Charles Schwab Investment Management Inc. reduced its position in WesBanco, Inc. (NASDAQ:WSBC - Free Report) by 2.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 821,331 shares of the financial services provider's stock after selling 23,064 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 1.23% of WesBanco worth $24,459,000 as of its most recent SEC filing.

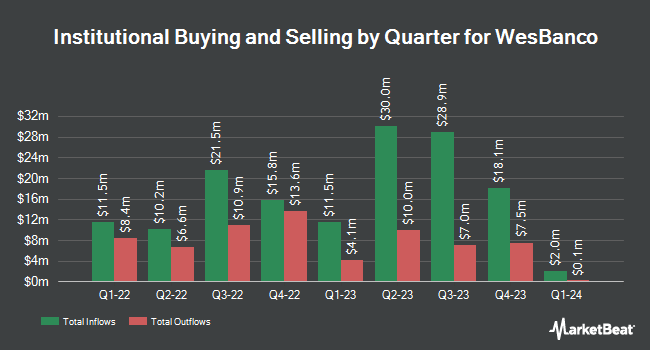

Other institutional investors and hedge funds also recently bought and sold shares of the company. Inspire Investing LLC increased its position in shares of WesBanco by 4.6% during the second quarter. Inspire Investing LLC now owns 12,630 shares of the financial services provider's stock worth $353,000 after acquiring an additional 560 shares during the period. Raymond James Trust N.A. raised its position in WesBanco by 3.9% in the 2nd quarter. Raymond James Trust N.A. now owns 17,380 shares of the financial services provider's stock valued at $485,000 after purchasing an additional 647 shares in the last quarter. Harbor Capital Advisors Inc. raised its position in WesBanco by 3.9% in the 3rd quarter. Harbor Capital Advisors Inc. now owns 17,590 shares of the financial services provider's stock valued at $524,000 after purchasing an additional 668 shares in the last quarter. Quarry LP boosted its stake in shares of WesBanco by 215.3% in the 2nd quarter. Quarry LP now owns 1,337 shares of the financial services provider's stock valued at $37,000 after buying an additional 913 shares during the period. Finally, Signaturefd LLC grew its position in shares of WesBanco by 214.5% during the second quarter. Signaturefd LLC now owns 1,384 shares of the financial services provider's stock worth $39,000 after buying an additional 944 shares in the last quarter. 61.41% of the stock is currently owned by hedge funds and other institutional investors.

WesBanco Stock Up 2.3 %

Shares of NASDAQ WSBC traded up $0.80 during mid-day trading on Friday, reaching $36.32. The company had a trading volume of 616,817 shares, compared to its average volume of 255,500. The firm has a 50 day simple moving average of $32.67 and a two-hundred day simple moving average of $30.61. The stock has a market cap of $2.43 billion, a P/E ratio of 17.38 and a beta of 0.84. WesBanco, Inc. has a 52-week low of $25.56 and a 52-week high of $37.36. The company has a current ratio of 0.93, a quick ratio of 0.93 and a debt-to-equity ratio of 0.55.

WesBanco (NASDAQ:WSBC - Get Free Report) last issued its quarterly earnings data on Wednesday, October 23rd. The financial services provider reported $0.54 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.51 by $0.03. The company had revenue of $243.34 million for the quarter, compared to the consensus estimate of $152.40 million. WesBanco had a net margin of 14.79% and a return on equity of 5.75%. During the same period last year, the firm posted $0.59 EPS. Sell-side analysts predict that WesBanco, Inc. will post 2.14 earnings per share for the current year.

WesBanco Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Friday, December 6th will be given a dividend of $0.37 per share. The ex-dividend date is Friday, December 6th. This represents a $1.48 dividend on an annualized basis and a yield of 4.07%. This is an increase from WesBanco's previous quarterly dividend of $0.36. WesBanco's dividend payout ratio is presently 70.81%.

Wall Street Analysts Forecast Growth

Several brokerages recently weighed in on WSBC. Raymond James raised shares of WesBanco from an "outperform" rating to a "strong-buy" rating and raised their target price for the company from $35.00 to $44.00 in a report on Friday. Royal Bank of Canada reiterated a "sector perform" rating and set a $35.00 target price on shares of WesBanco in a research note on Monday, September 9th. Finally, Stephens raised their price target on WesBanco from $33.00 to $34.00 and gave the company an "equal weight" rating in a research note on Monday, October 28th. Three equities research analysts have rated the stock with a hold rating, two have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, WesBanco currently has an average rating of "Moderate Buy" and an average target price of $37.83.

Get Our Latest Stock Analysis on WSBC

Insider Activity

In other WesBanco news, EVP Michael L. Perkins sold 1,125 shares of the stock in a transaction on Friday, November 8th. The stock was sold at an average price of $34.87, for a total value of $39,228.75. Following the completion of the transaction, the executive vice president now owns 46,817 shares in the company, valued at approximately $1,632,508.79. This represents a 2.35 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Insiders own 3.44% of the company's stock.

About WesBanco

(

Free Report)

WesBanco, Inc operates as the bank holding company for WesBanco Bank, Inc that provides retail banking, corporate banking, personal and corporate trust, brokerage, mortgage banking, and insurance services to individuals and businesses in the United States. The company operates through two segments, Community Banking, and Trust and Investment Services.

Featured Articles

Before you consider WesBanco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WesBanco wasn't on the list.

While WesBanco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.