Chartwell Investment Partners LLC reduced its stake in shares of Advanced Micro Devices, Inc. (NASDAQ:AMD - Free Report) by 72.3% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 14,776 shares of the semiconductor manufacturer's stock after selling 38,655 shares during the quarter. Chartwell Investment Partners LLC's holdings in Advanced Micro Devices were worth $2,424,000 at the end of the most recent quarter.

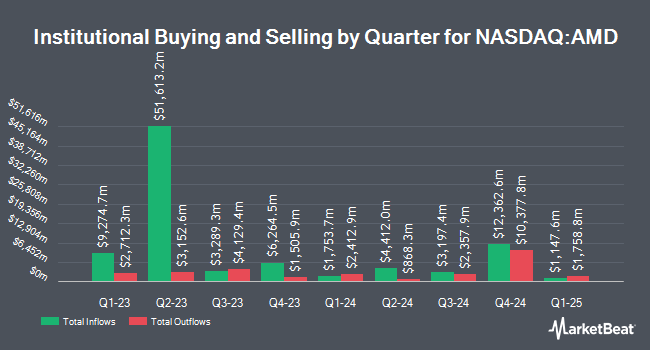

A number of other hedge funds also recently added to or reduced their stakes in the stock. Quantbot Technologies LP bought a new stake in Advanced Micro Devices during the 1st quarter valued at $331,000. Koshinski Asset Management Inc. lifted its holdings in Advanced Micro Devices by 30.9% in the first quarter. Koshinski Asset Management Inc. now owns 5,562 shares of the semiconductor manufacturer's stock worth $1,004,000 after purchasing an additional 1,313 shares during the period. Dearborn Partners LLC grew its position in Advanced Micro Devices by 15.4% in the 1st quarter. Dearborn Partners LLC now owns 2,861 shares of the semiconductor manufacturer's stock valued at $516,000 after buying an additional 382 shares in the last quarter. Texas Yale Capital Corp. increased its stake in Advanced Micro Devices by 15.0% during the 1st quarter. Texas Yale Capital Corp. now owns 1,667 shares of the semiconductor manufacturer's stock valued at $301,000 after buying an additional 217 shares during the period. Finally, Charles Schwab Investment Advisory Inc. acquired a new position in Advanced Micro Devices during the 1st quarter valued at about $235,000. 71.34% of the stock is currently owned by institutional investors.

Advanced Micro Devices Stock Down 3.0 %

Advanced Micro Devices stock traded down $4.33 during trading hours on Wednesday, hitting $139.30. The company had a trading volume of 35,033,673 shares, compared to its average volume of 55,770,762. Advanced Micro Devices, Inc. has a fifty-two week low of $116.37 and a fifty-two week high of $227.30. The company has a debt-to-equity ratio of 0.03, a current ratio of 2.50 and a quick ratio of 1.78. The firm has a market capitalization of $226.06 billion, a P/E ratio of 126.79, a price-to-earnings-growth ratio of 1.99 and a beta of 1.71. The firm's fifty day moving average is $154.55 and its 200-day moving average is $155.43.

Advanced Micro Devices (NASDAQ:AMD - Get Free Report) last posted its quarterly earnings results on Tuesday, October 29th. The semiconductor manufacturer reported $0.92 earnings per share for the quarter, hitting analysts' consensus estimates of $0.92. The business had revenue of $6.82 billion for the quarter, compared to the consensus estimate of $6.71 billion. Advanced Micro Devices had a net margin of 7.52% and a return on equity of 6.62%. Advanced Micro Devices's revenue for the quarter was up 17.6% compared to the same quarter last year. During the same period in the prior year, the business posted $0.53 earnings per share. On average, research analysts forecast that Advanced Micro Devices, Inc. will post 2.53 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several research analysts have recently issued reports on the stock. Robert W. Baird decreased their price objective on shares of Advanced Micro Devices from $200.00 to $175.00 and set an "outperform" rating for the company in a report on Wednesday, July 31st. Rosenblatt Securities reaffirmed a "buy" rating and set a $250.00 price target on shares of Advanced Micro Devices in a research note on Monday, October 28th. Evercore ISI boosted their price objective on Advanced Micro Devices from $193.00 to $198.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 30th. BNP Paribas upgraded Advanced Micro Devices to a "strong-buy" rating in a report on Wednesday, July 31st. Finally, UBS Group lowered their target price on Advanced Micro Devices from $210.00 to $205.00 and set a "buy" rating on the stock in a report on Wednesday, October 30th. One analyst has rated the stock with a sell rating, three have given a hold rating, twenty-eight have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, Advanced Micro Devices presently has a consensus rating of "Moderate Buy" and a consensus price target of $192.79.

Get Our Latest Analysis on Advanced Micro Devices

Insiders Place Their Bets

In other news, CEO Lisa T. Su sold 80,000 shares of the firm's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $143.87, for a total transaction of $11,509,600.00. Following the completion of the transaction, the chief executive officer now directly owns 3,566,762 shares of the company's stock, valued at approximately $513,150,048.94. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other news, EVP Forrest Eugene Norrod sold 40,540 shares of Advanced Micro Devices stock in a transaction that occurred on Tuesday, November 5th. The shares were sold at an average price of $141.67, for a total value of $5,743,301.80. Following the completion of the transaction, the executive vice president now owns 293,347 shares in the company, valued at approximately $41,558,469.49. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CEO Lisa T. Su sold 80,000 shares of the firm's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $143.87, for a total value of $11,509,600.00. Following the sale, the chief executive officer now directly owns 3,566,762 shares of the company's stock, valued at $513,150,048.94. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 0.73% of the company's stock.

Advanced Micro Devices Company Profile

(

Free Report)

Advanced Micro Devices, Inc operates as a semiconductor company worldwide. It operates through Data Center, Client, Gaming, and Embedded segments. The company offers x86 microprocessors and graphics processing units (GPUs) as an accelerated processing unit, chipsets, data center, and professional GPUs; and embedded processors, and semi-custom system-on-chip (SoC) products, microprocessor and SoC development services and technology, data processing unites, field programmable gate arrays (FPGA), and adaptive SoC products.

Featured Stories

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report