Chesapeake Capital Corp IL purchased a new stake in shares of Kodiak Gas Services, Inc. (NYSE:KGS - Free Report) during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor purchased 20,625 shares of the company's stock, valued at approximately $603,000.

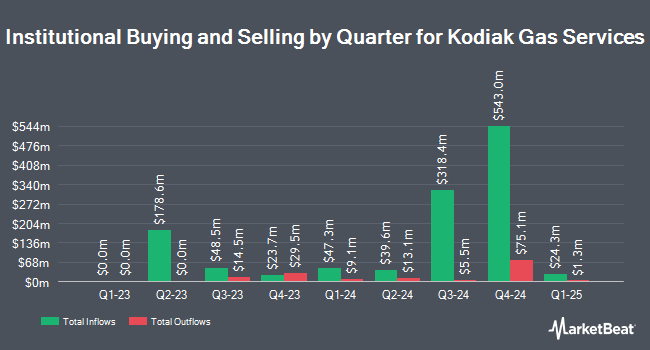

A number of other institutional investors also recently bought and sold shares of the company. U.S. Capital Wealth Advisors LLC purchased a new stake in shares of Kodiak Gas Services in the second quarter worth approximately $913,000. Public Employees Retirement System of Ohio acquired a new position in Kodiak Gas Services during the first quarter worth $1,046,000. Jacobs Levy Equity Management Inc. acquired a new stake in Kodiak Gas Services during the 1st quarter worth $11,544,000. HWG Holdings LP raised its holdings in shares of Kodiak Gas Services by 5,435.7% during the 3rd quarter. HWG Holdings LP now owns 80,932 shares of the company's stock worth $2,347,000 after acquiring an additional 79,470 shares during the period. Finally, HITE Hedge Asset Management LLC raised its holdings in Kodiak Gas Services by 74.8% in the 2nd quarter. HITE Hedge Asset Management LLC now owns 780,600 shares of the company's stock valued at $21,279,000 after buying an additional 334,086 shares during the period. Institutional investors own 24.95% of the company's stock.

Kodiak Gas Services Stock Performance

Shares of KGS traded up $0.64 during mid-day trading on Friday, hitting $36.44. 2,384,005 shares of the company's stock were exchanged, compared to its average volume of 544,194. The stock's 50-day simple moving average is $30.97 and its 200-day simple moving average is $28.51. The firm has a market cap of $3.19 billion, a price-to-earnings ratio of 125.66 and a beta of 0.79. The company has a quick ratio of 0.93, a current ratio of 1.27 and a debt-to-equity ratio of 1.86. Kodiak Gas Services, Inc. has a 52 week low of $17.50 and a 52 week high of $36.99.

Kodiak Gas Services Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, November 8th. Investors of record on Friday, November 1st were issued a $0.41 dividend. The ex-dividend date was Friday, November 1st. This represents a $1.64 annualized dividend and a yield of 4.50%. Kodiak Gas Services's payout ratio is 565.54%.

Analyst Upgrades and Downgrades

A number of research firms have recently commented on KGS. Mizuho initiated coverage on Kodiak Gas Services in a report on Wednesday, October 2nd. They issued an "outperform" rating and a $36.00 price objective on the stock. Barclays raised their price objective on shares of Kodiak Gas Services from $29.00 to $32.00 and gave the stock an "equal weight" rating in a research note on Monday, October 7th. Stifel Nicolaus upped their target price on Kodiak Gas Services from $31.00 to $35.00 and gave the company a "buy" rating in a research note on Wednesday, August 14th. Bank of America began coverage on shares of Kodiak Gas Services in a report on Wednesday, September 18th. They issued a "buy" rating and a $30.00 price target on the stock. Finally, Raymond James upped their price objective on shares of Kodiak Gas Services from $35.00 to $39.00 and gave the company an "outperform" rating in a research report on Friday, November 8th. Two investment analysts have rated the stock with a hold rating and nine have issued a buy rating to the company's stock. Based on data from MarketBeat, Kodiak Gas Services has a consensus rating of "Moderate Buy" and a consensus target price of $34.64.

Get Our Latest Stock Analysis on KGS

About Kodiak Gas Services

(

Free Report)

Kodiak Gas Services, Inc operates contract compression infrastructure for customers in the oil and gas industry in the United States. It operates in two segments, Compression Operations and Other Services. The Compression Operations segment operates company-owned and customer-owned compression infrastructure to enable the production, gathering, and transportation of natural gas and oil.

Featured Articles

Before you consider Kodiak Gas Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kodiak Gas Services wasn't on the list.

While Kodiak Gas Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.