Choreo LLC decreased its position in shares of Extra Space Storage Inc. (NYSE:EXR - Free Report) by 36.5% during the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 3,277 shares of the real estate investment trust's stock after selling 1,880 shares during the period. Choreo LLC's holdings in Extra Space Storage were worth $488,000 as of its most recent filing with the Securities & Exchange Commission.

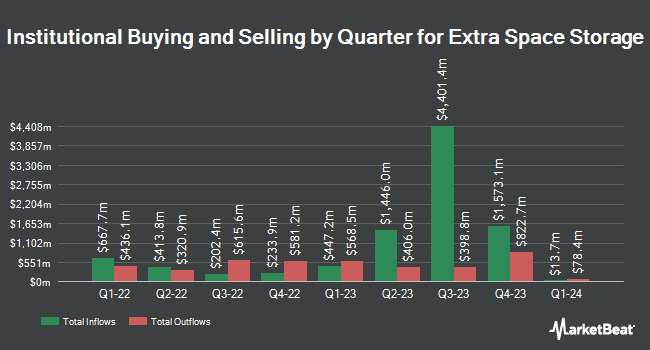

Other hedge funds have also bought and sold shares of the company. Ashton Thomas Securities LLC bought a new position in shares of Extra Space Storage in the third quarter worth about $33,000. Harvest Fund Management Co. Ltd purchased a new stake in Extra Space Storage in the third quarter worth about $42,000. Continuum Advisory LLC lifted its stake in Extra Space Storage by 68.1% in the third quarter. Continuum Advisory LLC now owns 311 shares of the real estate investment trust's stock worth $56,000 after acquiring an additional 126 shares during the period. DiNuzzo Private Wealth Inc. purchased a new stake in Extra Space Storage in the third quarter worth about $129,000. Finally, Exchange Traded Concepts LLC lifted its stake in Extra Space Storage by 13.7% in the fourth quarter. Exchange Traded Concepts LLC now owns 861 shares of the real estate investment trust's stock worth $129,000 after acquiring an additional 104 shares during the period. Institutional investors own 99.11% of the company's stock.

Analysts Set New Price Targets

Several research firms have commented on EXR. StockNews.com raised shares of Extra Space Storage from a "sell" rating to a "hold" rating in a research report on Tuesday, January 28th. Wells Fargo & Company reissued an "equal weight" rating and set a $175.00 price target on shares of Extra Space Storage in a research report on Monday, October 21st. Barclays decreased their price target on shares of Extra Space Storage from $192.00 to $184.00 and set an "overweight" rating for the company in a research report on Monday, January 13th. Truist Financial increased their price target on shares of Extra Space Storage from $167.00 to $168.00 and gave the company a "hold" rating in a research report on Thursday, December 5th. Finally, Scotiabank raised shares of Extra Space Storage from a "sector underperform" rating to a "sector perform" rating and set a $167.00 price target for the company in a research report on Friday, January 10th. One investment analyst has rated the stock with a sell rating, seven have given a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat, Extra Space Storage presently has an average rating of "Hold" and a consensus price target of $174.00.

Get Our Latest Stock Report on EXR

Extra Space Storage Trading Down 0.6 %

Shares of NYSE EXR traded down $0.99 during trading on Friday, hitting $154.96. 1,409,592 shares of the company were exchanged, compared to its average volume of 1,361,023. Extra Space Storage Inc. has a 12-month low of $131.02 and a 12-month high of $184.87. The company has a debt-to-equity ratio of 0.77, a quick ratio of 0.23 and a current ratio of 0.23. The company has a fifty day moving average price of $152.13 and a 200-day moving average price of $163.94. The firm has a market capitalization of $32.85 billion, a PE ratio of 40.57, a P/E/G ratio of 7.77 and a beta of 0.91.

Insider Buying and Selling

In related news, CEO Joseph D. Margolis sold 7,500 shares of the firm's stock in a transaction dated Thursday, January 2nd. The stock was sold at an average price of $148.01, for a total transaction of $1,110,075.00. Following the completion of the sale, the chief executive officer now directly owns 16,690 shares of the company's stock, valued at approximately $2,470,286.90. This trade represents a 31.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Corporate insiders own 1.36% of the company's stock.

Extra Space Storage Company Profile

(

Free Report)

Extra Space Storage Inc, headquartered in Salt Lake City, Utah, is a self-administered and self-managed REIT and a member of the S&P 500. As of December 31, 2023, the Company owned and/or operated 3,714 self-storage stores in 42 states and Washington, DC The Company's stores comprise approximately 2.6 million units and approximately 283.0 million square feet of rentable space operating under the Extra Space, Life Storage and Storage Express brands.

Read More

Before you consider Extra Space Storage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Extra Space Storage wasn't on the list.

While Extra Space Storage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.