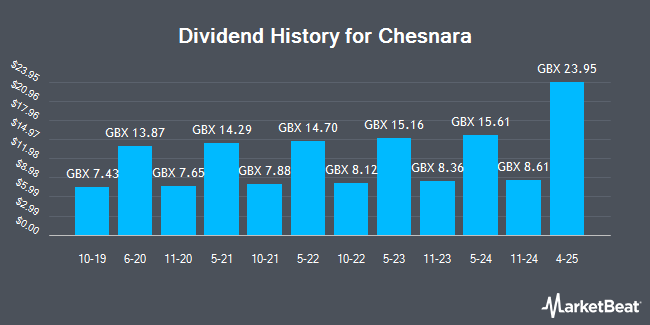

Chesnara plc (LON:CSN - Get Free Report) declared a dividend on Thursday, March 27th, Upcoming Dividends.Co.Uk reports. Shareholders of record on Thursday, April 10th will be given a dividend of GBX 23.95 ($0.31) per share on Monday, April 14th. This represents a yield of 4.24%. The ex-dividend date is Thursday, April 10th. This is a 178.2% increase from Chesnara's previous dividend of $8.61. The official announcement can be viewed at this link.

Chesnara Stock Down 1.1 %

Shares of CSN traded down GBX 3 ($0.04) during mid-day trading on Friday, hitting GBX 273 ($3.53). 427,137 shares of the company's stock were exchanged, compared to its average volume of 196,922. The company has a debt-to-equity ratio of 62.42, a quick ratio of 38.06 and a current ratio of 2.55. The company has a market cap of £415.39 million, a price-to-earnings ratio of 99.57 and a beta of 0.44. The stock's 50-day moving average is GBX 265.02 and its 200-day moving average is GBX 259.81. Chesnara has a fifty-two week low of GBX 240 ($3.11) and a fifty-two week high of GBX 289.50 ($3.75).

Chesnara (LON:CSN - Get Free Report) last issued its quarterly earnings results on Friday, March 28th. The company reported GBX 2.56 ($0.03) EPS for the quarter. Chesnara had a net margin of 1.02% and a return on equity of 1.21%. On average, sell-side analysts anticipate that Chesnara will post 25.3183154 earnings per share for the current fiscal year.

Insider Buying and Selling

In other news, insider Steve Murray purchased 11,012 shares of the firm's stock in a transaction that occurred on Friday, March 28th. The stock was bought at an average price of GBX 272 ($3.52) per share, for a total transaction of £29,952.64 ($38,768.63). 5.47% of the stock is currently owned by insiders.

Chesnara Company Profile

(

Get Free Report)

Chesnara (CSN.L) is a European life and pensions consolidator listed on the London Stock Exchange. It administers approximately one million policies and operates as Countrywide Assured in the UK, as The Waard Group and Scildon in the Netherlands, and as Movestic in Sweden.

Following a three-pillar strategy, Chesnara's primary responsibility is the efficient administration of its customers' life and savings policies, ensuring good customer outcomes and providing a secure and compliant environment to protect policyholder interests.

See Also

Before you consider Chesnara, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chesnara wasn't on the list.

While Chesnara currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.