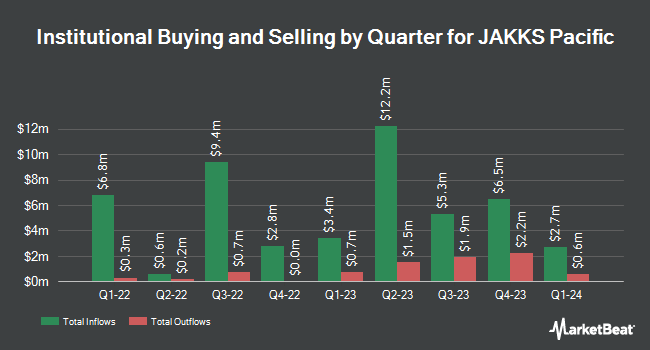

Charles Schwab Investment Management Inc. trimmed its stake in shares of JAKKS Pacific, Inc. (NASDAQ:JAKK - Free Report) by 56.3% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 24,191 shares of the company's stock after selling 31,154 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 0.22% of JAKKS Pacific worth $617,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other large investors have also bought and sold shares of the company. AQR Capital Management LLC raised its holdings in shares of JAKKS Pacific by 75.9% during the second quarter. AQR Capital Management LLC now owns 269,948 shares of the company's stock valued at $4,835,000 after acquiring an additional 116,519 shares in the last quarter. Allspring Global Investments Holdings LLC raised its stake in JAKKS Pacific by 154,821.4% in the second quarter. Allspring Global Investments Holdings LLC now owns 21,689 shares of the company's stock worth $388,000 after buying an additional 21,675 shares in the last quarter. Creative Planning bought a new stake in JAKKS Pacific during the 2nd quarter valued at approximately $527,000. Pacific Ridge Capital Partners LLC grew its holdings in shares of JAKKS Pacific by 34.1% during the 2nd quarter. Pacific Ridge Capital Partners LLC now owns 152,589 shares of the company's stock worth $2,733,000 after acquiring an additional 38,818 shares during the period. Finally, Dimensional Fund Advisors LP raised its position in shares of JAKKS Pacific by 29.8% in the 2nd quarter. Dimensional Fund Advisors LP now owns 444,488 shares of the company's stock worth $7,961,000 after acquiring an additional 102,155 shares in the last quarter. 44.38% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

JAKK has been the topic of several recent research reports. StockNews.com raised JAKKS Pacific from a "hold" rating to a "buy" rating in a research note on Friday, November 1st. Maxim Group began coverage on shares of JAKKS Pacific in a research note on Monday, August 26th. They issued a "buy" rating and a $46.00 price target for the company. Finally, B. Riley boosted their price objective on shares of JAKKS Pacific from $37.00 to $41.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Four investment analysts have rated the stock with a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Buy" and an average target price of $41.67.

Check Out Our Latest Report on JAKK

JAKKS Pacific Stock Down 0.2 %

Shares of NASDAQ:JAKK traded down $0.06 on Thursday, hitting $25.57. 59,205 shares of the company traded hands, compared to its average volume of 100,640. The stock has a 50 day simple moving average of $27.75 and a 200-day simple moving average of $23.62. The company has a market cap of $281.01 million, a PE ratio of 9.40 and a beta of 2.22. JAKKS Pacific, Inc. has a 52 week low of $17.06 and a 52 week high of $36.84.

JAKKS Pacific (NASDAQ:JAKK - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The company reported $4.60 earnings per share for the quarter, beating analysts' consensus estimates of $3.24 by $1.36. The business had revenue of $321.61 million during the quarter, compared to analyst estimates of $303.44 million. JAKKS Pacific had a net margin of 4.87% and a return on equity of 15.27%. As a group, sell-side analysts anticipate that JAKKS Pacific, Inc. will post 2.18 earnings per share for the current year.

Insider Activity at JAKKS Pacific

In other news, CFO John Louis Kimble sold 48,253 shares of JAKKS Pacific stock in a transaction that occurred on Thursday, November 21st. The shares were sold at an average price of $27.62, for a total value of $1,332,747.86. Following the completion of the sale, the chief financial officer now directly owns 95,544 shares in the company, valued at $2,638,925.28. The trade was a 33.56 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. 3.50% of the stock is owned by insiders.

About JAKKS Pacific

(

Free Report)

JAKKS Pacific, Inc designs, produces, markets, sells, and distributes toys and related products, electronic products, and other consumer products worldwide. It operates through two segments, Toys/Consumer Products and Costumes. The company offers action figures and accessories, such as licensed characters; toy vehicles and accessories; dolls and accessories, including small, large, fashion, and baby dolls based on licenses, as well as infant and pre-school products; private label products; and foot-to-floor ride-on products.

Featured Articles

Before you consider JAKKS Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JAKKS Pacific wasn't on the list.

While JAKKS Pacific currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.