Chevy Chase Trust Holdings LLC raised its stake in Atmos Energy Co. (NYSE:ATO - Free Report) by 13.6% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 310,529 shares of the utilities provider's stock after buying an additional 37,171 shares during the quarter. Chevy Chase Trust Holdings LLC owned approximately 0.20% of Atmos Energy worth $43,074,000 at the end of the most recent quarter.

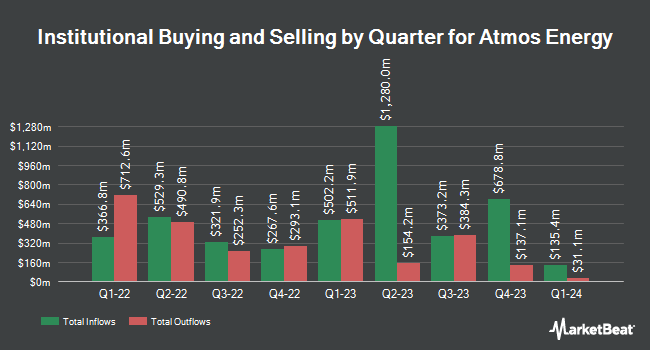

A number of other hedge funds and other institutional investors have also modified their holdings of the stock. Miller Howard Investments Inc. NY increased its position in shares of Atmos Energy by 0.3% during the second quarter. Miller Howard Investments Inc. NY now owns 30,179 shares of the utilities provider's stock worth $3,520,000 after purchasing an additional 82 shares in the last quarter. OneDigital Investment Advisors LLC boosted its holdings in shares of Atmos Energy by 3.7% in the third quarter. OneDigital Investment Advisors LLC now owns 2,307 shares of the utilities provider's stock valued at $320,000 after acquiring an additional 82 shares during the period. Global Retirement Partners LLC increased its holdings in shares of Atmos Energy by 1.4% in the 3rd quarter. Global Retirement Partners LLC now owns 5,973 shares of the utilities provider's stock valued at $829,000 after acquiring an additional 85 shares during the period. Wedbush Securities Inc. raised its position in Atmos Energy by 3.9% in the 2nd quarter. Wedbush Securities Inc. now owns 2,328 shares of the utilities provider's stock valued at $272,000 after purchasing an additional 88 shares during the last quarter. Finally, EP Wealth Advisors LLC boosted its stake in Atmos Energy by 5.4% during the 2nd quarter. EP Wealth Advisors LLC now owns 1,880 shares of the utilities provider's stock worth $219,000 after purchasing an additional 97 shares during the period. 90.17% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

ATO has been the subject of a number of research reports. Mizuho upped their target price on shares of Atmos Energy from $148.00 to $165.00 and gave the company an "outperform" rating in a report on Wednesday, November 27th. Barclays lifted their target price on Atmos Energy from $129.00 to $144.00 and gave the company an "equal weight" rating in a research note on Monday, October 7th. Wells Fargo & Company upped their price target on Atmos Energy from $145.00 to $156.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 16th. JPMorgan Chase & Co. lifted their price objective on shares of Atmos Energy from $134.00 to $144.00 and gave the company an "overweight" rating in a research report on Thursday, August 15th. Finally, LADENBURG THALM/SH SH upped their price objective on shares of Atmos Energy from $144.00 to $150.50 and gave the stock a "buy" rating in a research report on Wednesday, October 2nd. Four investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $147.69.

Check Out Our Latest Research Report on Atmos Energy

Insiders Place Their Bets

In other news, Director Edward Geiser acquired 2,500 shares of Atmos Energy stock in a transaction that occurred on Monday, November 11th. The shares were acquired at an average price of $144.89 per share, with a total value of $362,225.00. Following the completion of the purchase, the director now owns 2,602 shares of the company's stock, valued at approximately $377,003.78. This represents a 2,450.98 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. 0.50% of the stock is currently owned by company insiders.

Atmos Energy Price Performance

ATO stock traded down $1.13 during midday trading on Tuesday, hitting $147.43. 251,218 shares of the stock were exchanged, compared to its average volume of 873,408. Atmos Energy Co. has a fifty-two week low of $110.46 and a fifty-two week high of $152.65. The company has a debt-to-equity ratio of 0.65, a quick ratio of 0.80 and a current ratio of 0.94. The stock's 50-day moving average price is $142.62 and its 200-day moving average price is $130.29. The stock has a market cap of $22.91 billion, a price-to-earnings ratio of 21.63, a PEG ratio of 3.03 and a beta of 0.70.

Atmos Energy Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, December 9th. Investors of record on Monday, November 25th will be paid a $0.87 dividend. The ex-dividend date is Monday, November 25th. This represents a $3.48 dividend on an annualized basis and a yield of 2.36%. This is a positive change from Atmos Energy's previous quarterly dividend of $0.81. Atmos Energy's dividend payout ratio is presently 50.66%.

Atmos Energy Profile

(

Free Report)

Atmos Energy Corporation, together with its subsidiaries, engages in the regulated natural gas distribution, and pipeline and storage businesses in the United States. It operates through two segments, Distribution, and Pipeline and Storage. The Distribution segment is involved in the regulated natural gas distribution and related sales operations in eight states.

Read More

Before you consider Atmos Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atmos Energy wasn't on the list.

While Atmos Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.