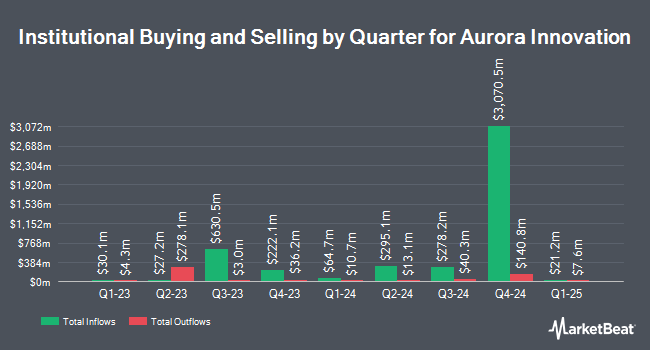

Charles Schwab Investment Management Inc. increased its holdings in Aurora Innovation, Inc. (NASDAQ:AUR - Free Report) by 26.7% in the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 8,424,827 shares of the company's stock after buying an additional 1,776,513 shares during the period. Charles Schwab Investment Management Inc. owned about 0.49% of Aurora Innovation worth $49,875,000 as of its most recent filing with the SEC.

Other institutional investors have also modified their holdings of the company. Souders Financial Advisors acquired a new position in Aurora Innovation during the 3rd quarter valued at about $59,000. Sigma Planning Corp bought a new position in shares of Aurora Innovation in the third quarter worth $63,000. Sequoia Financial Advisors LLC acquired a new position in shares of Aurora Innovation during the second quarter valued at $30,000. ASB Consultores LLC raised its stake in shares of Aurora Innovation by 24.0% during the third quarter. ASB Consultores LLC now owns 15,955 shares of the company's stock valued at $94,000 after purchasing an additional 3,088 shares in the last quarter. Finally, Drive Wealth Management LLC acquired a new stake in Aurora Innovation in the third quarter worth about $94,000. Institutional investors own 44.71% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have commented on AUR shares. Wolfe Research assumed coverage on shares of Aurora Innovation in a research report on Tuesday, November 26th. They set a "peer perform" rating on the stock. The Goldman Sachs Group upped their target price on Aurora Innovation from $2.00 to $2.50 and gave the stock a "sell" rating in a research report on Monday, November 4th. Evercore ISI boosted their price objective on Aurora Innovation from $3.00 to $5.00 and gave the stock an "in-line" rating in a research note on Monday, October 14th. Canaccord Genuity Group reaffirmed a "buy" rating and set a $7.00 target price on shares of Aurora Innovation in a research note on Monday, September 30th. Finally, TD Cowen boosted their price target on shares of Aurora Innovation from $3.00 to $4.00 and gave the stock a "hold" rating in a research report on Thursday, October 31st. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating and one has given a buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $4.63.

Check Out Our Latest Stock Report on Aurora Innovation

Aurora Innovation Stock Performance

AUR traded down $0.02 during trading on Friday, reaching $6.47. The company had a trading volume of 5,569,457 shares, compared to its average volume of 12,468,168. Aurora Innovation, Inc. has a 12-month low of $2.10 and a 12-month high of $7.01. The company has a market cap of $11.12 billion, a price-to-earnings ratio of -13.20 and a beta of 2.82. The firm's 50-day simple moving average is $5.89 and its 200 day simple moving average is $4.30.

Insider Activity

In related news, Director Gloria R. Boyland sold 30,000 shares of Aurora Innovation stock in a transaction on Tuesday, November 26th. The shares were sold at an average price of $6.30, for a total value of $189,000.00. Following the completion of the sale, the director now owns 344,647 shares of the company's stock, valued at approximately $2,171,276.10. The trade was a 8.01 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Reid Hoffman sold 3,500,000 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $5.58, for a total value of $19,530,000.00. Following the completion of the transaction, the director now directly owns 382,425 shares in the company, valued at $2,133,931.50. The trade was a 90.15 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 8,776,667 shares of company stock worth $48,432,337 over the last 90 days. 13.83% of the stock is owned by company insiders.

Aurora Innovation Profile

(

Free Report)

Aurora Innovation, Inc operates as a self-driving technology company in the United States. It focuses on developing Aurora Driver, a platform that brings a suite of self-driving hardware, software, and data services together to adapt and interoperate vehicles. The company was founded in 2017 and is headquartered in Pittsburgh, Pennsylvania.

See Also

Before you consider Aurora Innovation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aurora Innovation wasn't on the list.

While Aurora Innovation currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.