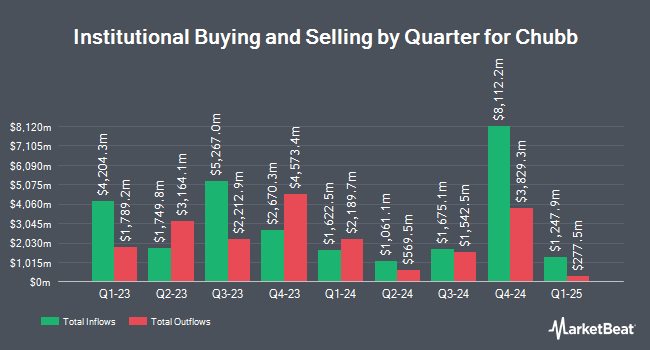

Citizens Financial Group Inc. RI increased its stake in Chubb Limited (NYSE:CB - Free Report) by 17.3% during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 15,374 shares of the financial services provider's stock after purchasing an additional 2,269 shares during the period. Citizens Financial Group Inc. RI's holdings in Chubb were worth $4,248,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors also recently modified their holdings of the company. Raymond James Financial Inc. bought a new position in Chubb in the 4th quarter worth approximately $1,158,897,000. FMR LLC increased its holdings in shares of Chubb by 7.3% in the third quarter. FMR LLC now owns 15,576,485 shares of the financial services provider's stock valued at $4,492,103,000 after buying an additional 1,052,999 shares in the last quarter. Proficio Capital Partners LLC lifted its holdings in shares of Chubb by 41,494.7% during the fourth quarter. Proficio Capital Partners LLC now owns 812,761 shares of the financial services provider's stock valued at $224,566,000 after purchasing an additional 810,807 shares during the last quarter. Caisse DE Depot ET Placement DU Quebec boosted its holdings in shares of Chubb by 49.7% in the third quarter. Caisse DE Depot ET Placement DU Quebec now owns 1,172,267 shares of the financial services provider's stock worth $338,070,000 after buying an additional 389,343 shares during the period. Finally, Barclays PLC boosted its stake in Chubb by 28.1% in the 3rd quarter. Barclays PLC now owns 1,772,688 shares of the financial services provider's stock worth $511,226,000 after purchasing an additional 388,746 shares during the period. Institutional investors and hedge funds own 83.81% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have weighed in on the company. JMP Securities reaffirmed a "market outperform" rating and set a $325.00 target price on shares of Chubb in a research note on Wednesday, January 29th. Keefe, Bruyette & Woods raised their target price on Chubb from $328.00 to $329.00 and gave the company an "outperform" rating in a report on Friday, January 31st. Wells Fargo & Company reduced their price objective on shares of Chubb from $268.00 to $264.00 and set an "equal weight" rating for the company in a research note on Tuesday, January 14th. Hsbc Global Res upgraded shares of Chubb from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, March 5th. Finally, JPMorgan Chase & Co. upped their price target on shares of Chubb from $296.00 to $300.00 and gave the company a "neutral" rating in a report on Wednesday, January 29th. Two research analysts have rated the stock with a sell rating, seven have issued a hold rating, eight have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, Chubb has a consensus rating of "Hold" and an average target price of $299.27.

Check Out Our Latest Research Report on CB

Insider Buying and Selling at Chubb

In related news, EVP Joseph F. Wayland sold 10,000 shares of the firm's stock in a transaction that occurred on Tuesday, March 4th. The shares were sold at an average price of $286.96, for a total value of $2,869,600.00. Following the completion of the sale, the executive vice president now owns 77,703 shares of the company's stock, valued at $22,297,652.88. This trade represents a 11.40 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Corporate insiders own 0.86% of the company's stock.

Chubb Price Performance

NYSE:CB opened at $291.15 on Wednesday. The company has a market capitalization of $116.58 billion, a price-to-earnings ratio of 12.81, a PEG ratio of 3.36 and a beta of 0.66. The company has a debt-to-equity ratio of 0.21, a quick ratio of 0.28 and a current ratio of 0.25. Chubb Limited has a 52 week low of $238.85 and a 52 week high of $302.05. The company has a 50-day moving average of $272.66 and a 200-day moving average of $280.61.

Chubb (NYSE:CB - Get Free Report) last posted its quarterly earnings data on Tuesday, January 28th. The financial services provider reported $6.02 earnings per share for the quarter, topping the consensus estimate of $5.33 by $0.69. Chubb had a net margin of 16.63% and a return on equity of 13.75%. As a group, equities research analysts anticipate that Chubb Limited will post 21.52 earnings per share for the current fiscal year.

Chubb Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, April 4th. Shareholders of record on Friday, March 14th will be issued a dividend of $0.91 per share. This represents a $3.64 dividend on an annualized basis and a yield of 1.25%. The ex-dividend date of this dividend is Friday, March 14th. Chubb's dividend payout ratio is currently 16.02%.

Chubb Profile

(

Free Report)

Chubb Limited provides insurance and reinsurance products worldwide. The company's North America Commercial P&C Insurance segment offers commercial property, casualty, workers' compensation, package policies, risk management, financial lines, marine, construction, environmental, medical risk, cyber risk, surety, and casualty; and group accident and health insurance to large, middle market, and small commercial businesses.

Read More

Want to see what other hedge funds are holding CB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Chubb Limited (NYSE:CB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Chubb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chubb wasn't on the list.

While Chubb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report