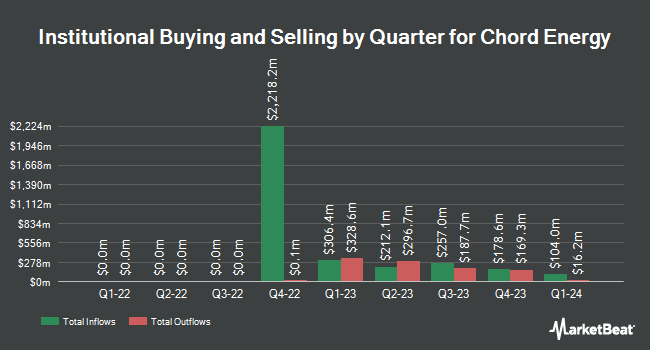

Quantbot Technologies LP increased its position in shares of Chord Energy Co. (NASDAQ:CHRD - Free Report) by 354.6% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 10,584 shares of the company's stock after acquiring an additional 8,256 shares during the quarter. Quantbot Technologies LP's holdings in Chord Energy were worth $1,378,000 as of its most recent filing with the SEC.

Other hedge funds have also made changes to their positions in the company. Victory Capital Management Inc. increased its position in Chord Energy by 397.5% during the 2nd quarter. Victory Capital Management Inc. now owns 1,589,061 shares of the company's stock worth $266,454,000 after purchasing an additional 1,269,658 shares in the last quarter. Pacer Advisors Inc. grew its holdings in Chord Energy by 8,762.1% during the 3rd quarter. Pacer Advisors Inc. now owns 1,245,034 shares of the company's stock worth $162,141,000 after acquiring an additional 1,230,985 shares in the last quarter. Dimensional Fund Advisors LP increased its holdings in Chord Energy by 72.0% in the second quarter. Dimensional Fund Advisors LP now owns 1,771,780 shares of the company's stock valued at $297,090,000 after buying an additional 741,705 shares during the last quarter. Millennium Management LLC increased its stake in Chord Energy by 226.5% during the second quarter. Millennium Management LLC now owns 696,488 shares of the company's stock valued at $116,787,000 after purchasing an additional 483,144 shares during the last quarter. Finally, KGH Ltd lifted its holdings in Chord Energy by 872.0% in the second quarter. KGH Ltd now owns 485,998 shares of the company's stock worth $81,492,000 after acquiring an additional 435,998 shares during the last quarter. Institutional investors and hedge funds own 97.76% of the company's stock.

Chord Energy Stock Performance

NASDAQ CHRD traded up $1.09 during trading on Friday, hitting $127.52. The company's stock had a trading volume of 382,804 shares, compared to its average volume of 893,702. Chord Energy Co. has a 52 week low of $123.30 and a 52 week high of $190.23. The company has a quick ratio of 0.89, a current ratio of 0.93 and a debt-to-equity ratio of 0.10. The firm has a market cap of $7.80 billion, a P/E ratio of 6.57, a price-to-earnings-growth ratio of 5.07 and a beta of 0.98. The firm has a 50 day moving average price of $130.17 and a 200 day moving average price of $150.84.

Chord Energy (NASDAQ:CHRD - Get Free Report) last released its earnings results on Wednesday, November 6th. The company reported $3.40 EPS for the quarter, missing the consensus estimate of $3.63 by ($0.23). The company had revenue of $1.12 billion for the quarter, compared to analyst estimates of $1.26 billion. Chord Energy had a net margin of 19.74% and a return on equity of 12.88%. Chord Energy's revenue for the quarter was up 33.4% compared to the same quarter last year. During the same quarter in the previous year, the company earned $5.04 earnings per share. Equities research analysts forecast that Chord Energy Co. will post 16.5 earnings per share for the current fiscal year.

Chord Energy Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, December 12th. Investors of record on Wednesday, November 27th will be given a dividend of $1.25 per share. This represents a $5.00 dividend on an annualized basis and a yield of 3.92%. The ex-dividend date of this dividend is Wednesday, November 27th. Chord Energy's dividend payout ratio (DPR) is presently 25.75%.

Wall Street Analysts Forecast Growth

CHRD has been the subject of several analyst reports. BMO Capital Markets reduced their price target on shares of Chord Energy from $205.00 to $175.00 and set an "outperform" rating for the company in a report on Friday, October 4th. Wells Fargo & Company dropped their price objective on Chord Energy from $185.00 to $180.00 and set an "overweight" rating on the stock in a research note on Wednesday, October 16th. Citigroup reduced their target price on shares of Chord Energy from $195.00 to $180.00 and set a "buy" rating for the company in a report on Monday, August 12th. UBS Group initiated coverage on Chord Energy in a research note on Wednesday, October 16th. They issued a "buy" rating and a $168.00 price target on the stock. Finally, Jefferies Financial Group began coverage on Chord Energy in a research note on Thursday, September 5th. They issued a "hold" rating and a $160.00 price objective for the company. Two research analysts have rated the stock with a hold rating, ten have issued a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, Chord Energy presently has an average rating of "Moderate Buy" and a consensus target price of $188.45.

Get Our Latest Stock Report on Chord Energy

Chord Energy Company Profile

(

Free Report)

Chord Energy Corporation operates as an independent exploration and production company in the United States. It acquires, explores, develops, and produces crude oil, natural gas, and natural gas liquids in the Williston Basin. The company sells its products to refiners, marketers, and other purchasers that have access to nearby pipeline and rail facilities.

See Also

Before you consider Chord Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chord Energy wasn't on the list.

While Chord Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.