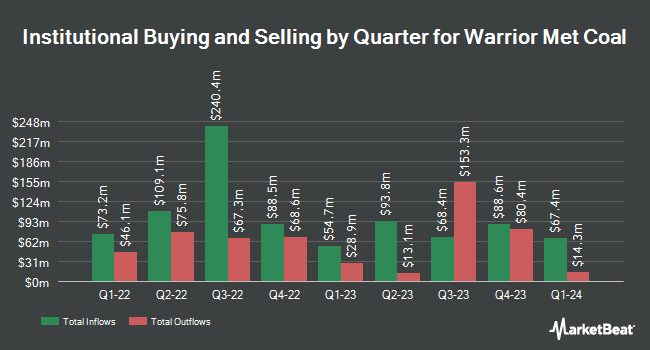

Charles Schwab Investment Management Inc. decreased its stake in shares of Warrior Met Coal, Inc. (NYSE:HCC - Free Report) by 2.2% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 923,180 shares of the company's stock after selling 20,818 shares during the period. Charles Schwab Investment Management Inc. owned approximately 1.76% of Warrior Met Coal worth $58,991,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also made changes to their positions in HCC. Dimensional Fund Advisors LP lifted its stake in Warrior Met Coal by 2.5% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,863,024 shares of the company's stock valued at $116,937,000 after acquiring an additional 45,950 shares in the last quarter. Renaissance Technologies LLC lifted its position in shares of Warrior Met Coal by 4.3% in the second quarter. Renaissance Technologies LLC now owns 1,501,379 shares of the company's stock worth $94,242,000 after purchasing an additional 62,200 shares in the last quarter. American Century Companies Inc. boosted its holdings in Warrior Met Coal by 6.1% during the second quarter. American Century Companies Inc. now owns 1,440,965 shares of the company's stock worth $90,449,000 after purchasing an additional 82,622 shares during the last quarter. River Road Asset Management LLC grew its position in Warrior Met Coal by 22.9% in the third quarter. River Road Asset Management LLC now owns 870,357 shares of the company's stock valued at $55,616,000 after purchasing an additional 162,387 shares in the last quarter. Finally, Bank of New York Mellon Corp grew its position in Warrior Met Coal by 3.1% in the second quarter. Bank of New York Mellon Corp now owns 543,020 shares of the company's stock valued at $34,085,000 after purchasing an additional 16,574 shares in the last quarter. 92.28% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research firms have recently commented on HCC. B. Riley increased their price objective on shares of Warrior Met Coal from $89.00 to $90.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Benchmark reissued a "hold" rating on shares of Warrior Met Coal in a research report on Monday, August 5th. Three investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. Based on data from MarketBeat.com, Warrior Met Coal currently has an average rating of "Hold" and an average target price of $75.75.

Read Our Latest Analysis on Warrior Met Coal

Warrior Met Coal Stock Performance

HCC stock traded up $0.02 during trading hours on Friday, reaching $70.32. The stock had a trading volume of 323,116 shares, compared to its average volume of 763,368. The stock has a 50-day simple moving average of $65.18 and a 200 day simple moving average of $64.07. Warrior Met Coal, Inc. has a fifty-two week low of $50.60 and a fifty-two week high of $75.53. The stock has a market capitalization of $3.68 billion, a PE ratio of 9.71 and a beta of 1.02. The company has a debt-to-equity ratio of 0.09, a current ratio of 5.81 and a quick ratio of 4.67.

Warrior Met Coal (NYSE:HCC - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $0.80 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.40 by $0.40. Warrior Met Coal had a net margin of 23.77% and a return on equity of 19.00%. The business had revenue of $327.72 million during the quarter, compared to the consensus estimate of $322.21 million. Warrior Met Coal's revenue was down 22.6% on a year-over-year basis. During the same period last year, the business posted $1.85 EPS. Analysts predict that Warrior Met Coal, Inc. will post 5.62 EPS for the current fiscal year.

Warrior Met Coal Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, November 12th. Stockholders of record on Tuesday, November 5th were paid a dividend of $0.08 per share. The ex-dividend date was Tuesday, November 5th. This represents a $0.32 annualized dividend and a dividend yield of 0.46%. Warrior Met Coal's dividend payout ratio is currently 4.42%.

Warrior Met Coal Company Profile

(

Free Report)

Warrior Met Coal, Inc produces and exports non-thermal metallurgical coal for the steel industry. It operates two underground mines located in Alabama. The company sells its metallurgical coal to a customer base of blast furnace steel producers located primarily in Europe, South America, and Asia. It also sells natural gas, which is extracted as a byproduct from coal production.

Read More

Before you consider Warrior Met Coal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warrior Met Coal wasn't on the list.

While Warrior Met Coal currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.