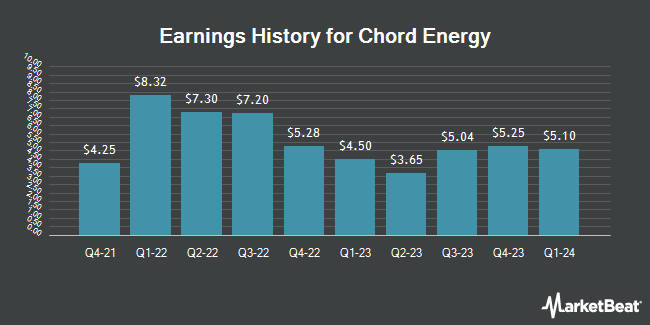

Chord Energy (NASDAQ:CHRD - Get Free Report) issued its quarterly earnings data on Wednesday. The company reported $3.40 EPS for the quarter, missing the consensus estimate of $3.63 by ($0.23), Briefing.com reports. The company had revenue of $1.12 billion during the quarter, compared to the consensus estimate of $1.26 billion. Chord Energy had a return on equity of 15.06% and a net margin of 20.83%. The firm's revenue for the quarter was up 33.4% compared to the same quarter last year. During the same quarter last year, the company posted $5.04 earnings per share.

Chord Energy Price Performance

NASDAQ:CHRD traded up $0.72 during mid-day trading on Thursday, hitting $132.68. 1,005,294 shares of the stock traded hands, compared to its average volume of 881,274. The business's 50-day moving average price is $132.91 and its 200 day moving average price is $156.86. The company has a market cap of $8.21 billion, a PE ratio of 6.41, a price-to-earnings-growth ratio of 4.86 and a beta of 0.98. Chord Energy has a 12-month low of $123.30 and a 12-month high of $190.23. The company has a quick ratio of 0.91, a current ratio of 0.96 and a debt-to-equity ratio of 0.11.

Wall Street Analyst Weigh In

Several analysts recently weighed in on CHRD shares. UBS Group started coverage on Chord Energy in a report on Wednesday, October 16th. They issued a "buy" rating and a $168.00 price objective for the company. Jefferies Financial Group started coverage on Chord Energy in a research report on Thursday, September 5th. They set a "hold" rating and a $160.00 target price on the stock. Piper Sandler lifted their target price on shares of Chord Energy from $206.00 to $211.00 and gave the company an "overweight" rating in a report on Tuesday, October 15th. Royal Bank of Canada reiterated an "outperform" rating and issued a $200.00 price target on shares of Chord Energy in a research note on Friday, September 20th. Finally, Bank of America lifted their price objective on Chord Energy from $201.00 to $208.00 and gave the company a "buy" rating in a report on Wednesday, August 21st. Two equities research analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $190.18.

Get Our Latest Research Report on Chord Energy

Insider Buying and Selling

In other Chord Energy news, Director Samantha Holroyd acquired 500 shares of Chord Energy stock in a transaction that occurred on Friday, August 23rd. The stock was bought at an average cost of $149.51 per share, for a total transaction of $74,755.00. Following the acquisition, the director now owns 14,417 shares of the company's stock, valued at $2,155,485.67. This represents a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a filing with the SEC, which is accessible through this hyperlink. 0.70% of the stock is owned by insiders.

About Chord Energy

(

Get Free Report)

Chord Energy Corporation operates as an independent exploration and production company in the United States. It acquires, explores, develops, and produces crude oil, natural gas, and natural gas liquids in the Williston Basin. The company sells its products to refiners, marketers, and other purchasers that have access to nearby pipeline and rail facilities.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Chord Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chord Energy wasn't on the list.

While Chord Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.