Savoir Faire Capital Management L.P. lifted its holdings in shares of Chipotle Mexican Grill, Inc. (NYSE:CMG - Free Report) by 144.5% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 205,352 shares of the restaurant operator's stock after buying an additional 121,352 shares during the period. Chipotle Mexican Grill makes up 6.0% of Savoir Faire Capital Management L.P.'s portfolio, making the stock its biggest position. Savoir Faire Capital Management L.P.'s holdings in Chipotle Mexican Grill were worth $11,832,000 as of its most recent SEC filing.

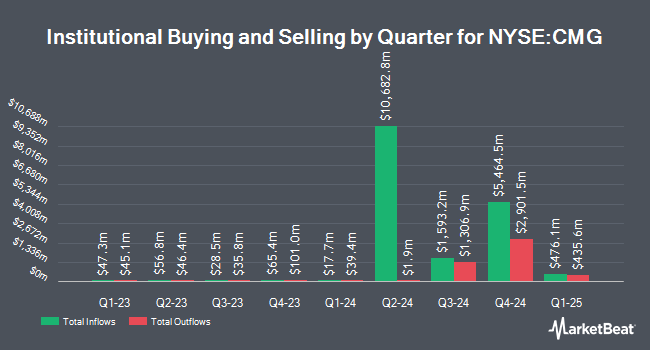

Several other institutional investors also recently modified their holdings of CMG. Thurston Springer Miller Herd & Titak Inc. purchased a new stake in Chipotle Mexican Grill during the 2nd quarter valued at $25,000. Riverview Trust Co increased its position in Chipotle Mexican Grill by 4,900.0% during the second quarter. Riverview Trust Co now owns 400 shares of the restaurant operator's stock valued at $25,000 after acquiring an additional 392 shares during the last quarter. RiverPark Advisors LLC lifted its holdings in Chipotle Mexican Grill by 4,900.0% in the second quarter. RiverPark Advisors LLC now owns 400 shares of the restaurant operator's stock valued at $25,000 after acquiring an additional 392 shares during the period. Archer Investment Corp bought a new position in Chipotle Mexican Grill in the second quarter valued at about $25,000. Finally, Oliver Lagore Vanvalin Investment Group boosted its position in Chipotle Mexican Grill by 4,900.0% in the second quarter. Oliver Lagore Vanvalin Investment Group now owns 400 shares of the restaurant operator's stock worth $25,000 after purchasing an additional 392 shares during the last quarter. 91.31% of the stock is owned by hedge funds and other institutional investors.

Chipotle Mexican Grill Stock Performance

Shares of CMG traded down $0.06 during mid-day trading on Tuesday, hitting $58.75. 9,444,620 shares of the stock were exchanged, compared to its average volume of 13,796,237. The company has a market cap of $80.05 billion, a PE ratio of 54.89, a price-to-earnings-growth ratio of 2.36 and a beta of 1.26. Chipotle Mexican Grill, Inc. has a 52-week low of $43.20 and a 52-week high of $69.26. The firm has a 50-day moving average of $58.11 and a two-hundred day moving average of $81.28.

Chipotle Mexican Grill (NYSE:CMG - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The restaurant operator reported $0.27 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.25 by $0.02. Chipotle Mexican Grill had a net margin of 13.51% and a return on equity of 43.20%. The company had revenue of $2.79 billion for the quarter, compared to the consensus estimate of $2.82 billion. During the same quarter in the prior year, the firm earned $0.23 earnings per share. Chipotle Mexican Grill's revenue was up 13.0% on a year-over-year basis. On average, sell-side analysts predict that Chipotle Mexican Grill, Inc. will post 1.11 EPS for the current year.

Analyst Ratings Changes

A number of equities analysts recently issued reports on the stock. Stephens reissued an "equal weight" rating and issued a $65.00 price objective on shares of Chipotle Mexican Grill in a report on Tuesday, November 12th. Piper Sandler boosted their price objective on shares of Chipotle Mexican Grill from $59.00 to $60.00 and gave the company a "neutral" rating in a research report on Wednesday, October 30th. Wells Fargo & Company upped their price objective on Chipotle Mexican Grill from $66.00 to $67.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 30th. Oppenheimer reiterated an "outperform" rating and set a $65.00 target price on shares of Chipotle Mexican Grill in a research report on Monday, September 30th. Finally, Citigroup reduced their price target on Chipotle Mexican Grill from $71.00 to $70.00 and set a "buy" rating for the company in a research report on Wednesday, October 30th. Ten investment analysts have rated the stock with a hold rating and eighteen have given a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $65.27.

Read Our Latest Stock Analysis on CMG

Insider Buying and Selling

In related news, insider Curtis E. Garner sold 15,750 shares of the stock in a transaction on Monday, October 7th. The stock was sold at an average price of $57.05, for a total transaction of $898,537.50. Following the sale, the insider now owns 457,764 shares in the company, valued at approximately $26,115,436.20. This represents a 3.33 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Director Robin S. Hickenlooper sold 1,790 shares of Chipotle Mexican Grill stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $56.38, for a total transaction of $100,920.20. Following the transaction, the director now directly owns 41,510 shares of the company's stock, valued at $2,340,333.80. The trade was a 4.13 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 33,290 shares of company stock worth $1,866,023. Corporate insiders own 1.02% of the company's stock.

About Chipotle Mexican Grill

(

Free Report)

Chipotle Mexican Grill, Inc, together with its subsidiaries, owns and operates Chipotle Mexican Grill restaurants. It sells food and beverages through offering burritos, burrito bowls, quesadillas, tacos, and salads. The company also provides delivery and related services its app and website. It has operations in the United States, Canada, France, Germany, and the United Kingdom.

Featured Articles

Before you consider Chipotle Mexican Grill, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chipotle Mexican Grill wasn't on the list.

While Chipotle Mexican Grill currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.