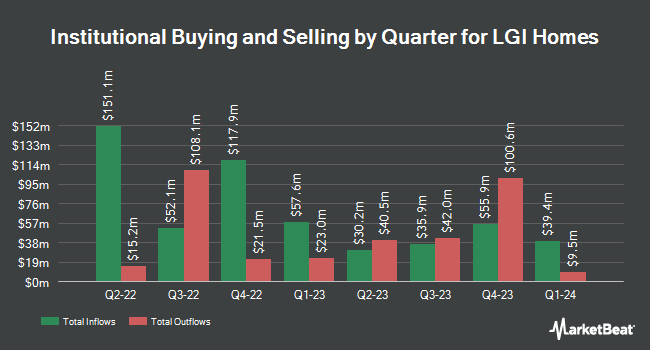

Charles Schwab Investment Management Inc. grew its holdings in shares of LGI Homes, Inc. (NASDAQ:LGIH - Free Report) by 7.6% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 349,141 shares of the financial services provider's stock after buying an additional 24,555 shares during the period. Charles Schwab Investment Management Inc. owned 1.49% of LGI Homes worth $41,380,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors and hedge funds have also made changes to their positions in the business. Innealta Capital LLC purchased a new position in shares of LGI Homes during the second quarter worth about $39,000. First Horizon Advisors Inc. boosted its holdings in shares of LGI Homes by 32.5% in the second quarter. First Horizon Advisors Inc. now owns 440 shares of the financial services provider's stock valued at $39,000 after acquiring an additional 108 shares during the period. Allspring Global Investments Holdings LLC acquired a new position in shares of LGI Homes in the 3rd quarter valued at $43,000. KBC Group NV raised its position in LGI Homes by 29.8% in the 3rd quarter. KBC Group NV now owns 732 shares of the financial services provider's stock valued at $87,000 after purchasing an additional 168 shares during the last quarter. Finally, CWM LLC boosted its stake in LGI Homes by 27.5% during the 3rd quarter. CWM LLC now owns 867 shares of the financial services provider's stock worth $103,000 after purchasing an additional 187 shares during the period. 84.89% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Separately, Wedbush reaffirmed a "neutral" rating and issued a $125.00 target price on shares of LGI Homes in a report on Wednesday, November 6th.

View Our Latest Stock Analysis on LGIH

LGI Homes Stock Performance

Shares of NASDAQ LGIH traded down $0.96 during mid-day trading on Tuesday, hitting $109.16. 119,354 shares of the company were exchanged, compared to its average volume of 208,153. The company has a quick ratio of 0.54, a current ratio of 12.72 and a debt-to-equity ratio of 0.77. The firm has a market cap of $2.57 billion, a price-to-earnings ratio of 13.09 and a beta of 1.99. The stock has a 50 day simple moving average of $108.94 and a 200-day simple moving average of $103.78. LGI Homes, Inc. has a 1-year low of $84.00 and a 1-year high of $136.89.

LGI Homes (NASDAQ:LGIH - Get Free Report) last posted its earnings results on Tuesday, November 5th. The financial services provider reported $2.95 EPS for the quarter, topping analysts' consensus estimates of $2.54 by $0.41. The company had revenue of $651.85 million for the quarter, compared to the consensus estimate of $645.27 million. LGI Homes had a return on equity of 10.32% and a net margin of 8.75%. LGI Homes's quarterly revenue was up 5.6% compared to the same quarter last year. During the same period in the previous year, the business earned $2.84 earnings per share. On average, sell-side analysts forecast that LGI Homes, Inc. will post 8.72 EPS for the current fiscal year.

LGI Homes Company Profile

(

Free Report)

LGI Homes, Inc designs, constructs, and sells homes. It offers entry-level homes, such as attached and detached homes, and active adult homes under the LGI Homes brand name; and luxury series homes under the Terrata Homes brand name. The company also engages in the wholesale business, which include building and selling homes to large institutions looking to acquire single-family rental properties.

Read More

Before you consider LGI Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LGI Homes wasn't on the list.

While LGI Homes currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.