Dai ichi Life Insurance Company Ltd lessened its stake in Check Point Software Technologies Ltd. (NASDAQ:CHKP - Free Report) by 25.8% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 35,321 shares of the technology company's stock after selling 12,284 shares during the quarter. Dai ichi Life Insurance Company Ltd's holdings in Check Point Software Technologies were worth $6,810,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

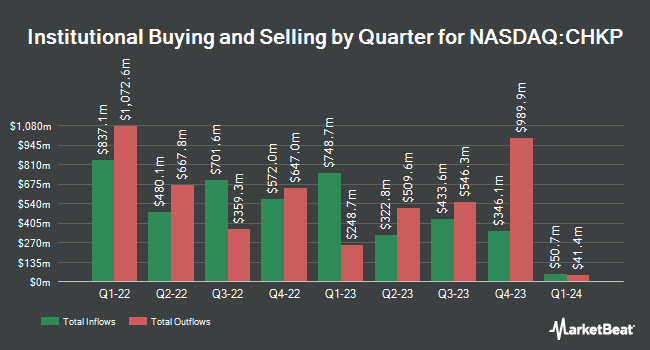

Several other large investors have also bought and sold shares of the company. Vanguard Group Inc. boosted its stake in Check Point Software Technologies by 1.3% during the 1st quarter. Vanguard Group Inc. now owns 335,251 shares of the technology company's stock valued at $54,985,000 after purchasing an additional 4,194 shares during the last quarter. Price T Rowe Associates Inc. MD lifted its stake in Check Point Software Technologies by 18.6% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 19,139 shares of the technology company's stock valued at $3,140,000 after acquiring an additional 3,008 shares during the period. California State Teachers Retirement System boosted its holdings in shares of Check Point Software Technologies by 11.6% during the 1st quarter. California State Teachers Retirement System now owns 149,989 shares of the technology company's stock valued at $24,600,000 after acquiring an additional 15,647 shares during the last quarter. Tidal Investments LLC purchased a new position in shares of Check Point Software Technologies during the first quarter valued at approximately $6,558,000. Finally, Swedbank AB bought a new position in Check Point Software Technologies during the first quarter valued at approximately $69,487,000. 87.62% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on CHKP shares. Evercore ISI increased their price target on Check Point Software Technologies from $180.00 to $185.00 and gave the company an "in-line" rating in a report on Wednesday, October 30th. Robert W. Baird reduced their target price on shares of Check Point Software Technologies from $210.00 to $205.00 and set a "neutral" rating for the company in a report on Wednesday, October 30th. BMO Capital Markets lifted their price target on shares of Check Point Software Technologies from $200.00 to $238.00 and gave the stock a "market perform" rating in a research note on Friday, October 25th. Truist Financial upped their price objective on Check Point Software Technologies from $200.00 to $220.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd. Finally, Needham & Company LLC reissued a "hold" rating on shares of Check Point Software Technologies in a report on Wednesday, October 30th. Fifteen research analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $197.74.

Get Our Latest Report on CHKP

Check Point Software Technologies Trading Up 0.0 %

Shares of NASDAQ:CHKP traded up $0.04 on Wednesday, reaching $181.55. The company had a trading volume of 441,915 shares, compared to its average volume of 695,001. The firm has a market capitalization of $19.97 billion, a PE ratio of 24.80, a PEG ratio of 3.12 and a beta of 0.63. Check Point Software Technologies Ltd. has a 52-week low of $143.28 and a 52-week high of $210.70. The firm's 50 day simple moving average is $189.67 and its 200-day simple moving average is $177.76.

Check Point Software Technologies (NASDAQ:CHKP - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The technology company reported $2.25 EPS for the quarter, hitting the consensus estimate of $2.25. Check Point Software Technologies had a net margin of 33.17% and a return on equity of 31.84%. The firm had revenue of $635.10 million during the quarter, compared to analyst estimates of $634.96 million. During the same quarter in the previous year, the business posted $1.80 EPS. Check Point Software Technologies's revenue was up 6.5% on a year-over-year basis. As a group, equities research analysts predict that Check Point Software Technologies Ltd. will post 7.87 earnings per share for the current year.

Check Point Software Technologies Company Profile

(

Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

Featured Articles

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.