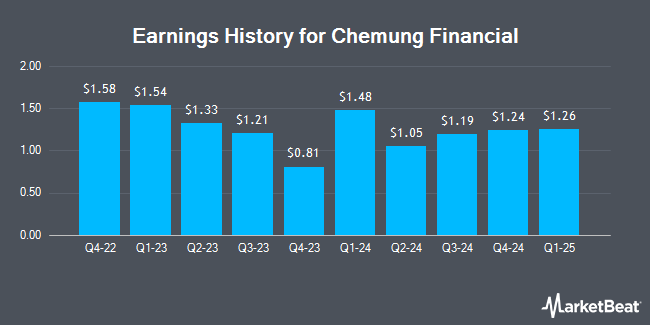

Chemung Financial (NASDAQ:CHMG - Get Free Report) will likely be posting its quarterly earnings results before the market opens on Thursday, April 17th. Analysts expect the company to announce earnings of $1.23 per share and revenue of $25.90 million for the quarter.

Chemung Financial (NASDAQ:CHMG - Get Free Report) last released its quarterly earnings data on Tuesday, January 28th. The bank reported $1.24 earnings per share for the quarter, topping the consensus estimate of $1.19 by $0.05. Chemung Financial had a net margin of 15.70% and a return on equity of 11.47%. On average, analysts expect Chemung Financial to post $5 EPS for the current fiscal year and $6 EPS for the next fiscal year.

Chemung Financial Stock Performance

CHMG stock traded up $1.11 during midday trading on Tuesday, reaching $42.40. The company had a trading volume of 12,075 shares, compared to its average volume of 13,333. The firm has a market capitalization of $203.05 million, a PE ratio of 8.55 and a beta of 0.10. The stock has a 50 day moving average price of $48.18 and a 200 day moving average price of $48.96. Chemung Financial has a fifty-two week low of $39.00 and a fifty-two week high of $55.73. The company has a quick ratio of 0.87, a current ratio of 0.87 and a debt-to-equity ratio of 0.24.

Chemung Financial Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, April 1st. Investors of record on Tuesday, March 18th were issued a $0.32 dividend. This is an increase from Chemung Financial's previous quarterly dividend of $0.31. The ex-dividend date was Tuesday, March 18th. This represents a $1.28 annualized dividend and a dividend yield of 3.02%. Chemung Financial's dividend payout ratio (DPR) is 25.81%.

Analyst Upgrades and Downgrades

Separately, Piper Sandler began coverage on Chemung Financial in a research report on Friday, December 20th. They issued a "neutral" rating and a $57.00 target price on the stock.

Get Our Latest Research Report on Chemung Financial

Insider Buying and Selling at Chemung Financial

In other Chemung Financial news, Director Joseph F. Iv Meade bought 592 shares of the business's stock in a transaction on Wednesday, January 15th. The shares were purchased at an average price of $47.33 per share, with a total value of $28,019.36. Following the purchase, the director now directly owns 3,710 shares of the company's stock, valued at approximately $175,594.30. The trade was a 18.99 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the SEC, which is accessible through this link. 12.04% of the stock is currently owned by company insiders.

About Chemung Financial

(

Get Free Report)

Chemung Financial Corporation operates as a bank holding company for Chemung Canal Trust Company that provides a range of banking, financing, fiduciary, and other financial services. The company provides demand, savings, and time deposits; non-interest and interest-bearing checking accounts; and insured money market accounts.

Featured Articles

Before you consider Chemung Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chemung Financial wasn't on the list.

While Chemung Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.