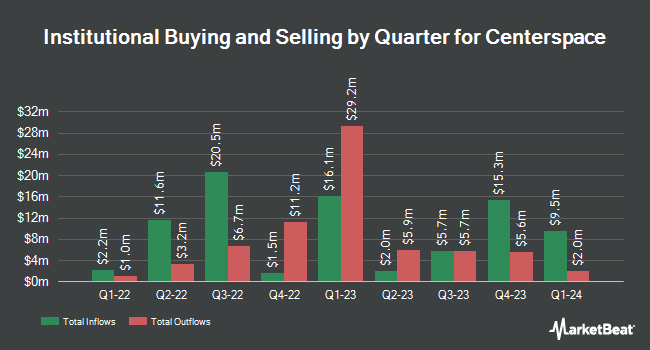

Charles Schwab Investment Management Inc. lifted its holdings in shares of Centerspace (NYSE:CSR - Free Report) by 9.5% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 275,511 shares of the company's stock after buying an additional 23,839 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.66% of Centerspace worth $19,415,000 at the end of the most recent quarter.

Other institutional investors also recently modified their holdings of the company. Mirae Asset Global Investments Co. Ltd. lifted its holdings in shares of Centerspace by 35.0% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 579 shares of the company's stock worth $41,000 after buying an additional 150 shares in the last quarter. Asset Management One Co. Ltd. lifted its stake in Centerspace by 0.7% in the 3rd quarter. Asset Management One Co. Ltd. now owns 23,116 shares of the company's stock worth $1,629,000 after purchasing an additional 170 shares in the last quarter. The Manufacturers Life Insurance Company boosted its holdings in Centerspace by 3.1% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 5,736 shares of the company's stock valued at $388,000 after purchasing an additional 171 shares during the period. State of Alaska Department of Revenue grew its position in shares of Centerspace by 1.3% during the 3rd quarter. State of Alaska Department of Revenue now owns 16,110 shares of the company's stock valued at $1,134,000 after purchasing an additional 208 shares in the last quarter. Finally, Van ECK Associates Corp increased its holdings in shares of Centerspace by 15.2% in the third quarter. Van ECK Associates Corp now owns 2,626 shares of the company's stock worth $186,000 after purchasing an additional 347 shares during the period. 79.00% of the stock is currently owned by hedge funds and other institutional investors.

Centerspace Price Performance

NYSE:CSR traded down $0.23 during mid-day trading on Friday, reaching $70.00. The stock had a trading volume of 72,520 shares, compared to its average volume of 90,415. The stock has a market capitalization of $1.16 billion, a P/E ratio of -43.48, a P/E/G ratio of 2.09 and a beta of 0.89. The firm has a 50 day moving average price of $71.29 and a two-hundred day moving average price of $70.86. The company has a debt-to-equity ratio of 0.70, a quick ratio of 0.05 and a current ratio of 0.05. Centerspace has a one year low of $52.26 and a one year high of $76.16.

Centerspace (NYSE:CSR - Get Free Report) last announced its quarterly earnings data on Monday, October 28th. The company reported ($0.40) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.17 by ($1.57). The business had revenue of $65.03 million during the quarter, compared to analysts' expectations of $66.35 million. Centerspace had a negative net margin of 5.57% and a negative return on equity of 1.72%. During the same period last year, the company posted $1.20 EPS. As a group, analysts expect that Centerspace will post 4.86 earnings per share for the current year.

Centerspace Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, January 13th. Stockholders of record on Monday, December 30th will be paid a $0.75 dividend. This represents a $3.00 dividend on an annualized basis and a dividend yield of 4.29%. The ex-dividend date is Monday, December 30th. Centerspace's dividend payout ratio (DPR) is presently -186.33%.

Analysts Set New Price Targets

Several equities research analysts recently issued reports on CSR shares. Raymond James lowered Centerspace from an "outperform" rating to a "market perform" rating in a research note on Monday, October 21st. Royal Bank of Canada reissued an "outperform" rating and set a $76.00 price objective on shares of Centerspace in a report on Wednesday, October 30th. Finally, BTIG Research raised their target price on shares of Centerspace from $69.00 to $79.00 and gave the company a "buy" rating in a research note on Monday, August 12th. Three analysts have rated the stock with a hold rating and two have issued a buy rating to the company. According to MarketBeat, Centerspace currently has an average rating of "Hold" and a consensus price target of $76.00.

Read Our Latest Stock Analysis on Centerspace

Centerspace Profile

(

Free Report)

Centerspace is an owner and operator of apartment communities committed to providing great homes by focusing on integrity and serving others. Founded in 1970, as of September 30, 2023, Centerspace owned interests in 71 apartment communities consisting of 12,785 apartment homes located in Colorado, Minnesota, Montana, Nebraska, North Dakota, and South Dakota.

Featured Stories

Before you consider Centerspace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Centerspace wasn't on the list.

While Centerspace currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.