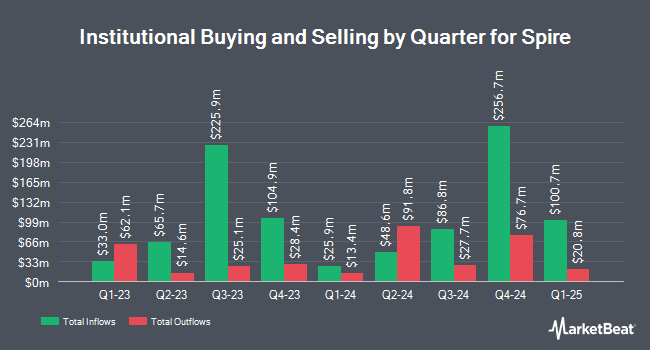

Charles Schwab Investment Management Inc. grew its position in shares of Spire Inc. (NYSE:SR - Free Report) by 4.7% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 805,932 shares of the utilities provider's stock after buying an additional 36,214 shares during the period. Charles Schwab Investment Management Inc. owned about 1.40% of Spire worth $54,231,000 as of its most recent SEC filing.

Several other hedge funds also recently made changes to their positions in SR. Dimensional Fund Advisors LP boosted its holdings in shares of Spire by 8.3% in the 2nd quarter. Dimensional Fund Advisors LP now owns 944,387 shares of the utilities provider's stock valued at $57,351,000 after buying an additional 72,119 shares during the period. Victory Capital Management Inc. grew its holdings in shares of Spire by 11.0% during the second quarter. Victory Capital Management Inc. now owns 698,819 shares of the utilities provider's stock valued at $42,439,000 after purchasing an additional 69,020 shares during the last quarter. Thrivent Financial for Lutherans raised its position in shares of Spire by 0.3% during the 3rd quarter. Thrivent Financial for Lutherans now owns 646,206 shares of the utilities provider's stock worth $43,483,000 after purchasing an additional 1,681 shares during the period. The Manufacturers Life Insurance Company lifted its holdings in shares of Spire by 0.5% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 501,852 shares of the utilities provider's stock worth $30,477,000 after purchasing an additional 2,598 shares during the last quarter. Finally, Thompson Siegel & Walmsley LLC lifted its holdings in shares of Spire by 12.4% in the 2nd quarter. Thompson Siegel & Walmsley LLC now owns 288,339 shares of the utilities provider's stock worth $17,511,000 after purchasing an additional 31,923 shares during the last quarter. Institutional investors and hedge funds own 87.36% of the company's stock.

Spire Price Performance

SR traded up $0.08 during trading on Friday, reaching $73.19. The stock had a trading volume of 140,414 shares, compared to its average volume of 362,627. Spire Inc. has a 1-year low of $56.36 and a 1-year high of $73.64. The firm has a market capitalization of $4.23 billion, a price-to-earnings ratio of 16.98, a price-to-earnings-growth ratio of 3.24 and a beta of 0.52. The stock has a 50 day moving average of $66.49 and a two-hundred day moving average of $64.25. The company has a quick ratio of 0.30, a current ratio of 0.45 and a debt-to-equity ratio of 1.24.

Spire Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, January 3rd. Investors of record on Wednesday, December 11th will be paid a dividend of $3.14 per share. The ex-dividend date of this dividend is Wednesday, December 11th. This represents a $12.56 annualized dividend and a yield of 17.16%. This is a boost from Spire's previous quarterly dividend of $0.76. Spire's dividend payout ratio (DPR) is currently 70.07%.

Analysts Set New Price Targets

A number of research analysts recently commented on the company. Mizuho upped their price objective on Spire from $62.00 to $65.00 and gave the stock a "neutral" rating in a research note on Tuesday, November 19th. UBS Group upped their price target on shares of Spire from $75.00 to $80.00 and gave the stock a "buy" rating in a research report on Thursday, November 21st. StockNews.com downgraded shares of Spire from a "hold" rating to a "sell" rating in a research report on Friday. Wells Fargo & Company upped their target price on shares of Spire from $73.00 to $75.00 and gave the stock an "equal weight" rating in a research report on Thursday, November 21st. Finally, LADENBURG THALM/SH SH cut Spire from a "neutral" rating to a "sell" rating and cut their price target for the company from $65.50 to $60.50 in a report on Thursday, October 17th. Two equities research analysts have rated the stock with a sell rating, five have issued a hold rating and one has issued a buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $69.93.

View Our Latest Stock Report on Spire

About Spire

(

Free Report)

Spire Inc, together with its subsidiaries, engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States. The company operates through three segments: Gas Utility, Gas Marketing, and Midstream. It is also involved in the marketing of natural gas and related services; and transportation and storage of natural gas.

Read More

Before you consider Spire, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spire wasn't on the list.

While Spire currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.