Chartwell Investment Partners LLC lifted its position in Methanex Co. (NASDAQ:MEOH - Free Report) TSE: MX by 27.8% in the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 202,863 shares of the specialty chemicals company's stock after acquiring an additional 44,173 shares during the quarter. Chartwell Investment Partners LLC owned approximately 0.30% of Methanex worth $8,387,000 as of its most recent filing with the SEC.

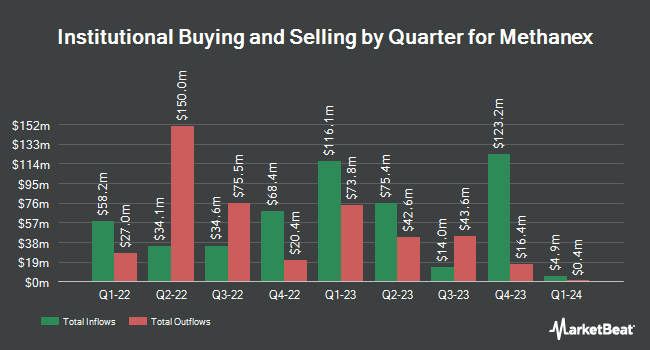

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Headlands Technologies LLC grew its holdings in shares of Methanex by 346.5% during the 1st quarter. Headlands Technologies LLC now owns 902 shares of the specialty chemicals company's stock valued at $40,000 after acquiring an additional 700 shares in the last quarter. Blue Trust Inc. raised its position in Methanex by 52,500.0% during the second quarter. Blue Trust Inc. now owns 1,578 shares of the specialty chemicals company's stock valued at $70,000 after acquiring an additional 1,575 shares in the last quarter. EverSource Wealth Advisors LLC lifted its stake in shares of Methanex by 572.5% in the 2nd quarter. EverSource Wealth Advisors LLC now owns 1,910 shares of the specialty chemicals company's stock valued at $93,000 after purchasing an additional 1,626 shares during the last quarter. Squarepoint Ops LLC acquired a new stake in shares of Methanex in the 2nd quarter valued at $201,000. Finally, Value Partners Investments Inc. increased its position in Methanex by 10.4% during the third quarter. Value Partners Investments Inc. now owns 5,642 shares of the specialty chemicals company's stock worth $233,000 after buying an additional 532 shares during the last quarter. 73.49% of the stock is currently owned by hedge funds and other institutional investors.

Methanex Stock Performance

MEOH stock traded down $0.02 during midday trading on Monday, hitting $42.17. The stock had a trading volume of 324,181 shares, compared to its average volume of 301,128. Methanex Co. has a 52 week low of $36.13 and a 52 week high of $56.43. The company has a current ratio of 1.34, a quick ratio of 0.87 and a debt-to-equity ratio of 0.79. The stock has a 50-day simple moving average of $40.99 and a 200 day simple moving average of $45.97. The firm has a market capitalization of $2.84 billion, a price-to-earnings ratio of 20.04 and a beta of 1.36.

Wall Street Analyst Weigh In

A number of brokerages have weighed in on MEOH. Piper Sandler boosted their price target on Methanex from $51.00 to $68.00 and gave the stock an "overweight" rating in a research report on Tuesday, September 10th. Barclays increased their price target on Methanex from $44.00 to $46.00 and gave the company an "equal weight" rating in a report on Monday. UBS Group lowered their target price on shares of Methanex from $54.00 to $53.00 and set a "buy" rating on the stock in a research note on Thursday. Royal Bank of Canada reissued a "sector perform" rating and set a $55.00 target price on shares of Methanex in a research report on Tuesday, September 3rd. Finally, Raymond James lowered their price target on Methanex from $62.00 to $54.00 and set an "outperform" rating on the stock in a research report on Wednesday, September 11th. Three analysts have rated the stock with a hold rating and six have given a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $55.50.

Get Our Latest Analysis on MEOH

Methanex Company Profile

(

Free Report)

Methanex Corporation produces and supplies methanol in China, Europe, the United States, South America, South Korea, Canada, and Asia. The company also purchases methanol produced by others under methanol offtake contracts and on the spot market. In addition, it owns and leases storage and terminal facilities.

See Also

Before you consider Methanex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Methanex wasn't on the list.

While Methanex currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.