Chase Investment Counsel Corp raised its stake in Fidelity National Information Services, Inc. (NYSE:FIS - Free Report) by 52.8% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 65,790 shares of the information technology services provider's stock after acquiring an additional 22,742 shares during the quarter. Fidelity National Information Services makes up 1.8% of Chase Investment Counsel Corp's portfolio, making the stock its 18th biggest holding. Chase Investment Counsel Corp's holdings in Fidelity National Information Services were worth $5,509,000 as of its most recent filing with the Securities & Exchange Commission.

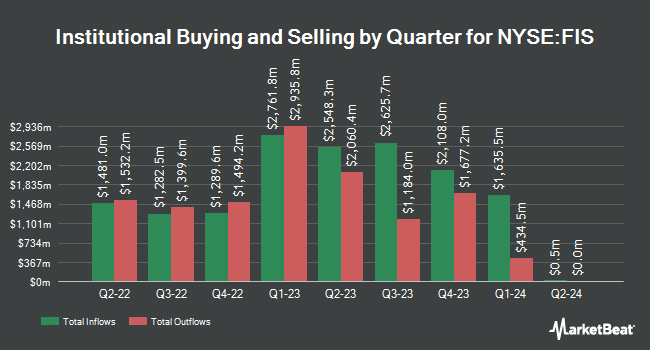

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Vanguard Group Inc. raised its stake in Fidelity National Information Services by 19.1% during the first quarter. Vanguard Group Inc. now owns 68,658,572 shares of the information technology services provider's stock valued at $5,093,093,000 after buying an additional 11,023,109 shares in the last quarter. Dimensional Fund Advisors LP raised its holdings in Fidelity National Information Services by 5.0% during the second quarter. Dimensional Fund Advisors LP now owns 5,251,434 shares of the information technology services provider's stock worth $395,729,000 after purchasing an additional 249,678 shares in the last quarter. Legal & General Group Plc lifted its position in Fidelity National Information Services by 1.6% in the second quarter. Legal & General Group Plc now owns 4,938,091 shares of the information technology services provider's stock worth $372,135,000 after purchasing an additional 75,429 shares during the period. Boston Partners boosted its stake in Fidelity National Information Services by 642.7% during the 1st quarter. Boston Partners now owns 4,470,605 shares of the information technology services provider's stock valued at $331,047,000 after purchasing an additional 3,868,683 shares in the last quarter. Finally, Raymond James & Associates increased its position in shares of Fidelity National Information Services by 449.8% during the 3rd quarter. Raymond James & Associates now owns 4,103,793 shares of the information technology services provider's stock valued at $343,693,000 after purchasing an additional 3,357,329 shares during the period. 96.23% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at Fidelity National Information Services

In related news, Director Jeffrey A. Goldstein acquired 626 shares of the stock in a transaction on Tuesday, October 15th. The shares were purchased at an average price of $88.25 per share, for a total transaction of $55,244.50. Following the purchase, the director now directly owns 10,397 shares in the company, valued at approximately $917,535.25. The trade was a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is available through this hyperlink. 0.20% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of analysts recently weighed in on the stock. Jefferies Financial Group raised their target price on shares of Fidelity National Information Services from $80.00 to $90.00 and gave the stock a "hold" rating in a report on Wednesday, October 16th. Robert W. Baird raised their price objective on Fidelity National Information Services from $92.00 to $94.00 and gave the stock a "neutral" rating in a research note on Tuesday, November 5th. Mizuho boosted their target price on Fidelity National Information Services from $91.00 to $104.00 and gave the stock an "outperform" rating in a research report on Tuesday, November 5th. Susquehanna increased their price target on Fidelity National Information Services from $88.00 to $103.00 and gave the company a "positive" rating in a research report on Tuesday, November 5th. Finally, Royal Bank of Canada boosted their price objective on Fidelity National Information Services from $95.00 to $104.00 and gave the stock an "outperform" rating in a report on Tuesday, November 5th. Ten research analysts have rated the stock with a hold rating and eleven have given a buy rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $89.68.

Read Our Latest Stock Analysis on FIS

Fidelity National Information Services Stock Performance

Shares of FIS traded up $0.92 during mid-day trading on Wednesday, reaching $88.54. The company's stock had a trading volume of 1,795,052 shares, compared to its average volume of 3,765,689. The company has a current ratio of 1.18, a quick ratio of 1.18 and a debt-to-equity ratio of 0.63. The stock has a market cap of $47.67 billion, a P/E ratio of 35.27, a PEG ratio of 0.74 and a beta of 1.06. Fidelity National Information Services, Inc. has a 1-year low of $53.39 and a 1-year high of $91.98. The business has a 50-day simple moving average of $86.29 and a two-hundred day simple moving average of $79.76.

Fidelity National Information Services (NYSE:FIS - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The information technology services provider reported $1.40 EPS for the quarter, topping analysts' consensus estimates of $1.29 by $0.11. The firm had revenue of $2.57 billion during the quarter, compared to analysts' expectations of $2.56 billion. Fidelity National Information Services had a net margin of 14.37% and a return on equity of 15.35%. The company's revenue for the quarter was up 3.1% compared to the same quarter last year. During the same period in the previous year, the business posted $0.94 earnings per share. As a group, equities research analysts anticipate that Fidelity National Information Services, Inc. will post 5.18 earnings per share for the current fiscal year.

Fidelity National Information Services Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 23rd. Stockholders of record on Monday, December 9th will be issued a dividend of $0.36 per share. This represents a $1.44 dividend on an annualized basis and a dividend yield of 1.63%. The ex-dividend date of this dividend is Monday, December 9th. Fidelity National Information Services's dividend payout ratio is presently 57.37%.

About Fidelity National Information Services

(

Free Report)

Fidelity National Information Services, Inc engages in the provision of financial services technology solutions for financial institutions, businesses, and developers worldwide. It operates through Banking Solutions, Capital Market Solutions, and Corporate and Other segments. The company provides core processing and ancillary applications; mobile and online banking; fraud, risk management, and compliance; card and retail payment; electronic funds transfer and network; wealth and retirement; and item processing and output solutions.

Further Reading

Before you consider Fidelity National Information Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fidelity National Information Services wasn't on the list.

While Fidelity National Information Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.