Charles Schwab Investment Management Inc. increased its holdings in shares of Applied Digital Co. (NASDAQ:APLD - Free Report) by 36.5% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 899,293 shares of the company's stock after purchasing an additional 240,554 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 0.42% of Applied Digital worth $7,419,000 as of its most recent SEC filing.

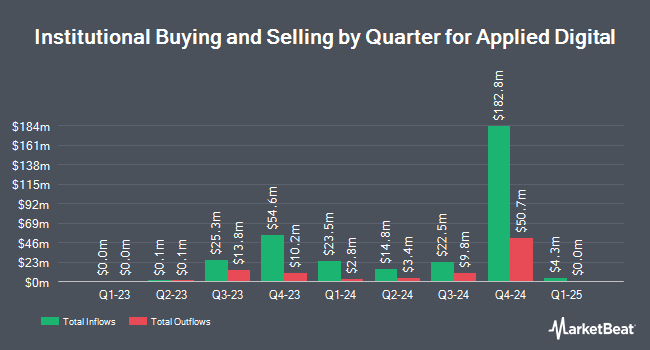

Other hedge funds have also added to or reduced their stakes in the company. Hood River Capital Management LLC raised its stake in shares of Applied Digital by 8.7% during the 2nd quarter. Hood River Capital Management LLC now owns 9,596,231 shares of the company's stock worth $57,098,000 after purchasing an additional 771,699 shares in the last quarter. Van ECK Associates Corp lifted its stake in Applied Digital by 18.3% in the second quarter. Van ECK Associates Corp now owns 2,869,980 shares of the company's stock valued at $17,077,000 after acquiring an additional 443,699 shares during the last quarter. Royce & Associates LP grew its position in shares of Applied Digital by 1.4% in the 3rd quarter. Royce & Associates LP now owns 1,132,140 shares of the company's stock valued at $9,340,000 after acquiring an additional 15,763 shares during the period. B. Riley Wealth Advisors Inc. increased its stake in shares of Applied Digital by 66.1% during the 2nd quarter. B. Riley Wealth Advisors Inc. now owns 774,655 shares of the company's stock worth $4,609,000 after purchasing an additional 308,223 shares during the last quarter. Finally, Exchange Traded Concepts LLC lifted its stake in Applied Digital by 4.9% in the 3rd quarter. Exchange Traded Concepts LLC now owns 728,424 shares of the company's stock valued at $6,009,000 after purchasing an additional 34,166 shares during the last quarter. Institutional investors own 65.67% of the company's stock.

Insider Activity at Applied Digital

In related news, Director Richard N. Nottenburg sold 19,369 shares of the stock in a transaction that occurred on Thursday, November 7th. The shares were sold at an average price of $7.51, for a total transaction of $145,461.19. Following the sale, the director now owns 384,317 shares in the company, valued at approximately $2,886,220.67. This trade represents a 4.80 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Douglas S. Miller sold 10,000 shares of Applied Digital stock in a transaction that occurred on Thursday, October 17th. The shares were sold at an average price of $8.01, for a total transaction of $80,100.00. Following the completion of the transaction, the director now directly owns 208,506 shares in the company, valued at $1,670,133.06. This trade represents a 4.58 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 359,369 shares of company stock worth $3,115,161. Company insiders own 11.81% of the company's stock.

Applied Digital Stock Performance

Shares of APLD traded up $0.28 during midday trading on Thursday, reaching $9.04. 17,235,670 shares of the stock were exchanged, compared to its average volume of 8,347,665. The company has a quick ratio of 0.22, a current ratio of 0.22 and a debt-to-equity ratio of 0.62. The stock's 50 day simple moving average is $8.28 and its 200 day simple moving average is $6.33. Applied Digital Co. has a twelve month low of $2.36 and a twelve month high of $11.25. The company has a market cap of $1.91 billion, a P/E ratio of -7.72 and a beta of 4.67.

Applied Digital (NASDAQ:APLD - Get Free Report) last posted its quarterly earnings data on Wednesday, October 9th. The company reported ($0.15) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.28) by $0.13. Applied Digital had a negative net margin of 74.95% and a negative return on equity of 88.87%. The firm had revenue of $60.70 million during the quarter, compared to the consensus estimate of $54.85 million. During the same quarter in the previous year, the firm posted ($0.10) EPS. The business's revenue for the quarter was up 67.2% compared to the same quarter last year. On average, sell-side analysts expect that Applied Digital Co. will post -0.4 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of brokerages have weighed in on APLD. Craig Hallum boosted their price target on Applied Digital from $10.00 to $12.00 and gave the stock a "buy" rating in a research report on Thursday, October 10th. B. Riley boosted their target price on Applied Digital from $8.00 to $9.00 and gave the stock a "buy" rating in a report on Friday, September 13th. Roth Mkm reaffirmed a "buy" rating and set a $10.00 price target on shares of Applied Digital in a report on Thursday, October 10th. HC Wainwright lifted their target price on shares of Applied Digital from $5.00 to $10.00 and gave the stock a "buy" rating in a report on Wednesday, October 16th. Finally, Needham & Company LLC reissued a "buy" rating and issued a $11.00 price target on shares of Applied Digital in a report on Friday, November 1st. Six equities research analysts have rated the stock with a buy rating, According to MarketBeat.com, the stock currently has a consensus rating of "Buy" and a consensus price target of $10.50.

View Our Latest Research Report on APLD

Applied Digital Company Profile

(

Free Report)

Applied Digital Corporation designs, develops, and operates datacenters in North America. Its datacenters provide digital infrastructure solutions to the high-performance computing industry. The company also provides artificial intelligence cloud services, high performance computing datacenter hosting, and crypto datacenter hosting services.

Featured Articles

Before you consider Applied Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Digital wasn't on the list.

While Applied Digital currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.