Charles Schwab Investment Management Inc. reduced its stake in Denny's Co. (NASDAQ:DENN - Free Report) by 13.1% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 634,520 shares of the restaurant operator's stock after selling 95,450 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.24% of Denny's worth $4,093,000 as of its most recent SEC filing.

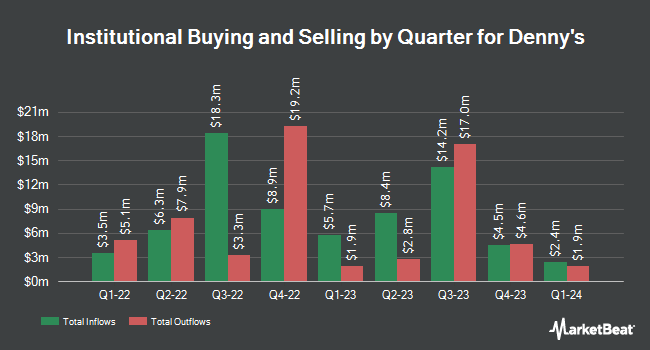

A number of other institutional investors also recently bought and sold shares of the stock. Allspring Global Investments Holdings LLC lifted its stake in shares of Denny's by 6.9% during the third quarter. Allspring Global Investments Holdings LLC now owns 8,634,514 shares of the restaurant operator's stock worth $55,693,000 after buying an additional 558,964 shares during the period. First Eagle Investment Management LLC lifted its position in Denny's by 14.1% during the 2nd quarter. First Eagle Investment Management LLC now owns 1,258,827 shares of the restaurant operator's stock worth $8,938,000 after acquiring an additional 155,100 shares during the period. Access Investment Management LLC purchased a new stake in Denny's during the 3rd quarter valued at about $1,387,000. Intech Investment Management LLC acquired a new position in shares of Denny's in the third quarter valued at about $83,000. Finally, AQR Capital Management LLC raised its stake in shares of Denny's by 63.8% in the second quarter. AQR Capital Management LLC now owns 216,694 shares of the restaurant operator's stock worth $1,539,000 after purchasing an additional 84,371 shares during the last quarter. 85.07% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently commented on the company. Truist Financial dropped their target price on Denny's from $10.00 to $8.00 and set a "buy" rating on the stock in a research report on Monday, October 28th. Oppenheimer dropped their price objective on shares of Denny's from $10.00 to $7.00 and set an "outperform" rating on the stock in a report on Wednesday, October 23rd. Wedbush reduced their target price on shares of Denny's from $7.00 to $6.00 and set a "neutral" rating for the company in a report on Wednesday, October 23rd. Benchmark lowered their price target on shares of Denny's from $15.00 to $10.00 and set a "buy" rating on the stock in a report on Friday, October 25th. Finally, StockNews.com upgraded Denny's from a "hold" rating to a "buy" rating in a research note on Wednesday. One analyst has rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $7.70.

Get Our Latest Report on Denny's

Denny's Trading Up 0.3 %

DENN traded up $0.02 on Friday, reaching $6.27. The stock had a trading volume of 633,707 shares, compared to its average volume of 598,231. The business's 50-day moving average price is $6.44 and its two-hundred day moving average price is $6.56. Denny's Co. has a 12-month low of $5.37 and a 12-month high of $11.16. The company has a market cap of $321.83 million, a P/E ratio of 19.00, a price-to-earnings-growth ratio of 1.32 and a beta of 2.01.

Denny's (NASDAQ:DENN - Get Free Report) last released its quarterly earnings results on Tuesday, October 22nd. The restaurant operator reported $0.14 earnings per share for the quarter, missing analysts' consensus estimates of $0.15 by ($0.01). The business had revenue of $111.76 million during the quarter, compared to analyst estimates of $115.46 million. Denny's had a negative return on equity of 48.64% and a net margin of 3.90%. The business's revenue for the quarter was down 2.1% compared to the same quarter last year. During the same period in the previous year, the company posted $0.17 EPS. As a group, analysts predict that Denny's Co. will post 0.52 earnings per share for the current year.

Denny's Profile

(

Free Report)

Denny's Corporation, through its subsidiaries, owns and operates franchised full-service restaurant chains under the Denny's and Keke's Breakfast Cafe brands in the United States and internationally. The company was formerly known as Advantica Restaurant Group, Inc and changed its name to Denny's Corporation in July 2002.

See Also

Before you consider Denny's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Denny's wasn't on the list.

While Denny's currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.