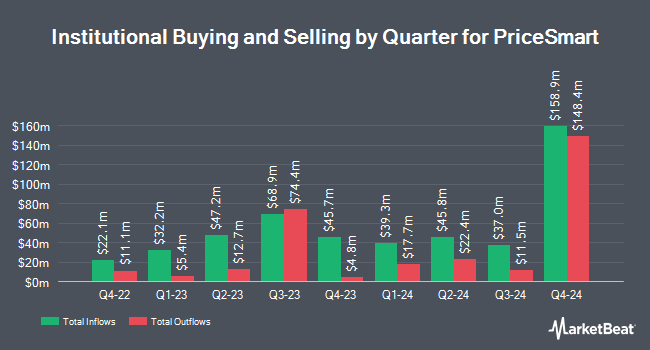

Charles Schwab Investment Management Inc. boosted its holdings in PriceSmart, Inc. (NASDAQ:PSMT - Free Report) by 3.6% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 438,517 shares of the company's stock after acquiring an additional 15,245 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.43% of PriceSmart worth $40,247,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also recently bought and sold shares of the business. Innealta Capital LLC purchased a new position in PriceSmart during the 2nd quarter valued at about $28,000. Canada Pension Plan Investment Board bought a new stake in shares of PriceSmart in the 2nd quarter valued at approximately $32,000. GAMMA Investing LLC boosted its position in PriceSmart by 76.4% during the second quarter. GAMMA Investing LLC now owns 418 shares of the company's stock worth $34,000 after purchasing an additional 181 shares during the period. Meeder Asset Management Inc. bought a new stake in PriceSmart during the second quarter worth approximately $40,000. Finally, Hantz Financial Services Inc. bought a new stake in PriceSmart during the second quarter worth approximately $45,000. 80.46% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Separately, StockNews.com upgraded PriceSmart from a "hold" rating to a "buy" rating in a research note on Saturday.

Check Out Our Latest Stock Analysis on PriceSmart

Insider Buying and Selling at PriceSmart

In related news, EVP David R. Price sold 2,750 shares of the business's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $92.24, for a total value of $253,660.00. Following the completion of the sale, the executive vice president now directly owns 48,844 shares in the company, valued at $4,505,370.56. The trade was a 5.33 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, EVP Paul Kovaleski sold 3,235 shares of the business's stock in a transaction on Wednesday, November 13th. The shares were sold at an average price of $89.96, for a total value of $291,020.60. Following the completion of the sale, the executive vice president now owns 44,309 shares of the company's stock, valued at $3,986,037.64. This trade represents a 6.80 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 16,290 shares of company stock worth $1,476,009 over the last ninety days. 18.60% of the stock is currently owned by corporate insiders.

PriceSmart Trading Up 0.9 %

NASDAQ:PSMT traded up $0.83 during mid-day trading on Tuesday, hitting $90.93. The company had a trading volume of 128,201 shares, compared to its average volume of 149,997. The firm has a market cap of $2.79 billion, a P/E ratio of 19.90 and a beta of 0.86. The company has a debt-to-equity ratio of 0.08, a quick ratio of 0.45 and a current ratio of 1.22. The business's fifty day moving average is $90.15 and its two-hundred day moving average is $86.58. PriceSmart, Inc. has a fifty-two week low of $68.71 and a fifty-two week high of $94.82.

PriceSmart (NASDAQ:PSMT - Get Free Report) last announced its earnings results on Wednesday, October 30th. The company reported $0.94 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.01 by ($0.07). The firm had revenue of $1.23 billion during the quarter, compared to analyst estimates of $1.22 billion. PriceSmart had a net margin of 2.83% and a return on equity of 12.63%. The firm's quarterly revenue was up 9.6% compared to the same quarter last year. During the same period in the prior year, the business posted $0.65 EPS. As a group, research analysts expect that PriceSmart, Inc. will post 5.28 earnings per share for the current year.

PriceSmart Profile

(

Free Report)

PriceSmart, Inc owns and operates U.S.-style membership shopping warehouse clubs in the United States, Central America, the Caribbean, and Colombia. The company provides basic and private label consumer products under the Member's Selection brand, including groceries, cleaning supplies, health and beauty aids, meat, produce, deli, seafood, and poultry.

See Also

Before you consider PriceSmart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PriceSmart wasn't on the list.

While PriceSmart currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.