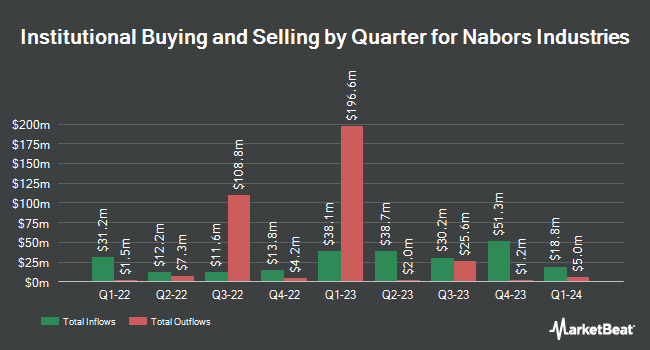

Charles Schwab Investment Management Inc. lessened its stake in shares of Nabors Industries Ltd. (NYSE:NBR - Free Report) by 17.3% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 144,914 shares of the oil and gas company's stock after selling 30,307 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 1.52% of Nabors Industries worth $9,343,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the stock. Intech Investment Management LLC increased its position in Nabors Industries by 6.4% during the 3rd quarter. Intech Investment Management LLC now owns 5,372 shares of the oil and gas company's stock worth $346,000 after purchasing an additional 322 shares in the last quarter. Entropy Technologies LP purchased a new stake in Nabors Industries in the 3rd quarter valued at about $600,000. Signaturefd LLC grew its holdings in Nabors Industries by 52.9% in the 3rd quarter. Signaturefd LLC now owns 1,364 shares of the oil and gas company's stock valued at $88,000 after buying an additional 472 shares during the period. nVerses Capital LLC purchased a new stake in Nabors Industries in the 3rd quarter valued at about $45,000. Finally, Inspire Investing LLC purchased a new stake in Nabors Industries in the 3rd quarter valued at about $411,000. Hedge funds and other institutional investors own 81.92% of the company's stock.

Nabors Industries Trading Up 0.5 %

Shares of NYSE:NBR traded up $0.36 during trading on Tuesday, reaching $68.13. 200,467 shares of the stock were exchanged, compared to its average volume of 285,563. The company has a debt-to-equity ratio of 5.43, a quick ratio of 1.63 and a current ratio of 1.88. Nabors Industries Ltd. has a 12-month low of $59.67 and a 12-month high of $105.96. The firm has a market cap of $729.60 million, a price-to-earnings ratio of -3.68 and a beta of 2.05. The firm's 50-day moving average price is $74.85 and its 200 day moving average price is $74.68.

Wall Street Analysts Forecast Growth

Several analysts have commented on the company. Barclays lowered their price target on Nabors Industries from $110.00 to $88.00 and set an "equal weight" rating for the company in a report on Wednesday, October 16th. Evercore ISI lowered their price target on Nabors Industries from $94.00 to $85.00 and set an "in-line" rating for the company in a report on Thursday, October 24th. Royal Bank of Canada restated a "sector perform" rating and issued a $102.00 price target on shares of Nabors Industries in a report on Wednesday, October 16th. Susquehanna lowered their price target on Nabors Industries from $79.00 to $77.00 and set a "neutral" rating for the company in a report on Thursday, October 24th. Finally, Citigroup lifted their price target on Nabors Industries from $75.00 to $80.00 and gave the company a "neutral" rating in a report on Thursday, October 31st. Seven investment analysts have rated the stock with a hold rating and one has given a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $97.00.

Read Our Latest Stock Report on NBR

About Nabors Industries

(

Free Report)

Nabors Industries Ltd. provides drilling and drilling-related services for land-based and offshore oil and natural gas wells in the United States and internationally. The company operates through four segments: U.S. Drilling, International Drilling, Drilling Solutions, and Rig Technologies. It provides tubular running services, including casing and tubing running, and torque monitoring; managed pressure drilling services; and drilling-bit steering systems and rig instrumentation software.

Read More

Before you consider Nabors Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nabors Industries wasn't on the list.

While Nabors Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.