Charles Schwab Investment Management Inc. grew its position in MasTec, Inc. (NYSE:MTZ - Free Report) by 1.2% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 630,315 shares of the construction company's stock after buying an additional 7,469 shares during the period. Charles Schwab Investment Management Inc. owned approximately 0.80% of MasTec worth $77,592,000 at the end of the most recent quarter.

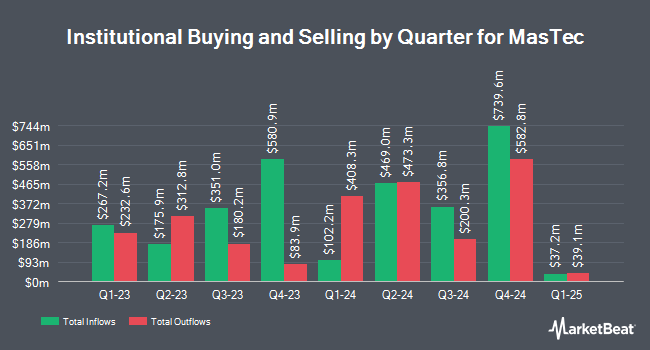

Several other institutional investors and hedge funds also recently made changes to their positions in the company. CIBC Asset Management Inc grew its holdings in shares of MasTec by 3.7% in the 3rd quarter. CIBC Asset Management Inc now owns 2,280 shares of the construction company's stock valued at $281,000 after buying an additional 82 shares during the period. New York State Teachers Retirement System boosted its stake in MasTec by 0.4% in the 3rd quarter. New York State Teachers Retirement System now owns 26,557 shares of the construction company's stock worth $3,269,000 after purchasing an additional 100 shares during the period. Victory Capital Management Inc. boosted its stake in MasTec by 0.8% in the 3rd quarter. Victory Capital Management Inc. now owns 12,858 shares of the construction company's stock worth $1,583,000 after purchasing an additional 101 shares during the period. UMB Bank n.a. boosted its stake in MasTec by 46.3% in the 3rd quarter. UMB Bank n.a. now owns 379 shares of the construction company's stock worth $47,000 after purchasing an additional 120 shares during the period. Finally, Blue Trust Inc. lifted its position in MasTec by 32.6% during the 2nd quarter. Blue Trust Inc. now owns 561 shares of the construction company's stock worth $60,000 after buying an additional 138 shares in the last quarter. Institutional investors and hedge funds own 78.10% of the company's stock.

Insider Buying and Selling at MasTec

In other MasTec news, COO Robert E. Apple sold 19,023 shares of the stock in a transaction dated Friday, November 1st. The shares were sold at an average price of $135.63, for a total value of $2,580,089.49. Following the transaction, the chief operating officer now directly owns 197,202 shares of the company's stock, valued at $26,746,507.26. This represents a 8.80 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director C Robert Campbell sold 3,000 shares of the stock in a transaction dated Wednesday, September 18th. The shares were sold at an average price of $116.26, for a total transaction of $348,780.00. Following the completion of the transaction, the director now directly owns 48,173 shares in the company, valued at approximately $5,600,592.98. This represents a 5.86 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 42,823 shares of company stock valued at $5,558,301 in the last three months. 21.30% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

Several equities research analysts have commented on the stock. The Goldman Sachs Group boosted their price target on shares of MasTec from $115.00 to $130.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 9th. KeyCorp boosted their price target on shares of MasTec from $123.00 to $145.00 and gave the stock an "overweight" rating in a research report on Tuesday, October 8th. B. Riley reissued a "buy" rating and set a $166.00 price target (up from $151.00) on shares of MasTec in a research report on Tuesday, November 5th. Citigroup boosted their price target on shares of MasTec from $122.00 to $150.00 and gave the stock a "buy" rating in a research report on Tuesday, October 22nd. Finally, Robert W. Baird upped their target price on shares of MasTec from $120.00 to $153.00 and gave the company a "neutral" rating in a report on Monday, November 4th. Two equities research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the stock. According to MarketBeat, MasTec has a consensus rating of "Moderate Buy" and a consensus target price of $148.62.

Get Our Latest Analysis on MasTec

MasTec Stock Performance

MasTec stock traded down $3.39 during trading hours on Thursday, hitting $144.55. The company had a trading volume of 653,468 shares, compared to its average volume of 858,865. The firm has a market cap of $11.45 billion, a PE ratio of 129.05 and a beta of 1.70. The company has a debt-to-equity ratio of 0.76, a current ratio of 1.24 and a quick ratio of 1.20. MasTec, Inc. has a one year low of $54.06 and a one year high of $150.12. The firm has a 50-day moving average of $130.77 and a 200 day moving average of $115.88.

MasTec Company Profile

(

Free Report)

MasTec, Inc, an infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada. It operates through five segments: Communications, Clean Energy and Infrastructure, Oil and Gas, Power Delivery, and Other.

See Also

Before you consider MasTec, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MasTec wasn't on the list.

While MasTec currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.