after selling 144,810 shares during the quarter. Charles Schwab Investment Management Inc. owned 1.09% of Power Integrations worth $39,833,000 at the end of the most recent quarter.

Several other institutional investors also recently bought and sold shares of the business. Intech Investment Management LLC purchased a new stake in Power Integrations during the third quarter worth approximately $983,000. BNP PARIBAS ASSET MANAGEMENT Holding S.A. lifted its position in shares of Power Integrations by 10.0% during the third quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 257,823 shares of the semiconductor company's stock worth $16,531,000 after purchasing an additional 23,405 shares in the last quarter. First Horizon Advisors Inc. lifted its position in shares of Power Integrations by 10.3% during the third quarter. First Horizon Advisors Inc. now owns 2,196 shares of the semiconductor company's stock worth $141,000 after purchasing an additional 205 shares in the last quarter. Advisors Asset Management Inc. lifted its position in shares of Power Integrations by 60.2% during the third quarter. Advisors Asset Management Inc. now owns 10,451 shares of the semiconductor company's stock worth $670,000 after purchasing an additional 3,926 shares in the last quarter. Finally, Connor Clark & Lunn Investment Management Ltd. lifted its position in shares of Power Integrations by 214.5% during the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 41,860 shares of the semiconductor company's stock worth $2,684,000 after purchasing an additional 28,548 shares in the last quarter.

Analysts Set New Price Targets

POWI has been the topic of several recent analyst reports. Northland Securities raised shares of Power Integrations from a "market perform" rating to an "outperform" rating and set a $80.00 price target on the stock in a report on Monday, August 12th. Deutsche Bank Aktiengesellschaft cut their price target on shares of Power Integrations from $73.00 to $68.00 and set a "hold" rating on the stock in a report on Wednesday, August 7th. Northland Capmk raised shares of Power Integrations from a "hold" rating to a "strong-buy" rating in a report on Monday, August 12th. Susquehanna lowered their target price on shares of Power Integrations from $80.00 to $77.00 and set a "positive" rating for the company in a research note on Thursday, November 7th. Finally, TD Cowen lowered their target price on shares of Power Integrations from $80.00 to $70.00 and set a "hold" rating for the company in a research note on Wednesday, August 7th. Three equities research analysts have rated the stock with a hold rating, four have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, Power Integrations currently has an average rating of "Moderate Buy" and an average price target of $78.00.

Check Out Our Latest Analysis on POWI

Power Integrations Stock Performance

Shares of NASDAQ:POWI traded down $1.04 during trading hours on Tuesday, hitting $66.09. 391,955 shares of the company's stock traded hands, compared to its average volume of 407,262. Power Integrations, Inc. has a 52 week low of $56.63 and a 52 week high of $89.68. The company's fifty day simple moving average is $63.47 and its two-hundred day simple moving average is $67.13. The company has a market cap of $3.76 billion, a price-to-earnings ratio of 100.14, a price-to-earnings-growth ratio of 7.27 and a beta of 1.12.

Power Integrations (NASDAQ:POWI - Get Free Report) last announced its earnings results on Wednesday, November 6th. The semiconductor company reported $0.40 EPS for the quarter, topping the consensus estimate of $0.36 by $0.04. The company had revenue of $115.84 million during the quarter, compared to analysts' expectations of $114.83 million. Power Integrations had a net margin of 9.27% and a return on equity of 4.14%. The business's revenue for the quarter was down 7.7% on a year-over-year basis. During the same period last year, the company posted $0.35 earnings per share. On average, analysts anticipate that Power Integrations, Inc. will post 0.54 EPS for the current fiscal year.

Power Integrations Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, November 29th will be given a dividend of $0.21 per share. This represents a $0.84 annualized dividend and a yield of 1.27%. The ex-dividend date is Friday, November 29th. This is a positive change from Power Integrations's previous quarterly dividend of $0.20. Power Integrations's dividend payout ratio (DPR) is presently 127.27%.

Insider Activity at Power Integrations

In other news, VP Clifford Walker sold 10,000 shares of Power Integrations stock in a transaction that occurred on Wednesday, November 27th. The shares were sold at an average price of $64.36, for a total value of $643,600.00. Following the transaction, the vice president now owns 130,934 shares of the company's stock, valued at $8,426,912.24. This trade represents a 7.10 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, VP Doug Bailey sold 8,549 shares of Power Integrations stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $64.96, for a total transaction of $555,343.04. Following the completion of the transaction, the vice president now directly owns 86,375 shares in the company, valued at approximately $5,610,920. This represents a 9.01 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 18,655 shares of company stock valued at $1,205,566. 1.50% of the stock is currently owned by corporate insiders.

Power Integrations Profile

(

Free Report)

Power Integrations, Inc designs, develops, manufactures, and markets analog and mixed-signal integrated circuits (ICs), and other electronic components and circuitry used in high-voltage power conversion worldwide. The company provides a range of alternating current to direct current power conversion products that address power supply ranging from less than one watt of output to approximately 500 watts of output for mobile-device chargers, consumer appliances, utility meters, LCD monitors, main and standby power supplies for desktop computers and TVs, LED lighting, and various other consumer and industrial applications, as well as power conversion in high-power applications comprising industrial motors, solar and wind-power systems, electric vehicles, and high-voltage DC transmission systems.

Further Reading

Before you consider Power Integrations, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Power Integrations wasn't on the list.

While Power Integrations currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report