Chesapeake Energy (NASDAQ:EXE - Get Free Report) had its target price lifted by stock analysts at Citigroup from $100.00 to $115.00 in a report issued on Friday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Citigroup's target price indicates a potential upside of 19.42% from the stock's previous close.

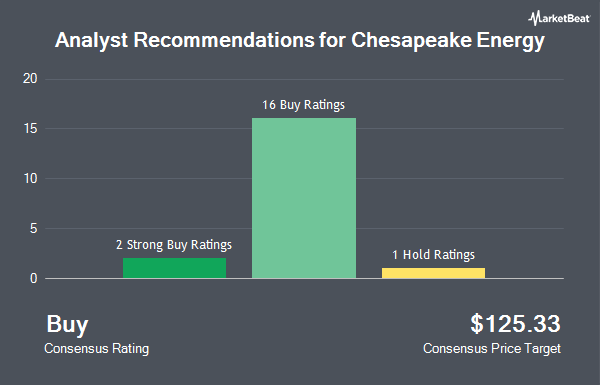

Other analysts also recently issued reports about the stock. Stephens lifted their price objective on shares of Chesapeake Energy from $85.00 to $86.00 and gave the company an "equal weight" rating in a report on Wednesday, October 30th. Bank of America assumed coverage on Chesapeake Energy in a research note on Monday, October 28th. They set a "buy" rating and a $114.00 price objective on the stock. UBS Group upped their price objective on Chesapeake Energy from $85.00 to $89.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 8th. Wells Fargo & Company increased their price target on shares of Chesapeake Energy from $83.00 to $100.00 and gave the company an "equal weight" rating in a research note on Monday, November 25th. Finally, Mizuho lifted their price objective on shares of Chesapeake Energy from $105.00 to $110.00 and gave the company an "outperform" rating in a research report on Thursday, October 31st. Three research analysts have rated the stock with a hold rating, four have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $104.29.

Check Out Our Latest Research Report on EXE

Chesapeake Energy Price Performance

Shares of EXE stock traded down $0.43 on Friday, reaching $96.30. 900,806 shares of the stock were exchanged, compared to its average volume of 2,100,239. The company has a market capitalization of $22.25 billion, a PE ratio of 59.62 and a beta of 0.52. Chesapeake Energy has a one year low of $69.12 and a one year high of $101.27. The company has a current ratio of 2.00, a quick ratio of 2.00 and a debt-to-equity ratio of 0.20. The firm's 50 day moving average price is $91.09.

Chesapeake Energy (NASDAQ:EXE - Get Free Report) last released its quarterly earnings data on Tuesday, October 29th. The company reported $0.16 EPS for the quarter, beating analysts' consensus estimates of $0.01 by $0.15. The business had revenue of $648.00 million during the quarter, compared to the consensus estimate of $708.98 million. Chesapeake Energy had a return on equity of 2.74% and a net margin of 6.07%. The firm's revenue was down 57.1% on a year-over-year basis. During the same quarter in the prior year, the company posted $1.09 earnings per share. On average, research analysts expect that Chesapeake Energy will post 0.86 earnings per share for the current fiscal year.

Insider Buying and Selling

In other news, Director Catherine A. Kehr sold 43,623 shares of the company's stock in a transaction on Friday, November 22nd. The shares were sold at an average price of $99.58, for a total value of $4,343,978.34. Following the sale, the director now directly owns 5,201 shares of the company's stock, valued at approximately $517,915.58. This represents a 89.35 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. 58.00% of the stock is owned by corporate insiders.

About Chesapeake Energy

(

Get Free Report)

Expand Energy Corporation is an independent natural gas producer principally in the United States. Expand Energy Corporation, formerly known as Chesapeake Energy Corporation, is based in OKLAHOMA CITY.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Chesapeake Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chesapeake Energy wasn't on the list.

While Chesapeake Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.