Oppenheimer & Co. Inc. lowered its stake in shares of Chewy, Inc. (NYSE:CHWY - Free Report) by 56.9% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 21,220 shares of the company's stock after selling 28,023 shares during the quarter. Oppenheimer & Co. Inc.'s holdings in Chewy were worth $622,000 as of its most recent filing with the Securities and Exchange Commission.

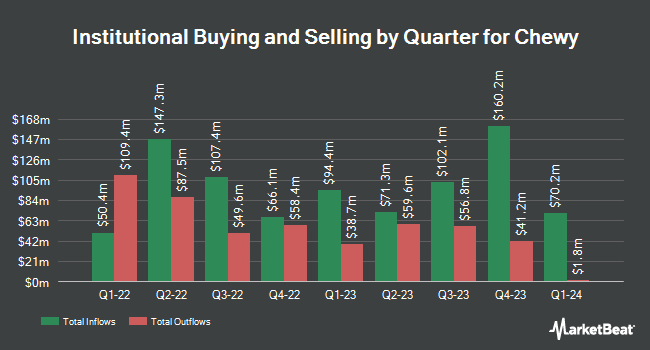

Other hedge funds and other institutional investors also recently modified their holdings of the company. BC Partners Advisors L.P. acquired a new position in Chewy in the second quarter worth $7,517,800,000. Vanguard Group Inc. boosted its stake in Chewy by 9.1% in the first quarter. Vanguard Group Inc. now owns 10,480,230 shares of the company's stock valued at $166,740,000 after acquiring an additional 875,532 shares during the period. Bank of New York Mellon Corp raised its position in shares of Chewy by 7.8% during the 2nd quarter. Bank of New York Mellon Corp now owns 3,553,104 shares of the company's stock worth $96,787,000 after purchasing an additional 258,502 shares during the period. Marshall Wace LLP lifted its holdings in shares of Chewy by 1,028.6% in the 2nd quarter. Marshall Wace LLP now owns 2,892,841 shares of the company's stock worth $78,801,000 after purchasing an additional 2,636,526 shares during the last quarter. Finally, Renaissance Technologies LLC grew its stake in Chewy by 8.7% during the 2nd quarter. Renaissance Technologies LLC now owns 2,521,755 shares of the company's stock worth $68,693,000 after buying an additional 200,900 shares during the last quarter. Institutional investors own 93.09% of the company's stock.

Insiders Place Their Bets

In other Chewy news, major shareholder Argos Holdings Gp Llc sold 1,250,000 shares of Chewy stock in a transaction that occurred on Tuesday, October 15th. The shares were sold at an average price of $29.40, for a total value of $36,750,000.00. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 2.10% of the company's stock.

Analyst Upgrades and Downgrades

CHWY has been the subject of several analyst reports. Raymond James downgraded shares of Chewy from an "outperform" rating to a "market perform" rating in a report on Wednesday, August 21st. Citigroup raised Chewy from a "neutral" rating to a "buy" rating and raised their price target for the company from $28.00 to $40.00 in a report on Friday, November 8th. UBS Group upped their price objective on shares of Chewy from $21.00 to $30.00 and gave the stock a "neutral" rating in a report on Thursday, August 29th. Evercore ISI boosted their price target on shares of Chewy from $22.00 to $29.00 and gave the stock an "in-line" rating in a research report on Wednesday, August 28th. Finally, JPMorgan Chase & Co. increased their price objective on shares of Chewy from $28.00 to $33.00 and gave the company an "overweight" rating in a report on Thursday, August 29th. Eight research analysts have rated the stock with a hold rating and fourteen have given a buy rating to the company. According to data from MarketBeat, Chewy has a consensus rating of "Moderate Buy" and a consensus target price of $31.25.

Check Out Our Latest Analysis on CHWY

Chewy Price Performance

Shares of CHWY opened at $34.60 on Thursday. The business's 50-day moving average is $29.76 and its 200-day moving average is $25.78. Chewy, Inc. has a fifty-two week low of $14.69 and a fifty-two week high of $39.10. The company has a market capitalization of $14.46 billion, a price-to-earnings ratio of 42.19, a P/E/G ratio of 3.29 and a beta of 1.06.

Chewy (NYSE:CHWY - Get Free Report) last issued its earnings results on Wednesday, August 28th. The company reported $0.05 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.03 by $0.02. Chewy had a net margin of 3.20% and a return on equity of 21.00%. The company had revenue of $2.86 billion during the quarter, compared to analyst estimates of $2.86 billion. Equities research analysts expect that Chewy, Inc. will post 0.32 earnings per share for the current fiscal year.

Chewy Profile

(

Free Report)

Chewy, Inc, together with its subsidiaries, engages in the pure play e-commerce business in the United States. It provides pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services for dogs, cats, fish, birds, small pets, horses, and reptiles through its retail websites and mobile applications.

Recommended Stories

Before you consider Chewy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chewy wasn't on the list.

While Chewy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.