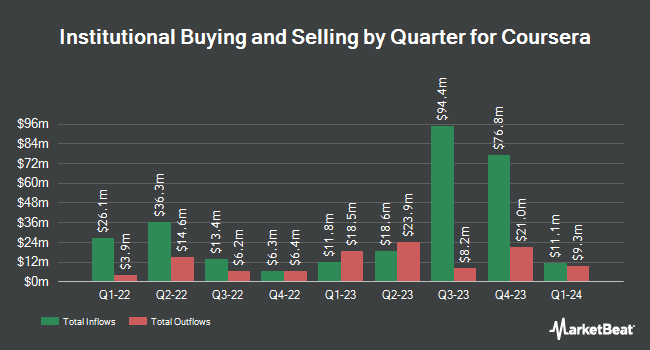

Charles Schwab Investment Management Inc. boosted its stake in shares of Coursera, Inc. (NYSE:COUR - Free Report) by 17.8% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 1,036,300 shares of the company's stock after buying an additional 156,512 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 0.65% of Coursera worth $8,228,000 as of its most recent SEC filing.

A number of other large investors have also added to or reduced their stakes in COUR. Assenagon Asset Management S.A. purchased a new stake in Coursera in the second quarter worth $9,525,000. Millennium Management LLC increased its holdings in Coursera by 67.0% in the 2nd quarter. Millennium Management LLC now owns 2,800,912 shares of the company's stock worth $20,055,000 after acquiring an additional 1,123,397 shares during the last quarter. M&G Plc purchased a new stake in Coursera in the 2nd quarter worth about $5,048,000. Acadian Asset Management LLC increased its stake in shares of Coursera by 101.9% in the second quarter. Acadian Asset Management LLC now owns 940,592 shares of the company's stock worth $6,731,000 after purchasing an additional 474,723 shares in the last quarter. Finally, Panagora Asset Management Inc. purchased a new position in shares of Coursera in the second quarter worth about $3,162,000. Hedge funds and other institutional investors own 89.55% of the company's stock.

Analysts Set New Price Targets

A number of research firms recently weighed in on COUR. Cantor Fitzgerald reiterated an "overweight" rating and issued a $10.00 price objective on shares of Coursera in a research note on Thursday, December 5th. Bank of America initiated coverage on Coursera in a research report on Thursday, September 19th. They issued a "buy" rating and a $11.00 price target for the company. Scotiabank assumed coverage on Coursera in a research report on Thursday, December 5th. They issued a "sector perform" rating and a $9.00 price target for the company. Morgan Stanley reduced their target price on Coursera from $15.00 to $10.00 and set an "overweight" rating for the company in a report on Friday, October 25th. Finally, Royal Bank of Canada reduced their target price on Coursera from $18.00 to $10.00 and set an "outperform" rating for the company in a report on Friday, October 25th. One analyst has rated the stock with a sell rating, three have assigned a hold rating and nine have assigned a buy rating to the company's stock. According to data from MarketBeat, Coursera currently has an average rating of "Moderate Buy" and a consensus target price of $10.52.

Get Our Latest Research Report on Coursera

Insider Transactions at Coursera

In other news, SVP Alan B. Cardenas sold 6,102 shares of the firm's stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $6.83, for a total transaction of $41,676.66. Following the transaction, the senior vice president now directly owns 194,082 shares of the company's stock, valued at approximately $1,325,580.06. This trade represents a 3.05 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Andrew Y. Ng sold 6,221 shares of the firm's stock in a transaction dated Wednesday, September 18th. The shares were sold at an average price of $8.03, for a total value of $49,954.63. Following the transaction, the director now directly owns 7,297,671 shares in the company, valued at $58,600,298.13. This trade represents a 0.09 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 13,885 shares of company stock worth $102,815. 16.30% of the stock is currently owned by corporate insiders.

Coursera Stock Down 0.6 %

NYSE:COUR traded down $0.05 during midday trading on Wednesday, hitting $8.45. The company had a trading volume of 1,899,902 shares, compared to its average volume of 2,304,604. The stock's fifty day moving average price is $7.53 and its 200-day moving average price is $7.61. Coursera, Inc. has a 52-week low of $6.29 and a 52-week high of $21.26. The company has a market capitalization of $1.34 billion, a PE ratio of -16.66 and a beta of 1.49.

Coursera Company Profile

(

Free Report)

Coursera, Inc operates an online educational content platform in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally. It operates in three segments: Consumer, Enterprise, and Degrees. The company offers guided projects, courses, and specializations, as well as online degrees; and certificates for entry-level professional, non-entry level professional, university, and MasterTrack.

Read More

Before you consider Coursera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coursera wasn't on the list.

While Coursera currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.