Charles Schwab Investment Management Inc. decreased its holdings in shares of Lantheus Holdings, Inc. (NASDAQ:LNTH - Free Report) by 0.5% during the fourth quarter, according to its most recent disclosure with the SEC. The fund owned 814,210 shares of the medical equipment provider's stock after selling 3,758 shares during the period. Charles Schwab Investment Management Inc. owned approximately 1.17% of Lantheus worth $72,839,000 at the end of the most recent quarter.

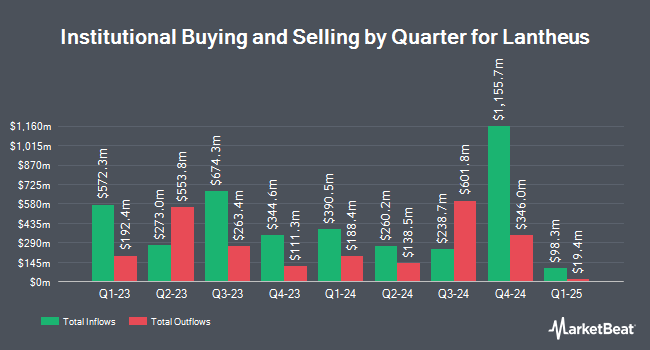

Other large investors have also modified their holdings of the company. Groupama Asset Managment purchased a new stake in Lantheus in the third quarter valued at approximately $439,000. Swedbank AB boosted its position in Lantheus by 53.3% in the fourth quarter. Swedbank AB now owns 1,107,243 shares of the medical equipment provider's stock valued at $99,054,000 after buying an additional 385,000 shares during the last quarter. Janus Henderson Group PLC boosted its position in Lantheus by 7.7% in the third quarter. Janus Henderson Group PLC now owns 3,588,571 shares of the medical equipment provider's stock valued at $393,844,000 after buying an additional 257,022 shares during the last quarter. Massachusetts Financial Services Co. MA purchased a new stake in Lantheus in the third quarter valued at approximately $25,955,000. Finally, Point72 DIFC Ltd purchased a new stake in Lantheus in the third quarter valued at approximately $23,001,000. Hedge funds and other institutional investors own 99.06% of the company's stock.

Insider Transactions at Lantheus

In related news, Director Mary Anne Heino sold 53,107 shares of the stock in a transaction on Monday, March 3rd. The stock was sold at an average price of $94.35, for a total value of $5,010,645.45. Following the completion of the transaction, the director now directly owns 440,399 shares of the company's stock, valued at approximately $41,551,645.65. This represents a 10.76 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director James H. Thrall sold 1,000 shares of the stock in a transaction on Wednesday, January 15th. The shares were sold at an average price of $94.76, for a total value of $94,760.00. Following the completion of the transaction, the director now directly owns 33,207 shares of the company's stock, valued at approximately $3,146,695.32. This represents a 2.92 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 1.50% of the company's stock.

Lantheus Price Performance

Shares of LNTH stock opened at $104.62 on Wednesday. The company has a market cap of $7.16 billion, a price-to-earnings ratio of 17.41 and a beta of 0.38. The stock has a 50 day simple moving average of $91.13 and a 200-day simple moving average of $96.88. Lantheus Holdings, Inc. has a 1-year low of $56.44 and a 1-year high of $126.89.

Lantheus (NASDAQ:LNTH - Get Free Report) last announced its earnings results on Thursday, February 27th. The medical equipment provider reported $1.34 earnings per share for the quarter, missing the consensus estimate of $1.57 by ($0.23). The business had revenue of $391.11 million for the quarter, compared to analyst estimates of $376.61 million. Lantheus had a return on equity of 44.29% and a net margin of 28.57%. Analysts anticipate that Lantheus Holdings, Inc. will post 6.01 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several research firms have commented on LNTH. Truist Financial upped their price objective on Lantheus from $120.00 to $127.00 and gave the stock a "buy" rating in a research report on Thursday, February 27th. The Goldman Sachs Group began coverage on Lantheus in a research report on Wednesday, December 18th. They issued a "buy" rating and a $143.00 price objective on the stock. StockNews.com lowered Lantheus from a "buy" rating to a "hold" rating in a research report on Thursday, November 21st. Finally, JMP Securities restated a "market outperform" rating and issued a $112.00 price objective on shares of Lantheus in a research report on Tuesday, January 14th. One analyst has rated the stock with a hold rating and seven have given a buy rating to the stock. According to data from MarketBeat.com, Lantheus currently has a consensus rating of "Moderate Buy" and a consensus target price of $132.86.

Get Our Latest Analysis on LNTH

About Lantheus

(

Free Report)

Lantheus Holdings, Inc develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in the diagnosis and treatment of heart, cancer, and other diseases worldwide. It provides DEFINITY, an injectable ultrasound enhancing agent used in echocardiography exams; TechneLite, a technetium generator for nuclear medicine procedures; Xenon-133, a radiopharmaceutical gas to assess pulmonary function; Neurolite, an injectable imaging agent to identify the area within the brain where blood flow has been blocked or reduced due to stroke; Cardiolite, an injectable Tc-99m-labeled imaging agent to assess blood flow to the muscle of the heart; and PYLARIFY, an F 18-labelled PSMA-targeted PET imaging agent used for imaging of PSMA positive-lesions in men with prostate cancer.

Featured Stories

Want to see what other hedge funds are holding LNTH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Lantheus Holdings, Inc. (NASDAQ:LNTH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lantheus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lantheus wasn't on the list.

While Lantheus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.