Charles Schwab Investment Management Inc. boosted its position in shares of Cleveland-Cliffs Inc. (NYSE:CLF - Free Report) by 3.3% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 3,751,153 shares of the mining company's stock after purchasing an additional 121,389 shares during the period. Charles Schwab Investment Management Inc. owned about 0.76% of Cleveland-Cliffs worth $47,902,000 at the end of the most recent reporting period.

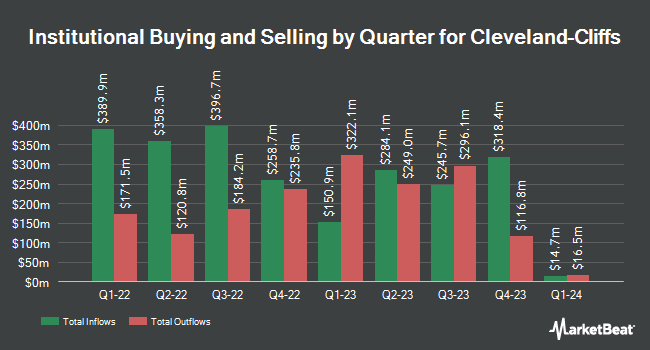

Other large investors have also recently added to or reduced their stakes in the company. Twelve Points Wealth Management LLC grew its holdings in shares of Cleveland-Cliffs by 58.5% in the 3rd quarter. Twelve Points Wealth Management LLC now owns 133,717 shares of the mining company's stock valued at $1,708,000 after acquiring an additional 49,359 shares in the last quarter. Commerce Bank grew its holdings in shares of Cleveland-Cliffs by 342.8% in the 3rd quarter. Commerce Bank now owns 116,870 shares of the mining company's stock valued at $1,492,000 after acquiring an additional 90,477 shares in the last quarter. Hodges Capital Management Inc. lifted its stake in Cleveland-Cliffs by 5.0% in the 2nd quarter. Hodges Capital Management Inc. now owns 2,199,634 shares of the mining company's stock valued at $33,852,000 after purchasing an additional 104,197 shares during the last quarter. DekaBank Deutsche Girozentrale lifted its stake in Cleveland-Cliffs by 2.5% in the 1st quarter. DekaBank Deutsche Girozentrale now owns 40,118 shares of the mining company's stock valued at $879,000 after purchasing an additional 984 shares during the last quarter. Finally, GSA Capital Partners LLP lifted its stake in Cleveland-Cliffs by 295.9% in the 3rd quarter. GSA Capital Partners LLP now owns 205,461 shares of the mining company's stock valued at $2,624,000 after purchasing an additional 153,560 shares during the last quarter. Institutional investors own 67.68% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages recently issued reports on CLF. StockNews.com downgraded shares of Cleveland-Cliffs from a "hold" rating to a "sell" rating in a research note on Thursday, November 7th. The Goldman Sachs Group began coverage on shares of Cleveland-Cliffs in a research note on Monday. They issued a "buy" rating and a $16.00 target price for the company. Seaport Res Ptn upgraded shares of Cleveland-Cliffs from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, August 27th. Morgan Stanley cut their target price on shares of Cleveland-Cliffs from $15.00 to $13.50 and set an "equal weight" rating for the company in a research note on Wednesday, September 18th. Finally, Citigroup cut their target price on shares of Cleveland-Cliffs from $18.00 to $12.50 and set a "neutral" rating for the company in a research note on Tuesday, September 10th. Three research analysts have rated the stock with a sell rating, five have given a hold rating, three have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $17.39.

View Our Latest Research Report on CLF

Cleveland-Cliffs Price Performance

Shares of NYSE CLF traded up $0.38 during midday trading on Monday, reaching $12.83. The company's stock had a trading volume of 11,174,293 shares, compared to its average volume of 10,341,011. The company has a debt-to-equity ratio of 0.53, a quick ratio of 0.55 and a current ratio of 1.85. Cleveland-Cliffs Inc. has a fifty-two week low of $10.21 and a fifty-two week high of $22.97. The business's 50 day moving average price is $12.69 and its two-hundred day moving average price is $13.87. The company has a market cap of $6.34 billion, a P/E ratio of -13.09 and a beta of 1.97.

Cleveland-Cliffs (NYSE:CLF - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The mining company reported ($0.33) earnings per share for the quarter, missing analysts' consensus estimates of ($0.31) by ($0.02). Cleveland-Cliffs had a negative net margin of 2.31% and a negative return on equity of 0.59%. The business had revenue of $4.57 billion during the quarter, compared to analyst estimates of $4.72 billion. During the same quarter in the previous year, the firm posted $0.54 earnings per share. The firm's quarterly revenue was down 18.5% on a year-over-year basis. On average, analysts forecast that Cleveland-Cliffs Inc. will post -0.45 EPS for the current fiscal year.

Cleveland-Cliffs Company Profile

(

Free Report)

Cleveland-Cliffs is the largest flat-rolled steel company and the largest iron ore pellet producer in North America. The company is vertically integrated from mining through iron making, steelmaking, rolling, finishing and downstream with hot and cold stamping of steel parts and components. The company was formerly known as Cliffs Natural Resources Inc and changed its name to Cleveland-Cliffs Inc in August 2017.

Recommended Stories

Before you consider Cleveland-Cliffs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cleveland-Cliffs wasn't on the list.

While Cleveland-Cliffs currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.