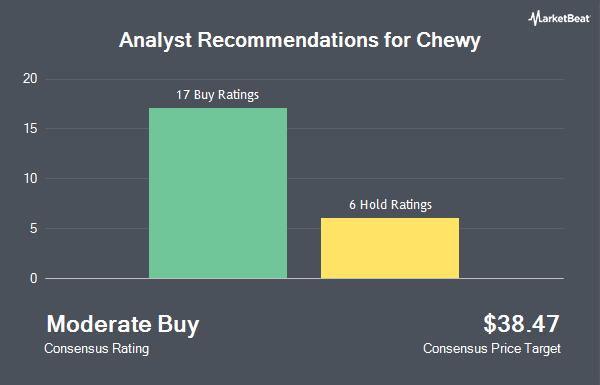

Shares of Chewy, Inc. (NYSE:CHWY - Get Free Report) have received an average recommendation of "Moderate Buy" from the twenty-three analysts that are covering the stock, MarketBeat Ratings reports. Nine analysts have rated the stock with a hold recommendation and fourteen have given a buy recommendation to the company. The average 12 month target price among brokerages that have issued ratings on the stock in the last year is $34.15.

CHWY has been the subject of several research reports. The Goldman Sachs Group raised their price target on shares of Chewy from $35.00 to $40.00 and gave the stock a "buy" rating in a research note on Thursday, December 5th. Raymond James cut shares of Chewy from an "outperform" rating to a "market perform" rating in a report on Wednesday, August 21st. Bank of America upgraded Chewy from an "underperform" rating to a "buy" rating and upped their target price for the company from $24.00 to $40.00 in a research report on Wednesday, November 20th. Needham & Company LLC reaffirmed a "hold" rating on shares of Chewy in a research note on Thursday, December 5th. Finally, JPMorgan Chase & Co. increased their price objective on shares of Chewy from $37.00 to $38.00 and gave the stock an "overweight" rating in a research note on Thursday, December 5th.

Get Our Latest Analysis on Chewy

Chewy Stock Performance

CHWY stock traded up $1.17 during midday trading on Wednesday, hitting $32.54. 5,612,381 shares of the company's stock were exchanged, compared to its average volume of 8,580,693. Chewy has a one year low of $14.69 and a one year high of $39.10. The stock's fifty day moving average price is $30.53 and its 200-day moving average price is $27.52. The company has a market cap of $13.61 billion, a PE ratio of 34.75, a price-to-earnings-growth ratio of 2.95 and a beta of 1.12.

Chewy (NYSE:CHWY - Get Free Report) last posted its earnings results on Wednesday, December 4th. The company reported $0.20 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.05 by $0.15. Chewy had a return on equity of 24.47% and a net margin of 3.51%. The business had revenue of $2.89 billion during the quarter, compared to analysts' expectations of $2.86 billion. During the same period in the prior year, the business earned ($0.08) EPS. Chewy's revenue for the quarter was up 5.2% compared to the same quarter last year. On average, analysts expect that Chewy will post 0.34 EPS for the current year.

Insiders Place Their Bets

In other news, CTO Satish Mehta sold 8,056 shares of the firm's stock in a transaction that occurred on Monday, December 2nd. The shares were sold at an average price of $33.47, for a total transaction of $269,634.32. Following the completion of the sale, the chief technology officer now owns 585,962 shares of the company's stock, valued at $19,612,148.14. This trade represents a 1.36 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this link. Also, major shareholder Argos Holdings Gp Llc sold 1,250,000 shares of the business's stock in a transaction on Tuesday, October 15th. The shares were sold at an average price of $29.40, for a total transaction of $36,750,000.00. The disclosure for this sale can be found here. In the last three months, insiders have sold 28,128,804 shares of company stock valued at $827,019,626. 2.10% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Chewy

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. Cetera Advisors LLC bought a new stake in shares of Chewy during the first quarter valued at approximately $334,000. SG Americas Securities LLC raised its stake in shares of Chewy by 125.6% in the second quarter. SG Americas Securities LLC now owns 94,838 shares of the company's stock worth $2,583,000 after purchasing an additional 52,809 shares during the last quarter. Wealth Enhancement Advisory Services LLC lifted its holdings in shares of Chewy by 23.9% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 23,922 shares of the company's stock valued at $652,000 after purchasing an additional 4,613 shares in the last quarter. Raymond James & Associates boosted its position in shares of Chewy by 23.7% during the second quarter. Raymond James & Associates now owns 96,887 shares of the company's stock valued at $2,639,000 after buying an additional 18,586 shares during the last quarter. Finally, First Horizon Advisors Inc. purchased a new stake in Chewy in the 2nd quarter valued at $48,000. 93.09% of the stock is owned by institutional investors.

About Chewy

(

Get Free ReportChewy, Inc, together with its subsidiaries, engages in the pure play e-commerce business in the United States. It provides pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services for dogs, cats, fish, birds, small pets, horses, and reptiles through its retail websites and mobile applications.

Featured Articles

Before you consider Chewy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chewy wasn't on the list.

While Chewy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.