Charles Schwab Investment Management Inc. boosted its stake in Rush Street Interactive, Inc. (NYSE:RSI - Free Report) by 26.4% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 741,862 shares of the company's stock after acquiring an additional 154,785 shares during the period. Charles Schwab Investment Management Inc. owned 0.33% of Rush Street Interactive worth $8,049,000 as of its most recent filing with the SEC.

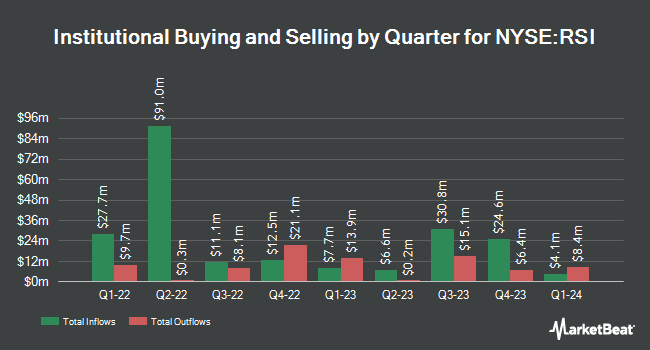

Other hedge funds have also added to or reduced their stakes in the company. New York State Teachers Retirement System raised its stake in shares of Rush Street Interactive by 17.2% in the third quarter. New York State Teachers Retirement System now owns 6,938 shares of the company's stock valued at $75,000 after buying an additional 1,020 shares during the period. Quarry LP raised its stake in Rush Street Interactive by 15.9% in the 2nd quarter. Quarry LP now owns 8,762 shares of the company's stock valued at $84,000 after acquiring an additional 1,200 shares during the period. CWM LLC raised its position in shares of Rush Street Interactive by 425.6% in the third quarter. CWM LLC now owns 9,209 shares of the company's stock valued at $100,000 after purchasing an additional 7,457 shares during the period. Principal Financial Group Inc. bought a new stake in shares of Rush Street Interactive in the second quarter valued at approximately $98,000. Finally, nVerses Capital LLC bought a new stake in shares of Rush Street Interactive in the third quarter valued at approximately $148,000. Institutional investors own 24.78% of the company's stock.

Rush Street Interactive Stock Performance

RSI traded up $0.36 during trading on Wednesday, reaching $13.86. The stock had a trading volume of 1,163,081 shares, compared to its average volume of 1,687,713. The stock has a market cap of $3.13 billion, a PE ratio of -675.50 and a beta of 1.88. Rush Street Interactive, Inc. has a one year low of $3.56 and a one year high of $14.92. The business has a 50-day moving average of $11.83 and a 200-day moving average of $10.33.

Insider Activity

In related news, CEO Richard Todd Schwartz sold 103,905 shares of the stock in a transaction dated Friday, November 15th. The stock was sold at an average price of $11.02, for a total transaction of $1,145,033.10. Following the completion of the sale, the chief executive officer now directly owns 1,703,578 shares in the company, valued at $18,773,429.56. This represents a 5.75 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, insider Paul Wierbicki sold 35,000 shares of the firm's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $11.23, for a total transaction of $393,050.00. Following the completion of the transaction, the insider now owns 139,982 shares in the company, valued at $1,571,997.86. This represents a 20.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 357,595 shares of company stock worth $4,224,380. 56.89% of the stock is currently owned by insiders.

Analysts Set New Price Targets

A number of equities research analysts have issued reports on RSI shares. Needham & Company LLC boosted their target price on shares of Rush Street Interactive from $14.00 to $15.00 and gave the company a "buy" rating in a report on Thursday, October 31st. Craig Hallum boosted their price objective on Rush Street Interactive from $14.00 to $17.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. Finally, Jefferies Financial Group boosted their price objective on Rush Street Interactive from $15.00 to $16.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. Two investment analysts have rated the stock with a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $12.43.

Get Our Latest Stock Report on Rush Street Interactive

About Rush Street Interactive

(

Free Report)

Rush Street Interactive, Inc operates as an online casino and sports betting company in the United States, Canada, Mexico, and rest of Latin America. It provides real-money online casino, online and retail sports betting, and social gaming services. In addition, the company offers full suite of games comprising of bricks-and-mortar casinos, table games, and slot machines.

Featured Stories

Before you consider Rush Street Interactive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rush Street Interactive wasn't on the list.

While Rush Street Interactive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.