Chevy Chase Trust Holdings LLC reduced its position in Charter Communications, Inc. (NASDAQ:CHTR - Free Report) by 2.7% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 52,785 shares of the company's stock after selling 1,437 shares during the period. Chevy Chase Trust Holdings LLC's holdings in Charter Communications were worth $17,107,000 as of its most recent SEC filing.

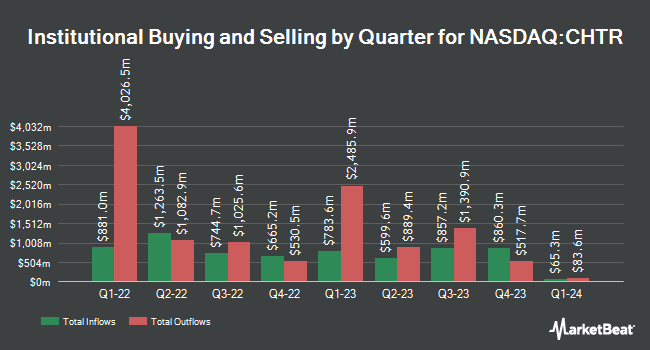

A number of other large investors have also recently bought and sold shares of the stock. Savant Capital LLC boosted its holdings in shares of Charter Communications by 1.7% during the second quarter. Savant Capital LLC now owns 1,859 shares of the company's stock worth $556,000 after purchasing an additional 31 shares during the last quarter. US Bancorp DE boosted its holdings in shares of Charter Communications by 0.4% during the third quarter. US Bancorp DE now owns 7,370 shares of the company's stock worth $2,388,000 after purchasing an additional 31 shares during the last quarter. B. Riley Wealth Advisors Inc. boosted its holdings in shares of Charter Communications by 3.1% during the second quarter. B. Riley Wealth Advisors Inc. now owns 1,051 shares of the company's stock worth $314,000 after purchasing an additional 32 shares during the last quarter. Grove Bank & Trust boosted its holdings in shares of Charter Communications by 39.1% during the third quarter. Grove Bank & Trust now owns 121 shares of the company's stock worth $39,000 after purchasing an additional 34 shares during the last quarter. Finally, CVA Family Office LLC boosted its holdings in shares of Charter Communications by 31.3% during the third quarter. CVA Family Office LLC now owns 147 shares of the company's stock worth $48,000 after purchasing an additional 35 shares during the last quarter. Institutional investors and hedge funds own 81.76% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts recently weighed in on CHTR shares. Deutsche Bank Aktiengesellschaft increased their target price on Charter Communications from $340.00 to $365.00 and gave the stock a "hold" rating in a research report on Monday, November 4th. Barclays increased their target price on Charter Communications from $300.00 to $315.00 and gave the stock an "underweight" rating in a research report on Monday, November 4th. Wells Fargo & Company increased their target price on Charter Communications from $350.00 to $400.00 and gave the stock an "equal weight" rating in a research report on Monday, November 4th. Bank of America raised Charter Communications from a "neutral" rating to a "buy" rating and increased their target price for the stock from $385.00 to $450.00 in a research report on Monday, November 4th. Finally, Benchmark increased their target price on Charter Communications from $440.00 to $450.00 and gave the stock a "buy" rating in a research report on Tuesday, November 5th. Four equities research analysts have rated the stock with a sell rating, ten have assigned a hold rating and five have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $378.00.

Read Our Latest Report on Charter Communications

Charter Communications Stock Up 1.1 %

NASDAQ CHTR traded up $4.51 on Wednesday, hitting $402.12. 1,389,848 shares of the stock traded hands, compared to its average volume of 1,374,077. The stock has a 50-day moving average of $357.95 and a 200 day moving average of $332.16. Charter Communications, Inc. has a twelve month low of $236.08 and a twelve month high of $415.27. The company has a market capitalization of $57.18 billion, a P/E ratio of 12.59, a price-to-earnings-growth ratio of 0.63 and a beta of 1.08. The company has a current ratio of 0.34, a quick ratio of 0.34 and a debt-to-equity ratio of 5.24.

Charter Communications (NASDAQ:CHTR - Get Free Report) last announced its quarterly earnings data on Friday, November 1st. The company reported $8.82 earnings per share (EPS) for the quarter, beating the consensus estimate of $8.55 by $0.27. Charter Communications had a return on equity of 28.73% and a net margin of 8.52%. The firm had revenue of $13.80 billion for the quarter, compared to analysts' expectations of $13.66 billion. During the same quarter in the prior year, the firm posted $8.25 earnings per share. Charter Communications's revenue for the quarter was up 1.6% compared to the same quarter last year. As a group, analysts expect that Charter Communications, Inc. will post 32.87 earnings per share for the current fiscal year.

Charter Communications Profile

(

Free Report)

Charter Communications, Inc operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States. The company offers subscription-based internet, video, and mobile and voice services; a suite of broadband connectivity services, including fixed internet, WiFi, and mobile; Advanced WiFi services; Spectrum Security Shield; in-home WiFi, which provides customers with high performance wireless routers and managed WiFi services to enhance their fixed wireless internet experience; out-of-home WiFi; and Spectrum WiFi services.

Featured Articles

Before you consider Charter Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charter Communications wasn't on the list.

While Charter Communications currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for January 2025. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.