Charles Schwab Investment Management Inc. lifted its holdings in shares of Freeport-McMoRan Inc. (NYSE:FCX - Free Report) by 1.6% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 8,223,038 shares of the natural resource company's stock after purchasing an additional 127,251 shares during the period. Charles Schwab Investment Management Inc. owned 0.57% of Freeport-McMoRan worth $410,494,000 at the end of the most recent reporting period.

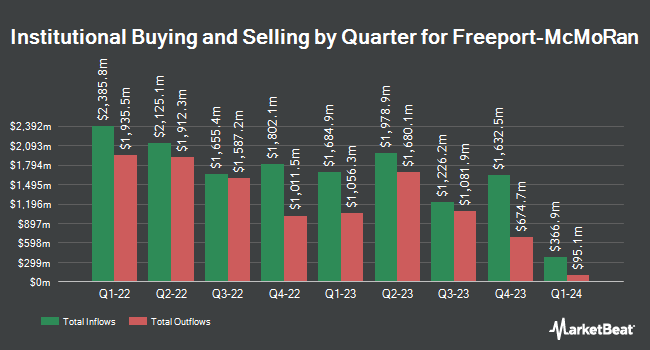

Several other large investors have also added to or reduced their stakes in FCX. L & S Advisors Inc acquired a new stake in shares of Freeport-McMoRan during the 3rd quarter worth approximately $9,817,000. Blackhawk Capital Partners LLC. acquired a new stake in Freeport-McMoRan in the third quarter worth $200,000. King Luther Capital Management Corp increased its stake in Freeport-McMoRan by 1.6% in the third quarter. King Luther Capital Management Corp now owns 20,303 shares of the natural resource company's stock valued at $1,014,000 after purchasing an additional 323 shares in the last quarter. Cornerstone Advisors LLC increased its stake in Freeport-McMoRan by 42.5% in the third quarter. Cornerstone Advisors LLC now owns 11,400 shares of the natural resource company's stock valued at $569,000 after purchasing an additional 3,400 shares in the last quarter. Finally, Connor Clark & Lunn Investment Management Ltd. raised its holdings in shares of Freeport-McMoRan by 125.7% during the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 442,636 shares of the natural resource company's stock valued at $22,096,000 after purchasing an additional 246,555 shares during the period. Institutional investors and hedge funds own 80.77% of the company's stock.

Analyst Ratings Changes

Several brokerages have recently commented on FCX. Raymond James raised their target price on Freeport-McMoRan from $55.00 to $57.00 and gave the company an "outperform" rating in a research note on Wednesday, October 23rd. UBS Group raised Freeport-McMoRan from a "neutral" rating to a "buy" rating and raised their price objective for the company from $54.00 to $55.00 in a research note on Wednesday, September 4th. StockNews.com lowered Freeport-McMoRan from a "buy" rating to a "hold" rating in a research report on Thursday, September 26th. Morgan Stanley cut their target price on Freeport-McMoRan from $60.00 to $58.00 and set an "overweight" rating on the stock in a report on Thursday, September 19th. Finally, JPMorgan Chase & Co. boosted their price target on shares of Freeport-McMoRan from $53.00 to $55.00 and gave the company a "neutral" rating in a research note on Tuesday, October 15th. Six research analysts have rated the stock with a hold rating, eight have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, Freeport-McMoRan has an average rating of "Moderate Buy" and an average price target of $54.00.

View Our Latest Stock Report on Freeport-McMoRan

Freeport-McMoRan Stock Down 0.4 %

FCX stock traded down $0.18 during trading on Friday, reaching $43.58. The stock had a trading volume of 3,474,645 shares, compared to its average volume of 12,848,229. The company has a quick ratio of 1.30, a current ratio of 2.33 and a debt-to-equity ratio of 0.31. The company has a market capitalization of $62.62 billion, a price-to-earnings ratio of 31.91, a P/E/G ratio of 1.90 and a beta of 1.91. Freeport-McMoRan Inc. has a one year low of $36.04 and a one year high of $55.24. The company's 50 day moving average is $46.85 and its two-hundred day moving average is $47.20.

Freeport-McMoRan (NYSE:FCX - Get Free Report) last released its earnings results on Tuesday, October 22nd. The natural resource company reported $0.38 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.37 by $0.01. The company had revenue of $6.79 billion during the quarter, compared to analyst estimates of $6.45 billion. Freeport-McMoRan had a return on equity of 7.40% and a net margin of 7.81%. Freeport-McMoRan's quarterly revenue was up 16.6% on a year-over-year basis. During the same period in the prior year, the company posted $0.39 earnings per share. Equities research analysts forecast that Freeport-McMoRan Inc. will post 1.51 EPS for the current year.

Freeport-McMoRan Cuts Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, November 1st. Stockholders of record on Tuesday, October 15th were paid a dividend of $0.075 per share. This represents a $0.30 dividend on an annualized basis and a dividend yield of 0.69%. The ex-dividend date of this dividend was Tuesday, October 15th. Freeport-McMoRan's payout ratio is 21.90%.

About Freeport-McMoRan

(

Free Report)

Freeport-McMoRan Inc engages in the mining of mineral properties in North America, South America, and Indonesia. It primarily explores for copper, gold, molybdenum, silver, and other metals. The company's assets include the Grasberg minerals district in Indonesia; Morenci, Bagdad, Safford, Sierrita, and Miami in Arizona; Chino and Tyrone in New Mexico; and Henderson and Climax in Colorado, North America, as well as Cerro Verde in Peru and El Abra in Chile.

See Also

Before you consider Freeport-McMoRan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freeport-McMoRan wasn't on the list.

While Freeport-McMoRan currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.