Charles Schwab Investment Management Inc. boosted its stake in shares of Cogent Biosciences, Inc. (NASDAQ:COGT - Free Report) by 20.3% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 825,793 shares of the technology company's stock after acquiring an additional 139,096 shares during the quarter. Charles Schwab Investment Management Inc. owned about 0.75% of Cogent Biosciences worth $8,919,000 as of its most recent filing with the Securities and Exchange Commission.

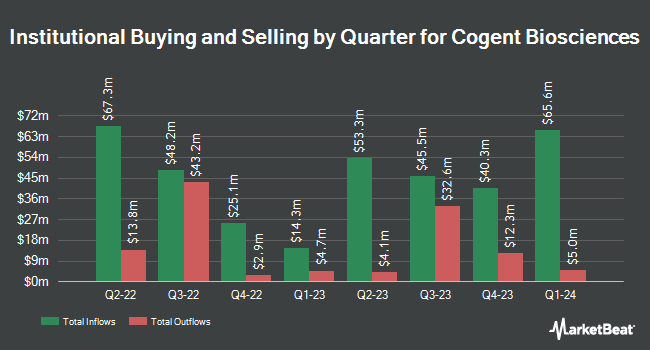

Several other hedge funds have also recently modified their holdings of COGT. Point72 Asset Management L.P. lifted its holdings in shares of Cogent Biosciences by 124.5% in the 2nd quarter. Point72 Asset Management L.P. now owns 14,986,398 shares of the technology company's stock valued at $126,335,000 after buying an additional 8,310,150 shares during the period. Hennion & Walsh Asset Management Inc. acquired a new position in shares of Cogent Biosciences in the second quarter worth $1,077,000. Sofinnova Investments Inc. raised its stake in Cogent Biosciences by 15.5% in the 2nd quarter. Sofinnova Investments Inc. now owns 2,773,286 shares of the technology company's stock valued at $23,379,000 after purchasing an additional 372,515 shares during the last quarter. Deerfield Management Company L.P. Series C raised its position in shares of Cogent Biosciences by 144.0% in the second quarter. Deerfield Management Company L.P. Series C now owns 3,744,263 shares of the technology company's stock valued at $31,564,000 after buying an additional 2,209,918 shares during the last quarter. Finally, Quest Partners LLC acquired a new position in Cogent Biosciences in the 2nd quarter valued at $89,000.

Analyst Upgrades and Downgrades

A number of research analysts have recently commented on COGT shares. Citigroup upped their price objective on shares of Cogent Biosciences from $13.00 to $15.00 and gave the company a "buy" rating in a research note on Tuesday, September 24th. HC Wainwright reiterated a "buy" rating on shares of Cogent Biosciences in a research note on Wednesday. Robert W. Baird raised their price target on shares of Cogent Biosciences from $8.00 to $10.00 and gave the company a "neutral" rating in a report on Thursday, September 5th. Needham & Company LLC downgraded Cogent Biosciences from a "buy" rating to a "hold" rating in a report on Wednesday. Finally, Wedbush reissued a "neutral" rating and issued a $11.00 price objective on shares of Cogent Biosciences in a report on Tuesday, November 12th. Three analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $14.83.

View Our Latest Stock Report on COGT

Cogent Biosciences Price Performance

Shares of NASDAQ:COGT traded down $0.23 during trading on Wednesday, reaching $9.27. 2,151,561 shares of the company's stock traded hands, compared to its average volume of 1,452,135. The company has a 50 day moving average of $10.49 and a 200-day moving average of $9.78. Cogent Biosciences, Inc. has a 12 month low of $3.90 and a 12 month high of $12.61. The stock has a market capitalization of $1.02 billion, a P/E ratio of -3.51 and a beta of 1.71.

Cogent Biosciences (NASDAQ:COGT - Get Free Report) last announced its quarterly earnings results on Tuesday, November 12th. The technology company reported ($0.64) earnings per share for the quarter, missing analysts' consensus estimates of ($0.57) by ($0.07). During the same period last year, the business posted ($0.64) earnings per share. Equities research analysts predict that Cogent Biosciences, Inc. will post -2.4 earnings per share for the current fiscal year.

Cogent Biosciences Company Profile

(

Free Report)

Cogent Biosciences, Inc, a biotechnology company, focuses on developing precision therapies for genetically defined diseases. Its lead product candidate includes bezuclastinib (CGT9486), a selective tyrosine kinase inhibitor designed to target mutations within the KIT receptor tyrosine kinase, including KIT D816V KIT D816V mutation that drives systemic mastocytosis, as well as other mutations in KIT exon 17, which are found in patients with advanced gastrointestinal stromal tumors.

Featured Stories

Before you consider Cogent Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cogent Biosciences wasn't on the list.

While Cogent Biosciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.