Charles Schwab Investment Management Inc. lessened its stake in shares of CommScope Holding Company, Inc. (NASDAQ:COMM - Free Report) by 28.2% during the 4th quarter, according to its most recent disclosure with the SEC. The institutional investor owned 3,273,875 shares of the communications equipment provider's stock after selling 1,284,227 shares during the period. Charles Schwab Investment Management Inc. owned about 1.52% of CommScope worth $17,057,000 as of its most recent filing with the SEC.

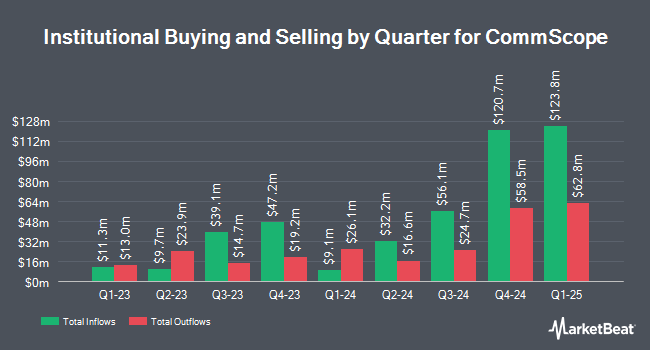

Several other large investors have also recently bought and sold shares of COMM. National Bank of Canada FI grew its position in shares of CommScope by 109.1% in the 3rd quarter. National Bank of Canada FI now owns 5,475 shares of the communications equipment provider's stock valued at $33,000 after acquiring an additional 2,857 shares during the period. Quarry LP grew its holdings in CommScope by 1,005.4% during the third quarter. Quarry LP now owns 8,114 shares of the communications equipment provider's stock worth $50,000 after purchasing an additional 7,380 shares during the period. Ballentine Partners LLC acquired a new position in CommScope during the fourth quarter worth approximately $58,000. Jones Financial Companies Lllp bought a new stake in CommScope in the fourth quarter valued at approximately $60,000. Finally, US Bancorp DE lifted its position in shares of CommScope by 527.9% in the fourth quarter. US Bancorp DE now owns 16,067 shares of the communications equipment provider's stock valued at $84,000 after buying an additional 13,508 shares during the last quarter. 88.04% of the stock is owned by institutional investors and hedge funds.

CommScope Price Performance

CommScope stock traded up $0.20 during midday trading on Monday, hitting $5.80. The company's stock had a trading volume of 5,108,073 shares, compared to its average volume of 4,468,685. The company has a 50-day moving average price of $5.29 and a two-hundred day moving average price of $5.46. CommScope Holding Company, Inc. has a 1-year low of $0.86 and a 1-year high of $7.19. The company has a market cap of $1.26 billion, a price-to-earnings ratio of -1.31, a PEG ratio of 0.41 and a beta of 1.89.

Wall Street Analysts Forecast Growth

COMM has been the topic of a number of research analyst reports. Morgan Stanley cut CommScope from an "equal weight" rating to an "underweight" rating and set a $5.00 price target on the stock. in a research note on Tuesday, December 17th. Deutsche Bank Aktiengesellschaft reaffirmed a "hold" rating and set a $7.00 target price on shares of CommScope in a report on Thursday, February 27th. StockNews.com raised shares of CommScope from a "hold" rating to a "buy" rating in a report on Friday, February 28th. JPMorgan Chase & Co. upgraded CommScope from an "underweight" rating to a "neutral" rating and set a $5.00 price objective for the company in a report on Tuesday, January 14th. Finally, Raymond James lowered CommScope from a "market perform" rating to an "underperform" rating in a research note on Monday, January 6th. Two investment analysts have rated the stock with a sell rating, three have assigned a hold rating and one has assigned a buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and a consensus target price of $4.75.

Read Our Latest Research Report on CommScope

CommScope Company Profile

(

Free Report)

CommScope Holding Company, Inc provides infrastructure solutions for communications, data center, and entertainment networks worldwide. The company operates through Connectivity and Cable Solutions (CCS); Outdoor Wireless Networks (OWN); Networking, Intelligent Cellular and Security Solutions (NICS), and Access Network Solutions (ANS) segments.

Further Reading

Before you consider CommScope, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CommScope wasn't on the list.

While CommScope currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.