Charles Schwab Investment Management Inc. cut its stake in shares of Sturm, Ruger & Company, Inc. (NYSE:RGR - Free Report) by 14.9% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 231,686 shares of the company's stock after selling 40,573 shares during the quarter. Charles Schwab Investment Management Inc. owned 1.38% of Sturm, Ruger & Company, Inc. worth $9,657,000 as of its most recent SEC filing.

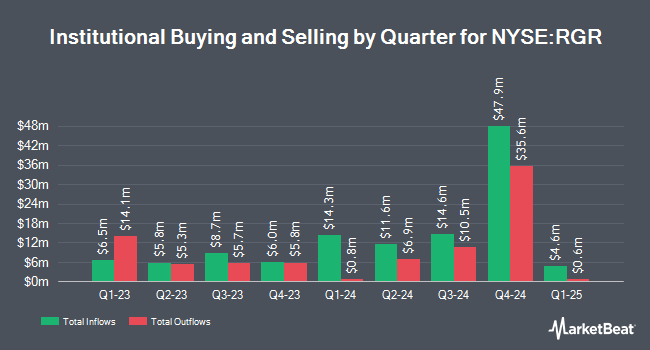

A number of other hedge funds and other institutional investors also recently bought and sold shares of the business. GAMMA Investing LLC lifted its holdings in Sturm, Ruger & Company, Inc. by 53.8% in the third quarter. GAMMA Investing LLC now owns 735 shares of the company's stock valued at $31,000 after acquiring an additional 257 shares during the period. Aigen Investment Management LP lifted its holdings in Sturm, Ruger & Company, Inc. by 7.5% in the third quarter. Aigen Investment Management LP now owns 7,510 shares of the company's stock valued at $313,000 after acquiring an additional 527 shares during the period. Price T Rowe Associates Inc. MD lifted its holdings in Sturm, Ruger & Company, Inc. by 12.4% in the first quarter. Price T Rowe Associates Inc. MD now owns 6,912 shares of the company's stock valued at $319,000 after acquiring an additional 762 shares during the period. Public Sector Pension Investment Board lifted its holdings in Sturm, Ruger & Company, Inc. by 4.0% in the second quarter. Public Sector Pension Investment Board now owns 38,267 shares of the company's stock valued at $1,594,000 after acquiring an additional 1,483 shares during the period. Finally, Palouse Capital Management Inc. acquired a new stake in Sturm, Ruger & Company, Inc. in the second quarter valued at $77,000. Institutional investors and hedge funds own 64.00% of the company's stock.

Sturm, Ruger & Company, Inc. Trading Up 0.6 %

Shares of NYSE:RGR traded up $0.23 during midday trading on Tuesday, hitting $36.99. 177,072 shares of the stock were exchanged, compared to its average volume of 152,568. The stock has a market cap of $621.06 million, a P/E ratio of 21.38 and a beta of 0.16. Sturm, Ruger & Company, Inc. has a twelve month low of $35.61 and a twelve month high of $48.20. The company has a 50 day moving average price of $39.85 and a 200-day moving average price of $41.46.

Sturm, Ruger & Company, Inc. Cuts Dividend

The company also recently declared a quarterly dividend, which was paid on Wednesday, November 27th. Stockholders of record on Wednesday, November 13th were paid a dividend of $0.11 per share. This represents a $0.44 annualized dividend and a dividend yield of 1.19%. The ex-dividend date was Wednesday, November 13th. Sturm, Ruger & Company, Inc.'s dividend payout ratio (DPR) is presently 25.43%.

Sturm, Ruger & Company, Inc. Company Profile

(

Free Report)

Sturm, Ruger & Company, Inc, together with its subsidiaries, designs, manufactures, and sells firearms under the Ruger name and trademark in the United States. The company operates through two segments: Firearms and Castings. It provides single-shot, autoloading, bolt-action, and modern sporting rifles; rimfire and centerfire autoloading pistols; single-action and double-action revolvers; and firearms accessories and replacement parts, as well as manufactures lever-action rifles under the Marlin name and trademark.

Read More

Before you consider Sturm, Ruger & Company, Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sturm, Ruger & Company, Inc. wasn't on the list.

While Sturm, Ruger & Company, Inc. currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.