Charles Schwab Investment Management Inc. boosted its holdings in shares of AutoNation, Inc. (NYSE:AN - Free Report) by 2.0% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 327,165 shares of the company's stock after purchasing an additional 6,277 shares during the period. Charles Schwab Investment Management Inc. owned approximately 0.83% of AutoNation worth $55,566,000 at the end of the most recent quarter.

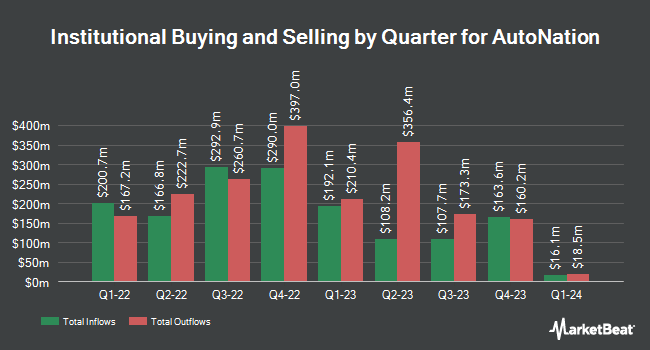

Other large investors have also recently added to or reduced their stakes in the company. Fortitude Family Office LLC raised its holdings in AutoNation by 581.8% during the 4th quarter. Fortitude Family Office LLC now owns 150 shares of the company's stock worth $25,000 after buying an additional 128 shares during the period. Global X Japan Co. Ltd. increased its stake in AutoNation by 150.8% in the 4th quarter. Global X Japan Co. Ltd. now owns 158 shares of the company's stock valued at $27,000 after buying an additional 95 shares during the period. Venturi Wealth Management LLC lifted its position in AutoNation by 403.6% in the 3rd quarter. Venturi Wealth Management LLC now owns 282 shares of the company's stock worth $50,000 after buying an additional 226 shares in the last quarter. McIlrath & Eck LLC boosted its stake in shares of AutoNation by 16.4% during the 3rd quarter. McIlrath & Eck LLC now owns 964 shares of the company's stock valued at $172,000 after buying an additional 136 shares during the period. Finally, Orion Portfolio Solutions LLC purchased a new position in shares of AutoNation during the 3rd quarter valued at $201,000. 94.62% of the stock is currently owned by institutional investors.

AutoNation Stock Performance

Shares of AutoNation stock traded up $4.01 during trading on Monday, reaching $164.22. The company's stock had a trading volume of 601,305 shares, compared to its average volume of 437,960. AutoNation, Inc. has a one year low of $150.08 and a one year high of $198.50. The company has a debt-to-equity ratio of 1.39, a quick ratio of 0.21 and a current ratio of 0.74. The firm has a market cap of $6.41 billion, a price-to-earnings ratio of 9.69, a price-to-earnings-growth ratio of 3.51 and a beta of 1.32. The business's fifty day moving average price is $181.67 and its 200-day moving average price is $173.91.

AutoNation (NYSE:AN - Get Free Report) last issued its quarterly earnings results on Tuesday, February 11th. The company reported $4.97 EPS for the quarter, topping analysts' consensus estimates of $4.26 by $0.71. AutoNation had a return on equity of 30.48% and a net margin of 2.59%. As a group, equities research analysts predict that AutoNation, Inc. will post 18.15 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several equities research analysts recently commented on the company. StockNews.com raised AutoNation from a "hold" rating to a "buy" rating in a research note on Thursday, February 13th. Stephens increased their price target on shares of AutoNation from $195.00 to $200.00 and gave the stock an "equal weight" rating in a research note on Wednesday, February 12th. Wells Fargo & Company lifted their price objective on shares of AutoNation from $170.00 to $194.00 and gave the company an "equal weight" rating in a research note on Wednesday, February 12th. Guggenheim reissued a "buy" rating on shares of AutoNation in a research report on Wednesday, February 12th. Finally, JPMorgan Chase & Co. raised their target price on AutoNation from $180.00 to $195.00 and gave the company a "neutral" rating in a report on Wednesday, February 19th. Three research analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat, AutoNation currently has a consensus rating of "Moderate Buy" and an average target price of $204.71.

Check Out Our Latest Stock Report on AN

About AutoNation

(

Free Report)

AutoNation, Inc, through its subsidiaries, operates as an automotive retailer in the United States. The company operates through three segments: Domestic, Import, and Premium Luxury. It offers a range of automotive products and services, including new and used vehicles; and parts and services, such as automotive repair and maintenance, and wholesale parts and collision services.

Featured Articles

Before you consider AutoNation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AutoNation wasn't on the list.

While AutoNation currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 best stocks to own in Spring 2025, carefully selected for their growth potential amid market volatility. This exclusive report highlights top companies poised to thrive in uncertain economic conditions—download now to gain an investing edge.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.